Conventional soybean meal prices take a nosedive

June 21, 2018

BY UFOP

Prices of conventional soybean meal have come down significantly since the beginning of May. Ample supply from Brazil, favorable growing conditions in the U.S. and the escalating trade dispute between China and the U.S. are putting downward pressure on prices.

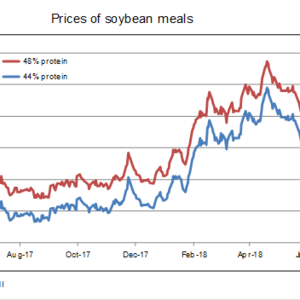

Asking prices of soybean meal have weakened considerably following a sharp rise in the first quarter of 2018. Since their annual highs at the beginning of May, soybean meals fell 14 percent to 363 euros per metric ton (48 percent protein) and 16 percent to 333 euros per ton (44 percent protein), respectively. Nevertheless, in each case prices are still around 18 percent above the level seen in June 2017.

The significant drop in asking prices over the past few weeks is due to the weakening trend in the futures market, Agrarmarkt Informations-Gesellschaft (AMI) has reported. Soybean meal prices in Chicago have fallen continuously since the beginning of May.

Advertisement

Advertisement

The market outlook continues to be bearish. The Brazilian soybean harvest is seen to be even larger than previously expected. Since U.S. soybean stocks are developing very well in virtually optimal weather conditions, the U.S. could also bring in a bumper crop. The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) expects that the recent escalation of the trade dispute between the U.S. and China and the associated introduction of import duties on U.S. soybeans will shift trade flows noticeably before long. This would put pressure on U.S. soybean prices, because U.S. soybeans would have to find new markets. The EU could stand to benefit from this situation, especially because oil mills are there and ready to process corresponding soy quantities.

UFOP has underlined that global supply of oilseeds is good. The Argentine crop failures are not felt in the market, UFOP has pointed out. Instead, the trade conflict combined with good harvest outlooks in the U.S. and Brazil are the key factors determining the market conditions. The USDA recently estimated the Argentine 2017-’18 soybean harvest just under 36 percent lower at approximately 37 million tons.

Advertisement

Advertisement

Related Stories

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

The USDA’s National Agricultural Statistics Service on June 30 released its annual Acreage report, estimating that 83.4 million acres of soybeans have been planted in the U.S. this year, down 4% when compared to 2024.

Upcoming Events