EIA: Biodiesel capacity down in 2021

September 15, 2021

BY Erin Krueger

U.S. biodiesel nameplate production capacity fell slightly between 2020 and 2021. The number of biodiesel plants was also down, according to data released by the U.S. Energy Information Administration on Sept. 3.

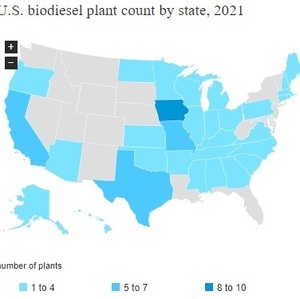

As of Jan. 1, 2021, the U.S. was home to 75 biodiesel plants, down 16 when compared to the 91 facilities reported one year earlier. Biodiesel capacity fell to 2.409 billion gallons per year in 2021, down 105 MMgy when compared to the 2.514 billion gallons of capacity reported for 2020.

Most U.S. biodiesel plants are located in Petroleum Administration for Defense District (PADD) 2, which is located in the Midwest. The number of biodiesel plants in PADD 2 fell to 37 this year, down five when compared to the 42 facilities reported for 2020. Nameplate capacity in PADD 2 was also down, falling to 1.483 billion gallons in 2021, down 17 MMgy when compared to the 1.5 billion gallons of capacity reported for last year.

The number of plants in PADD 3, the Gulf Coast region, fell by one, from 16 in 2020 to 15 in 2021. Capacity fell to 580 MMgy this year, down 32 MMgy when compared to the 612 MMgy of capacity reported for 2020.

Advertisement

PADD 5, located along the West Coast, currently has 10 biodiesel plants, down five when compared to the 15 reported for 2020. Capacity has fallen to 194 MMgy, down 29 MMgy when compared to the 223 MMgy of capacity reported for last year.

The number of plants in PADD 1, located along the East Coast, fell to 13 this year, down four when compared to the 17 plants reported for 2020. Capacity for PADD 1 is at 152 MMgy, down 27 MMgy from the 179 MMgy of capacity reported for last year.

There are currently no biodiesel plants located in PADD 4, located in the Rocky Mountain region.

The EIA has also for the first time released U.S. capacity data for biorefineries that produce renewable diesel, renewable heating oil, renewable jet fuel, renewable naphtha and gasoline, and “other" renewable fuels and intermediate products.

Advertisement

As of Jan. 1, 2021, the EIA has identified six such U.S. facilities that were operational with a combined nameplate capacity of 791 MMgy. No comparable data is available for prior years.

Most of that capacity is currently located in PADD 3, which currently has two such biorefineries with a combined capacity of 437 MMgy. Two facilities are also currently located in PADD 2. Those facilities have a combined nameplate capacity of 195 MMgy. PADD 4 and PADD 5 each currently have one facility with respective nameplate capacities of 117 MMgy and 42 MMgy. No facilities are currently located in PADD 1.

Additional data is available on the EIA website.

Related Stories

Phillips 66 on July 25 released Q2 financial results, reporting the company’s Rodeo Renewable Energy Complex in California continues to run at reduced rates due to market conditions. Pre-tax income for the renewables segment was up when compared to Q1.

The EIB and Eni on July 24 signed a €500 million 15-year finance contract to support the conversion of Eni’s Livorno refinery in Tuscany, Italy, into a biorefinery that can produce renewable diesel, renewable naphtha and bio-LPG.

Iowa Secretary of Agriculture Mike Naig announced that the Iowa Renewable Fuels Infrastructure Program Board recently approved an additional 24 applications from Iowa fuel retailers to support new and expanded biofuel infrastructure projects.

CountryMark on July 22 celebrated the completion of more than $100 million in upgrades at its refinery in Indiana, including those related to soybean oil storage. The facility produces renewable diesel via coprocessing technology.

ATOBA Energy and Air Moana are partnering to implement scalable solutions for the supply of SAF. The collaboration aims to ensure long-term SAF availability while supporting local initiatives to develop sustainable fuel production in Tahiti.

Upcoming Events