Commodities: Yield projected to be up in most of Corn Belt

FILE PHOTO

November 24, 2015

BY Jason Sagebiel, INTL FCStone

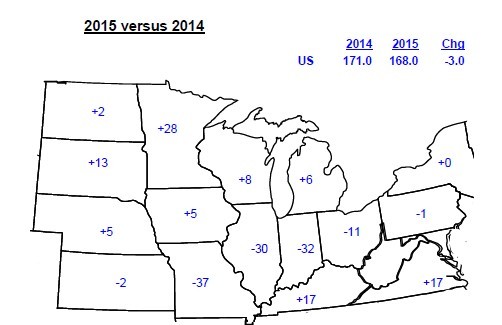

Harvest has wrapped up and yield reports have been better than expected. In the USDA’s October supply and demand report, the government increased yields to 168 bushels per acre, up from the first new crop yield report in May of 166.8. Excessive rains in areas of the corn-belt during May and June had analysts projecting yield cuts. As shown in the graphic, aside from the Eastern Corn Belt, most areas are projected to outperform last year’s yield numbers. Although yields are projected to drop substantially in Illinois, Indiana and Missouri, year on year, recent estimates have shown slight rebounds and the departure from normal is not as extensive.

The October report placed corn production at 13.555 billion bushels, down from the previous report, despite a yield increase. The drop in production was due to decreases in both planted and harvested acres (88.4 and 80.7 million acres respectively vs. 88.9 and 81.1 million acres previously). Demand for corn was unchanged with corn used for feed was pegged at 5.275 billion bushels; ethanol 5.350 billion bushels and exports 1.850 billion bushels. Last year, the above sectors consumed 5.317 billion bushels 5.207 billion bushels and 1.864 billion bushels respectively. Globally corn stocks rest at 187.83 million metric tons (mmt), down from a year ago of 196.03 mmt but still above the 2013/14 year of 175.88 mmt.

Prices are finding support this fall due to lack of movement by the producer. The crop will still be short in areas of the Eastern Corn Belt due to effects of the excess moisture and the shortfall will make the cash market a bit more volatile in the east when compared to the west. The map illustrates the yield difference in October vs. yield a year ago. This data leads down the path as to why the Eastern Corn Belt will be short again this year, as state stocks in these areas are tight. This will keep the cash market exuberant.

Advertisement

Advertisement

* Comments in this column are market commentary and are not to be construed as market advice.

Advertisement

Advertisement

Related Stories

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

The USDA’s National Agricultural Statistics Service on June 30 released its annual Acreage report, estimating that 83.4 million acres of soybeans have been planted in the U.S. this year, down 4% when compared to 2024.

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Scientists at ORNL have developed a first-ever method of detecting ribonucleic acid, or RNA, inside plant cells using a technique that results in a visible fluorescent signal. The technology could help develop hardier bioenergy and food crops.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

Upcoming Events