Corn exports down, grains in all forms offer brighter picture

U.S. Grains Council

May 11, 2016

BY U.S. Grains Council

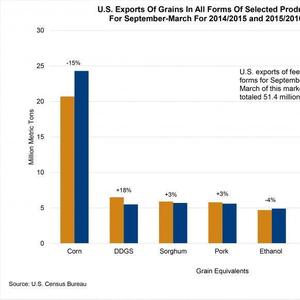

U.S. exports of feed grains in all forms for September through March of this marketing year totaled 51.4 million metric tons, down 7 percent from the same period last marketing year, with higher exports of distillers dried grains with solubles (DDGS), corn gluten feed, corn gluten meal, sorghum and pork working to offset weaker exports of corn, barley, beef, poultry and ethanol, according to numbers recently released by the U.S. Census Bureau.

Last marketing year, U.S. exports of feed grains in all forms totaled a near record 100 million tons, representing 26 percent of U.S. corn, sorghum and barley production. This year, the U.S. Grains Council expects the total will be in the range of 93 to 96 million tons based on export statistics to date and market conditions.

U.S. feed grains in all forms is a measurement including U.S. corn, sorghum, barley, DDGS, corn gluten feed, corn gluten meal and ethanol as measured in corn equivalents, as well as the grains consumed in the production of meat and poultry.

By accounting for all feed grains that are exported by the United States—in either unprocessed or value-added form—the measure is intended to offer a holistic look at demand from global customers being met by U.S. farmers. It also offers a more expansive view of the amount of U.S. feed grain production being exported.

Advertisement

Advertisement

For instance, this marketing year, U.S. corn exports have decreased by 15 percent compared to last marketing year as they face challenges from the strong U.S. dollar and larger-than-expected global grain supplies. Among the top 10 markets, the most notable declines have come in Asian markets with exports down to Japan (-30 percent), Korea (-48 percent) and Taiwan (-49 percent). However, there are bright spots including Mexico, which is up 24 percent and has overtaken Japan as the top U.S. corn market so far this marketing year. Other notable gainers include Colombia (+11 percent), Saudi Arabia (+19 percent) and Guatemala (+12 percent).

DDGS sales have also been a bright spot, with shipments during the first seven months of the marketing year up 18 percent. This corn coproduct has the potential to reach a record amount of exports this year, with broad-based gains including seven of the top 10 markets showing increases. The best performing market has been China, with exports up significantly, though this was in part due to lower-than-normal exports early in the 2014/2015 marketing year. Other major markets showing gains included Mexico (+4 percent), Vietnam (+38 percent), Korea (+24 percent), EU-28 (+29 percent), Thailand (+9 percent), and Indonesia (+36 percent).

At the same time, U.S. ethanol exports are down 4 percent as sharply lower petroleum and gasoline prices have hurt exports to discretionary blending markets. However, China has increased its imports of U.S. ethanol, registering its highest level of U.S. ethanol imports ever in March. For September to March of this marketing year, China has purchased 134.7 million gallons (510 million liters) total, which is only fractionally lower than Canada, the traditional top market for U.S. ethanol with 135.2 million gallons (512 million liters) purchased during the same period.

Advertisement

Advertisement

USGC's global staff is closely watching a recent uptick in sales not captured in the statistics released this week and expects continued strength in future export reports. This is based on recent sales to Colombia, Korea and countries in North Africa as well as sales to markets that don’t typically come in as top U.S. importers, including South Africa and Pakistan. Information from the trade indicates that ethanol exports also continue to show strength as the marketing year continues.

Programming from USGC's global offices will continue to target customers seeking to capitalize on the favorable price environment and logistic advantages buying from the U.S. can offer and will evolve as needed as the corn growing season in the U.S. begins.

Click here to view the council’s grain-in-all-forms export portal with the updated trade numbers out this week.

Related Stories

The European Commission on July 18 announced its investigation into biodiesel imports from China is now complete and did not confirm the existence of fraud. The commission will take action, however, to address some systemic weaknesses it identified.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

The government of Brazil on June 25 announced it will increase the mandatory blend of ethanol in gasoline from 27% to 30% and the mandatory blend of biodiesel in diesel from 14% to 15%, effective Aug. 1.

Upcoming Events