E15 infrastructure bill would add $35.9M to Minnesota GDP

April 4, 2017

BY Minnesota Bio-Fuels Assoc.

An infrastructure bill in the Minnesota House and Senate that calls for expanding access to E15 would contribute $35.9 million to the state's GDP, according to an analysis by ABF Economics.

House File 1257 and Senate File 1277 seeks to provide a one-time funding of $12.5 million to fuel retailers and fuel wholesalers to install equipment necessary to store or dispense E15. This funding would enable an estimated average of 150 retail stations to offer E15.

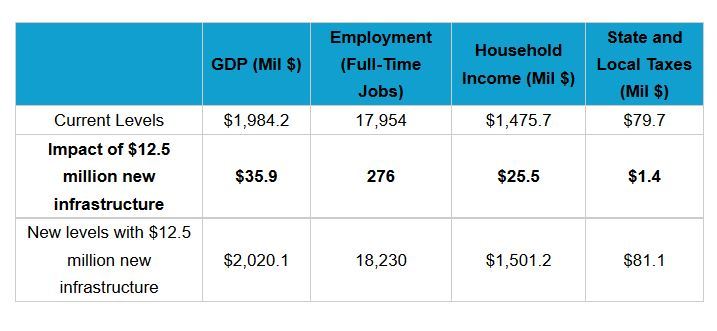

This investment, ABF Economics said, would not only translate to a $35.9 million contribution to Minnesota's GDP, but also support 276 full-time jobs, generate $25.5 million in household income and pay $1.4 million in state and local taxes.

In 2016, the ethanol industry contributed $1.98 billion to Minnesota's GDP, supported 17,954 jobs, generated $1.47 billion in household income and paid $79.7 million in state and local taxes. With this infrastructure bill, the annual contribution from the ethanol industry to Minnesota would be $2.02 billion in GDP, 18,230 jobs, $1.5 billion in household income and $81.1 million in state and local taxes.

Advertisement

Advertisement

Expanding the number of stations offering E15 by 150 could potentially increase annual E15 usage in Minnesota between 120 million gallons and 150 million gallons. This in turn would help the state meet its target of increasing biofuels in transportation fuel.

According to Minn. Stat 239.7911, biofuels should comprise 25 percent in transportation fuel by 2020. As of 2015, biofuels comprised 12.47 percent of transportation fuel in Minnesota. Increasing access and usage of E15 would certainly help us meet the goals set in Minn. State 239.7911.

Advertisement

Advertisement

Related Stories

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Upcoming Events