Corn demand picture a moving target

SOURCE: USDA

May 15, 2013

BY Jason Sagebiel

April 29—The corn market has been under pressure for most of the year as money exits agriculture type commodities. In addition, follow-through selling came as the USDA placed a bearish undertone in the March stocks report. However, the market will shift to the fundmental perspective. First, old crop supplies are tight or in tight hands reflected by the very firm basis levels exhibited throughout the U.S. Secondly, new crop prices will be under pressure with even below trend line yields but planting delays could cause some immediate concern.

Corn movement from the producer has been vitually nonexistent since the March stocks report. With lower prices, producers have been less excited about moving corn as their attention focuses on the next crop, therefore, cash markets have been historically tight. This should keep old crop supported at values observed in April.

Advertisement

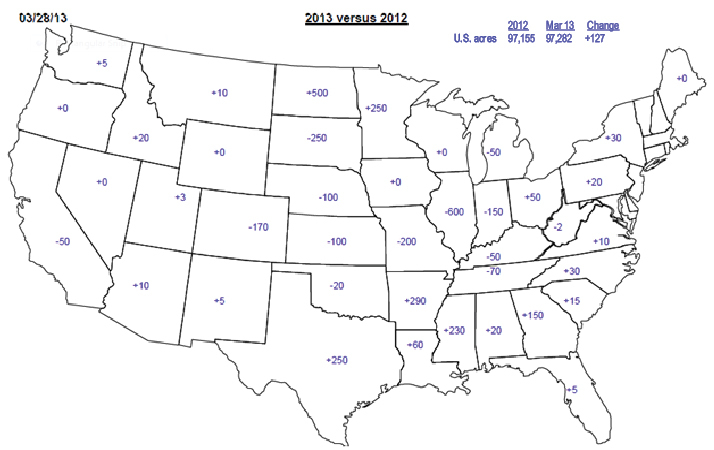

With recent moisture, the new crop outlook is more optimistic but one would not assume trend line yields are achievable. With more acreage slated in areas that are historically less productive the national yield curve will see a drag. However, without a drought at the magnitude of last year, new crop production is much more promising this year. The demand picture will be a moving target and that will be determined by price throughout the 2013-’14 marketing campaign. New crop corn will hold $5.20 support levels until better yield prospects are more defined.

Advertisement

Related Stories

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Upcoming Events