Corn market lackluster in November, but cash market strong

SOURCE: USDA/INTL FCStone

December 11, 2013

BY Jason Sagebiel, INTL FCStone Inc.

The month of November exhibited a lackluster market with a highly anticipated report due to the missed October USDA report. It offered a slightly bullish tone because some data reported was friendly relative to what the trade was expecting.

This year’s corn production was projected at 13.989 billion bushels, up from 10.780 billion bushels last year. Larger supplies have made this market feel much more comfortable as the carryout rests just under 1.90 billion bushels or a 14.6 percent carryout-to-use ratio, not seen since 2005. This has been the contributing factor for a lower corn market since mid-August. With lower prices forecast, the reason for increased demand has been assumed. Ethanol demand is expected to be at 4.90 billion bushels, up from 4.648 billion bushels last year but below 5.0 billion bushels in 2011-’12.

Advertisement

Advertisement

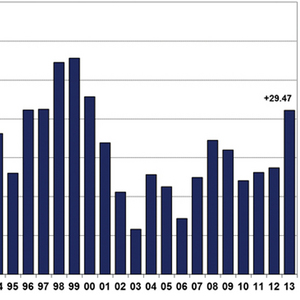

World corn ending stocks increased from 151.42 million metric tons (mmt) to 164.33 mmt as increased U.S. production boosted previous estimates. With projected world carryout at the highest level since 2000 (see chart), world corn values should remain under pressure. The market will still have South America's weather to worry about because Argentina and Brazil are forecast to produce 26 and 70 mmt, respectively. The positive takeaway for the corn market in November was the strong cash market. Slow producer movement attributed to lower futures prices was the cause for the cash market to be so strong. Corn prices should stay sideways into the new year but lack of corn movement will keep basis firm.

Advertisement

Advertisement

Related Stories

The European Commission on July 18 announced its investigation into biodiesel imports from China is now complete and did not confirm the existence of fraud. The commission will take action, however, to address some systemic weaknesses it identified.

Kintetsu World Express Inc. has signed an additional agreement with Hong Kong, China-based Cathay Pacific Airways for the use of sustainable aviation fuel (SAF). The agreement expands a three-year partnership between the two companies.

Broco Energy on July 17 announced a new partnership with the Massachusetts Port Authority (Massport) to deliver and transition Massport's fuel tanks to renewable diesel across its various facilities.

Shell Aviation, Accenture, and Amex GBT on July 10 announced Avelia is in the process of evolving to an industry solution with independent data hosting and a multi-supplier model helping users access the GHG benefits of SAF.

The U.S EPA on July 17 released data showing more than 1.9 billion RINs were generated under the RFS during June, down 11% when compared to the same month of last year. Total RIN generation for the first half of 2025 reached 11.17 billion.

Upcoming Events