Commodities: Natural gas prices high due to inventory depletion

July 1, 2014

BY Ben Straus, U.S. Energy Services

The key to understanding the short and medium term gyrations of the natural gas market is what’s happening with natural gas inventory levels. Because stocks are relatively low for this time of year, futures prices over the next 9 months remain at elevated levels compared to subsequent years. The market will continue to take a keen interest in the rate of refill over the course of the summer as it bears directly on the market’s capacity to weather another cold winter.

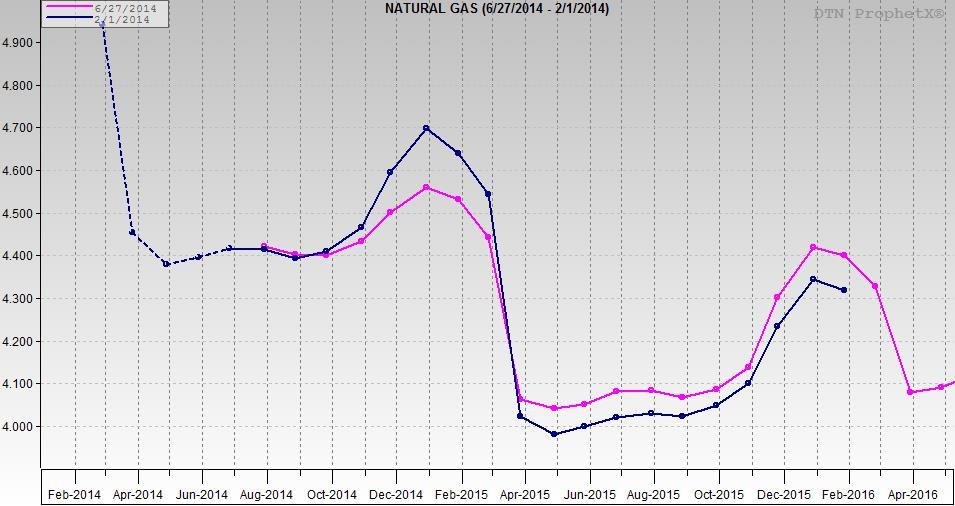

Since early 2014, natural gas futures for 2015 have been pricing at a substantial discount to futures for 2014. In the natural gas industry, when near term futures price at a premium to longer-dated contracts is referred to as “backwardation.” In other markets the same structure is sometimes referred to as “inverse.” Although the harsh winter could reasonably be expected to cause uplift in prices through the traditional heating months of January through March, it does not directly explain why low-demand summer months of the current year are priced at a 30 cents per MMBtu or 7 percent premium to the summer of 2015. The “natural gas (6/27/2014 – 2/1/2014)” chart shows that while expectations for prices for the upcoming winter have receded slightly from the start of February to late June, in general, near-term prices remain structurally higher than the corresponding month in the following year.

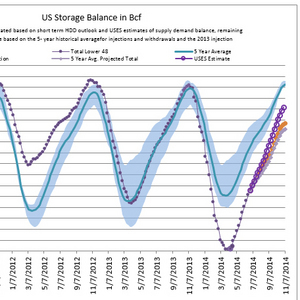

So why are prices so high? In a word, “Inventory.” 2014 prices have risen steadily in response to the ongoing depletion of storage inventory that began in earnest as of mid-January. The “U.S. storage balance in Bcf” chart tells the sad tale. While inventory levels were adequate, if not robust, heading into the winter, a series of strong cold spells punctuated what can be described as a persistently colder than normal winter. By Jan. 10, inventories dipped below their lowest level over the last five years for that point in the storage cycle. It didn’t get any prettier from that point until the very bottom, when storage levels reached their nadir at 822 Bcf, in late March. At the low, inventories were essentially half what they normally are, requiring a steep climb to return to normalcy. Following a bit of a slow start in April, injections into inventory have been going gang-busters, exceeding both the 5-year average level and the elevated rate observed in 2013. From May 9 through June 20, each weekly addition to storage exceeded 100 Bcf, a record rate of storage injection. Despite the improvement, forecasts still suggest that inventory levels will fall far short of the five-year average by the end of the summer, leaving the market a little tighter heading into the demanding winter season. A key item to watch over the coming months is the influence of summer heat. In April through June, demand for electricity is low relative to the months of July and August. Consequently, demand for natural gas to run power generation plants in spring and fall is lower than in the peak of summer. If July turns out to be a hot month with higher call on gas-fired generation for power production, lower volumes of natural gas will flow into storage, and the price differential between 2014 futures and 2015 futures may well widen.

Advertisement

Advertisement

Related Stories

The European Commission on July 18 announced its investigation into biodiesel imports from China is now complete and did not confirm the existence of fraud. The commission will take action, however, to address some systemic weaknesses it identified.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

The government of Brazil on June 25 announced it will increase the mandatory blend of ethanol in gasoline from 27% to 30% and the mandatory blend of biodiesel in diesel from 14% to 15%, effective Aug. 1.

Upcoming Events