Corn markets to remain flat; ethanol supports local values

SOURCE: FCSTONE

January 3, 2017

BY Jason Sagebiel, Intl FCStone

The corn market was subdued during December. The market tested the $3.65 price level only to run into resistance, falling back into a range-bound trade around $3.50. The December USDA report made no changes to the current domestic supply-demand scenario, although it adjusted the global outlook. World corn carryout increased by 4.47 mmt to 254.94 mmt, stemming from builds in China, Vietnam Brazil and Russia. This compares to 244.80 mmt and 245.39 mmt in the past two years, respectively.

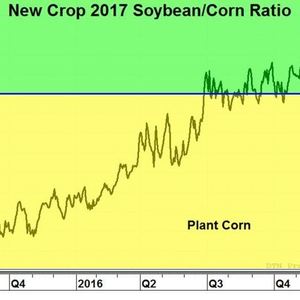

As the new year progresses, the market will focus on several factors. First, will there be any significant changes in the January supply-demand table and will the money flows adjust in the grain complex? Second, will the U.S. dollar have a significant impact on both commodity values and our ability to maintain a strong export program? In the physical corn market, flat price will be the key in the movement of corn until post-planting, when space and time factors prompt movement. Profitable ethanol margins will support local corn values and potentially add support to futures values. Other corn end-user margins will need to be monitored because they have the ability to strengthen demand or, conversely, add to the already massive projected carryout. South American weather could add some premium to corn values, as it has in soybeans, but corn will be less sensitive to those potential issues. The acreage battle has already begun, encouraging more soybean acres to be planted this spring. Corn could see support as it attempts to maintain acres.

(Comments in this article are market commentary and are not to be construed as market advice.)

Advertisement

Advertisement

Related Stories

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

The government of Brazil on June 25 announced it will increase the mandatory blend of ethanol in gasoline from 27% to 30% and the mandatory blend of biodiesel in diesel from 14% to 15%, effective Aug. 1.

The U.S. EIA reduced its 2025 and 2026 production forecasts for a category of biofuels that includes SAF in its latest Short-Term Energy Outlook, released June 10. The forecast for 2025 renewable diesel production was also revised down.

Upcoming Events