EIA projects US renewable diesel supply will surpass biodiesel

March 24, 2022

BY U.S. Energy Information Administration

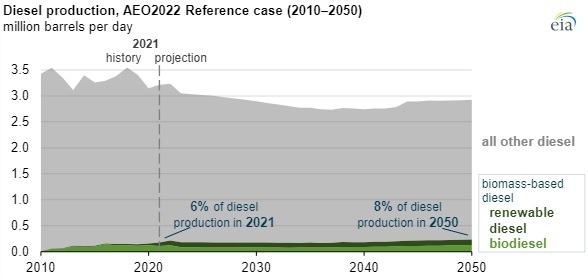

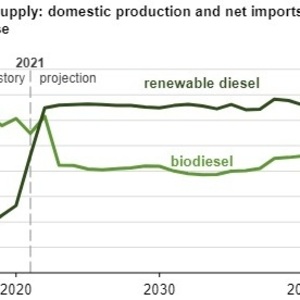

In our Annual Energy Outlook 2022 (AEO2022) Reference case, which reflects current laws and regulations, we project that renewable diesel supply (domestic production and net imports) will exceed biodiesel supply in the near term. We project that renewable diesel supply will increase to 130,000 barrels per day (b/d) in 2022 and 145,000 b/d in 2050, reflecting a significant increase in renewable diesel production capacity in the near term.

Biomass-based diesel fuels include biodiesel and renewable diesel, both of which are refined from the same types of fat, oil, and grease feedstocks. Renewable diesel is chemically indistinguishable from petroleum diesel (known as a drop-in diesel fuel), meaning that it meets specifications for use in existing infrastructure and diesel engines and is not subject to any blending limitations. Biodiesel is a mixture of chemical compounds known as alkyl esters and is often combined with petroleum diesel in blends of 5 percent to 20 percent, known as B5 to B20, respectively.

Advertisement

We project that production of renewable diesel supply will grow because of its compatibility with existing distribution infrastructure and engines, higher state and federal targets for renewable fuel production, incentives from tax credits, and the conversion of existing petroleum refineries into renewable diesel refineries.

Targets and incentives that contribute to renewable diesel’s growth include the Renewable Fuel Standard, California’s Low-Carbon Fuel Standard, and the U.S. biomass-based diesel blender credit, which currently applies through 2022 and allows qualified taxpayers to claim a credit of $1.00/gallon when the required amount of biodiesel or renewable diesel is blended with petroleum diesel for sale or use in a trade or business. In response to the improved economics of renewable diesel due to these policy actions, domestic production capacity has increased, both in the form of new stand-alone facilities and converted petroleum refineries.

We assume that policies, rather than market demand, drive the adoption of biomass-based diesel fuels in the AEO2022 Reference case. Renewable diesel and biodiesel compete for the same feedstocks, so some of the projected growth in renewable diesel production displaces biodiesel production. We project these two fuels will remain a relatively small part of the larger diesel market, accounting for less than 8 percent of the U.S. diesel production in 2050.

Advertisement

Although renewable diesel has no blend restrictions, it is relatively more expensive than biodiesel to produce. By contrast, biodiesel needs to be blended with another diesel fuel to be consumed. Both fuels attract interest and investment because they represent a potential pathway for reducing carbon emissions in the transportation sector and provide an alternative fuel source to petroleum-based diesel fuel.

Related Stories

The public comment period on the U.S. EPA’s proposed rule to set 2027 and 2027 RFS RVOs and revise RFS regulations closed Aug. 8. Biofuel groups have largely expressed support for the proposal but also outlined several ways to improve the rulemaking.

In celebration of World Biodiesel Day, MOL Group on Aug. 8 announced SAF was successfully produced for the first time at INA’s Rijeka Refinery during a pilot project to process biocomponent. Renewable diesel was also produced.

Iowa farmers have a new market opportunity for their 2025 soybean crop. Landus is expanding its Clean Fuel Regulation initiative, made possible by recent policy changes expected to increase Canada's demand for liquid biofuel.

Topsoe, a leading global provider of advanced technology and solutions for the energy transition, has been selected as the renewable diesel technology partner for CountryMark’s Mount Vernon, Indiana refinery.

The U.S. exported 35,953.6 metric tons biodiesel and biodiesel blends of B30 or greater, according to data released by the USDA Foreign Agricultural Service on Aug. 5. Biodiesel imports were at 2,148.9 metric tons for the month.

Upcoming Events