Corn markets quiet in April; concerns rise regarding NAFTA talk

May 3, 2017

BY Jason Sagebiel, Intl FCStone

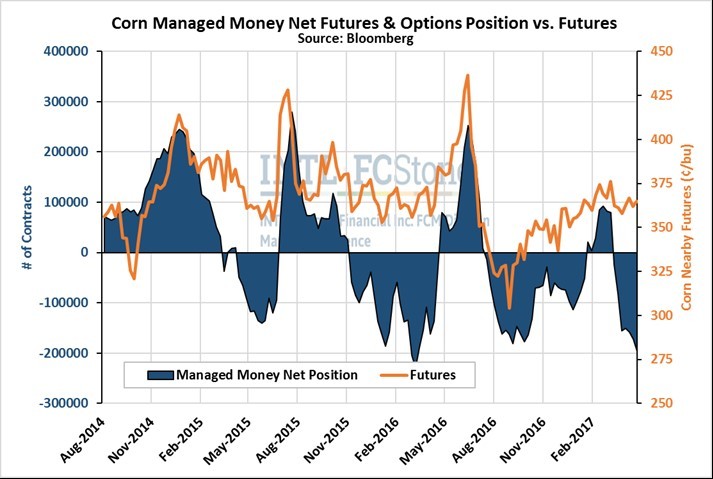

The month of April was quiet, especially within the cash market. Prices eroded as managed money has been selling the corn market amidst a big U.S. carryout and a growing global carryout. Concerns regarding politics and implications that may arise from NAFTA will have potential influences on the market going forward.

In the meantime, the April USDA supply/demand report was issued and no alterations to domestic ending stocks were made. However, the demand allocation for corn was amended. Corn used for feed demand continued to decline to 5.5 billion bushels, down 50 million from the previous month. This projection has eroded since the October estimate of 5.650 billion bushels. Additionally, corn demand into ethanol production has increased from October’s projection by 175 million bushels to 5.450 billion bushels in the April report.

Export demand remained constant from the last report at 2.225 billion bushels. Ultimately corn carryout is forecaste at 2.320 billion bushels, a 15.9 percent carryout-to-use ratio. Global corn carryout increased in the April report from 220.68 mmt to 222.98 mmt. This compares to 211.83 mmt last year and 209.82 mmt in 2014/15. The increase this year was mostly due to higher production in Brazil and Argentina.

Advertisement

The chart illustrates the managed money position at the time of this writing and the corresponding nearby futures position. Managed money was holding a short of near 197,000 contracts as of April 25.

Comments in this article are market commentary and are not to be construed as market advice

Advertisement

Related Stories

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

The government of Brazil on June 25 announced it will increase the mandatory blend of ethanol in gasoline from 27% to 30% and the mandatory blend of biodiesel in diesel from 14% to 15%, effective Aug. 1.

The U.S. EIA reduced its 2025 and 2026 production forecasts for a category of biofuels that includes SAF in its latest Short-Term Energy Outlook, released June 10. The forecast for 2025 renewable diesel production was also revised down.

Upcoming Events