E85 is increasingly price competitive in areas of the Midwest

U.S. EIA

September 23, 2013

BY U.S. Energy Information Administration

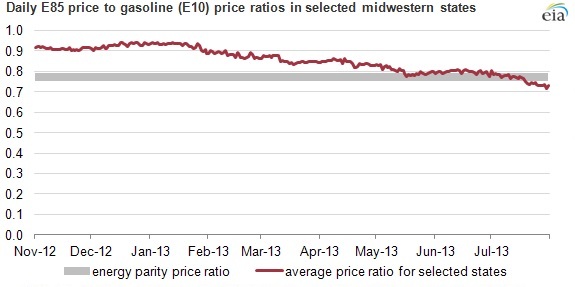

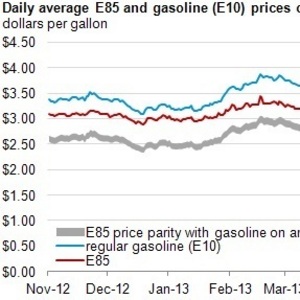

The retail price of E85 motor fuel, which is gasoline blended with up to 85 percent ethanol, has fallen in recent months. While ethanol has been cheaper than regular gasoline on a per-gallon basis for several years, ethanol's lower energy content often meant that consumers paid more per mile when using higher ethanol blends such as E85. However, recent declines in E85 prices at stations offering that fuel in several Midwestern states have brought E85 close to price parity with regular gasoline on an energy content basis.

Price parity on an energy content basis means that drivers with one of the more than 8 million flex fuel vehicles (FFVs) in the country (approximately 3 percemt of vehicles) capable of running on fuels with higher ethanol content can achieve the same mileage per dollar with E85 as with E10 (gasoline with up to 10 percent blended ethanol), the main blend used in vehicles now.

The lowest E85 pump prices have generally been in the Midwest, where most U.S. ethanol is produced and which, consequently, has relatively low wholesale ethanol prices. Nationwide, approximately 2,350 service stations—or 2 percent of all retail stations—offer E85 motor fuel, with the overwhelming majority located in the Midwest.

Advertisement

Because E85 is less energy dense than standard E10 gasoline, consumers using E85 will need to refuel more often. In addition, they may need to travel farther to reach a station that offers E85, because they are less widespread. For these reasons, some consumers may not be willing to switch from E10 to E85 until the latter is discounted below its energy parity price. Important questions include how many consumers would not consider switching without such a discount and the size of the discount that may be required.

The pricing of E85 relative to gasoline depends on both ethanol production costs, which are primarily driven by the price of ethanol feedstock (mainly corn), and the price of crude oil, which is the main driver of gasoline prices. Also, under the existing federal renewable fuel standard (RFS) program, producers and importers of gasoline are obligated to acquire renewable fuel credits, known as renewable identification numbers (RINs), which are generated during the production of renewable fuel. Since February, the rise in the market price of ethanol RINs has tended to reduce the price of E85 relative to E10 because production of E85 generates more RINs than production of the standard E10 blend. As the extra RIN value to E85 producers is passed along through the distribution chain in the form of a price discount, E85 becomes more competitive with regular gasoline.

Advertisement

Customers accustomed to comparing gasoline prices on a price-per-gallon basis may not be familiar with how to compare fuel prices on an energy basis. E85, which can have up to 25% less energy per gallon than regular E10 gasoline depending on seasonal variation in fuel specifications, needs to be discounted a comparable amount for consumers to achieve the same mileage per dollar (see chart below).

While fueling with E85 may now be a price competitive option for some consumers with FFVs, other ethanol blends, such as E15, continue to face challenges unrelated to pricing. Although the U.S. EPA authorized E15 to be used in vehicles manufactured in 2001 and later, most U.S. vehicle warranties do not cover the use of E15. And, because of potential liability issues arising from use of E15 in vehicles and small engines that are not approved for its use, only a handful of retailers currently offer that blend.

Related Stories

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

The government of Brazil on June 25 announced it will increase the mandatory blend of ethanol in gasoline from 27% to 30% and the mandatory blend of biodiesel in diesel from 14% to 15%, effective Aug. 1.

The U.S. EIA reduced its 2025 and 2026 production forecasts for a category of biofuels that includes SAF in its latest Short-Term Energy Outlook, released June 10. The forecast for 2025 renewable diesel production was also revised down.

The U.S. exported 21,545.9 metric tons of biodiesel and biodiesel blends of B30 and greater in April, according to data released by the USDA Foreign Agricultural Service on June 4. U.S. imports of biodiesel were at 4,417.3 metric tons for the month.

Upcoming Events