E2 analyzes implications of possible IRA repeal

SOURCE: E2

October 23, 2024

BY Erin Krueger

E2 on Oct. 15 released a new analysis on the Inflation Reduction Act’s economic impact along with a survey of more than 900 businesses that indicates repealing or rolling back the IRA’s provisions would result in business losses, layoffs and closures.

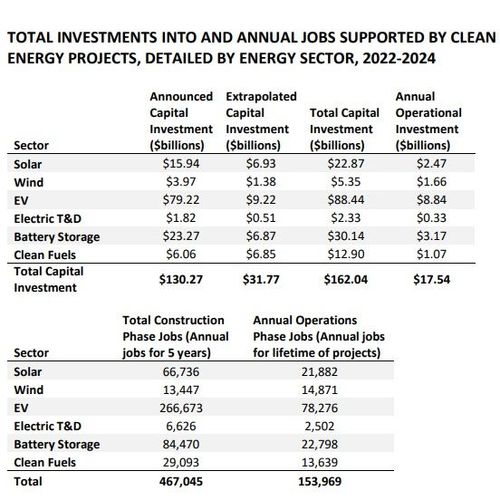

E2’s analysis shows large-scale clean energy projects announced during the two years following the signing of the IRA will support more than 600,000 jobs, generate hundreds of billions of dollars new wages, tax revenues and economic growth, and continue producing tens of billions more in economic benefits each year after they open.

Advertisement

Advertisement

The clean fuels sector, which E2’s analysis defines to include hydrogen and various biofuels, accounts for approximately 8% of the large-scale clean energy projects announced since the passing of the IRA in terms of total investment. The analysis indicates that the clean fuels sector has attracted $12.9 billion in total capital investment over the two-year period. That includes $10.08 billion in the first year and $2.83 million in the second year. The annual operational investment for clean fuels is estimated at $1.07 billion.

Total construction phase jobs, defined as annual jobs for five years, is estimated at 29,093 jobs for the clean fuels sector. Annual operational phase jobs, defined as annual jobs for lifetime of projects, is estimated at 13,639 jobs.

The survey, completed in August by 930 business stakeholders, illustrates the business impact of the IRA and its provisions. Approximately 85% of survey respondents said the IRA was “very important” or somewhat important” to their company’s growth. More than half of survey respondents said they would lose business or revenue if the IRA is repealed, with more than a quarter indicating they would lose projects or contracts. Approximately 21% said they would have to lay off workers if the law is repealed.

Advertisement

Advertisement

Approximately 36% of survey respondents reported that their organization is involved with the renewable and/or zero-carbon fuels sector, with 3.4% reporting that renewable and/or zero-carbon fuels is their firm’s primary technology focus based on the majority of labor hours performed.

Of the 334 survey respondents that reported their organization is involved with the renewable and/or zero carbon fuels sector, 54.2% said they were active in the renewable diesel space, with 53.3% active in biodiesel, 46.7 active in sustainable aviation fuels (SAF), 45.5% active in waste fuels, 42.2% active in woody biomass/cellulosic fuel; 38% active in corn ethanol, 20.4% active in other biofuels, 7.2% active in other ethanol/non-woody biomass, and 5.4% active in other renewable and/or zero carbon fuels.

Additional information, including full copies of the analysis and survey results, is available on the E2 website.

Related Stories

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

International Air Transport Association has announced the release of the Sustainable Aviation Fuel (SAF) Matchmaker platform, to facilitate SAF procurement between airlines and SAF producers by matching requests for SAF supply with offers.

Alfanar on June 20 officially opened its new office in London, further reaffirming its continued investment in the U.K. The company is developing Lighthouse Green Fuels, a U.K.-based SAF project that is expected to be complete in 2029.

ATR and French SAF aggregator ATOBA Energy on June 19 signed a memorandum of understanding (MOU) to explore ways to facilitate and accelerate sustainable aviation fuel (SAF) adoption for ATR operators.

International Sustainability & Carbon Certification has announced that Environment and Climate Change Canada has approved ISCC as a certification scheme in line with its sustainability criteria under its Clean Fuel Regulations.

Upcoming Events