Commodities: Future natural gas prices hang on inventory levels

April 28, 2014

BY Ben Straus, U.S. Energy Services

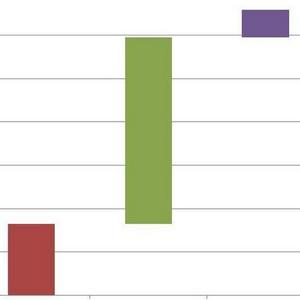

Natural gas storage inventories ended the traditional heating season at 822 billion cubic feet (Bcf), nearly 1,000 Bcf below the five year average level of 1,814 Bcf. Although there are interesting long-term storylines in the natural gas market, the short term is rightly dominated by an intense focus on whether inventory levels can be sufficiently replenished before the mercury plunges again. The largest jump in inventories over a single injection season occurred in 2003, when inventory rose 2,545 Bcf, from 642 Bcf to 3,187 Bcf. If this summer were to equal the previous record for a single injection season, storage balances would be almost 12 percent below the lowest level of the last five years at 3,367 Bcf versus 3,816 Bcf. Can injections in 2014 set a new record and will it be enough to stave off elevated prices at the start of the next winter heating season?

Injection data will provide the ultimate answer to that question, but looking to recent historical trends in key components of overall natural gas supply and demand can provide a clue as to whether a recovery to reasonable levels is attainable. On the supply side, analysts are calling for a continuation of a multi-year trend of increasing domestic U.S. production, which has been offset over the past two years by declining net imports. Demand-wise, residential and commercial demand, while sensitive to weather, is not experiencing structural growth, and tends to be more stable during the summer months. Industrial and power generation demand, however, have been growing from year to year, though in different ways. The story with industrial demand is relatively simple. Gas prices have dropped in the past five years compared to where they were in the prior five, creating opportunities for new industrial processes to start up. Power generation demand is not as straight-forward. Demand in that segment has experienced both structural growth based on the long-term economics and also in terms of a short-term bump from a relative price advantage over coal from 2012 through 2013. It’s the second feature of this segment that’s relevant from a forward looking perspective, because the same price competition dynamic that pushed up demand over the last couple of years, is likely to be reversed under the current higher price environment. Over the 214 days of summer, storage injections must deliver an increase of almost 2.5 Bcf per day more than 2013 to get inventory levels back to 3,500 Bcf.

Obviously building a model of the supply and demand balance is distinct from the actual week to week interplay between the two that ultimately shows up in the U.S. Energy Information Administration injection data. Ultimately, by following weekly storage injections, consumers of natural gas can get a sense of whether or not this year’s injection season is on a path to recovery, and make more informed decisions about how to manage price risk this winter.

|

Natural Gas Prices |

Nymex |

Ventura |

California Citygate |

||

|

1/31/2014 | |||||

Advertisement

Advertisement

$4.94

$6.59

$5.43

4/25/2014

$4.65

Advertisement

Advertisement

$4.74

$5.09

4/29/2013

$4.39

$4.06

$4.23

Related Stories

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

The government of Brazil on June 25 announced it will increase the mandatory blend of ethanol in gasoline from 27% to 30% and the mandatory blend of biodiesel in diesel from 14% to 15%, effective Aug. 1.

The U.S. EIA reduced its 2025 and 2026 production forecasts for a category of biofuels that includes SAF in its latest Short-Term Energy Outlook, released June 10. The forecast for 2025 renewable diesel production was also revised down.

Upcoming Events