Corn stocks up, prospective plantings down in USDA reports

Gary Schnitkey

March 31, 2015

BY Susanne Retka Schill

Corn acres are expected to be down for the third year in a row, the USDA said in its Prospective Plantings report, and corn stocks are higher, according to the Grain Stocks report, both released March 31 by the National Agricultural Statistics Service.

The corn planted area for all purposes in 2015 is estimated at 89.2 million acres, down 2 percent from last year. If realized, it would be the lowest planted acreage in the U.S. since 2010, and the third consecutive year of declining corn acres. Intended soybean acres, on the other hand, are forecast to hit a record high of 84.6 million acres, up 1 percent from last year.

Corn stocks in all positions on March 1 totaled 7.74 billion bushels, up 11 percent from a year ago. Of that, more than half, at 4.38 billion bushels, were stored on farms, up 13 percent from a year ago. Off-farm stocks are up 7 percent from a year ago. The December 2014 to February 2015 disappearance is 3.47 billion bushels, compared with 3.44 billion bushels during the same period last year. Soybeans stored in all position total 1.33 billion bushels, up 34 percent from the prior year. Indicated disappearance for the December 2014 to February 2015 quarter total 1.19 billion bushels.

Advertisement

Advertisement

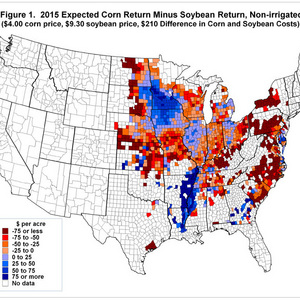

University of Illinois ag economist Gary Schnitkey said the shift in corn and soybean acres was expected, in an analysis released the day before the USDA reports. In the analysis, Schnitkey mapped the 2015 expected corn return (based on county-level trend yields and a $4 per bushel price) minus the return for soybeans (based on county yields and a $9.30 soybean prices and a $210 per acre difference in corn and soybean production costs.) Noting that in much of the Corn Belt, corn had higher expected returns than soybean, he said, “One would not expect large shifts from corn to soybeans in these areas. Shifts to soybeans likely are to occur outside the central Corn Belt and the Mississippi Delta.”

Writing after the release of the March 31 reports, University of Illinois ag economist Darrel Good said, “While the March 1 [corn] stocks estimate is 136 million bushels larger than the average trade guess, it does not imply that feed and residual use is progressing at a slower rate than implied by the USDA projection. Given the expansion that is taking place in hog, broiler, and dairy cow numbers, the projection of 5.3 billion bushels for the year still appears reasonable.”

Advertisement

Advertisement

In looking at prospective planting acres, Good gave an initial projection for the 2015 corn crop of 13.4 billion bushels, based on estimated acres harvested for grain of 81.7 million acres of corn, multiplied by a 164 bushels-per-acre yield trend. “The decline in corn acres is mostly offset by increased planting intentions for other feed grains. Relatively small changes in corn acreage are reported for most states, with the largest change being a 600,000 acre reduction in South Dakota,” he added.

While the soybean stocks and planting intention estimates were “modestly friendly surprises” when compared to pre-report trade expectations, Good said. “On the other hand, the stocks and planting intentions estimates represented modestly negative surprises for the corn market. Part of the negative corn price response to the estimates likely reflects inflated trend yield estimates for 2015 and perhaps an incorrect interpretation of the pace of feed and residual use during the first half of the marketing year. Attention will now turn to spring weather and planting progress.”

Related Stories

The U.S EPA on July 17 released data showing more than 1.9 billion RINs were generated under the RFS during June, down 11% when compared to the same month of last year. Total RIN generation for the first half of 2025 reached 11.17 billion.

The U.S. EPA on July 17 published updated small refinery exemption (SRE) data, reporting that six new SRE petitions have been filed under the RFS during the past month. A total of 195 SRE petitions are now pending.

European biodiesel producer Greenergy on July 10 confirmed plans to shut down its biodiesel plant in Immingham, Lincolnshire, U.K. The company temporarily suspended operations at the facility earlier this year.

Aemetis Inc., a renewable natural gas and biofuels company, announced on July 17 that its India subsidiary, Universal Biofuels, appointed Anjaneyulu Ganji as chief financial officer, effective July 17.

Avia Solutions Group, the world's largest ACMI (aircraft, crew, maintenance, and insurance) provider, has partnered with DHL Express to reduce greenhouse gas emissions from its international shipments using SAF.

Upcoming Events