EIA: US imports of renewable diesel increased in the early months of 2024

Data source: EIA Petroleum Supply Monthly / Note: Rest of U.S. imports went to Perth Amboy, New Jersey, and Atlanta, Georgia, in the first five months of 2024 and went to Newark, New Jersey, and Houston, Texas, in 2023.

August 8, 2024

BY U.S. Energy Information Administration

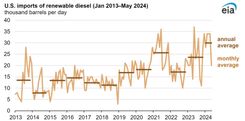

In the first five months of 2024, U.S. imports of renewable diesel averaged 30,000 barrels per day (b/d), approaching the monthly record set in May 2023. Most of the imports (94%) were destined for the U.S. West Coast, where most of the country's renewable diesel is consumed. All U.S. imports came from Neste’s plants in Singapore and Rotterdam.

Renewable diesel is a transportation and heating fuel that is chemically equivalent to petroleum-based distillate fuel but is produced using fats, oils, or greases rather than petroleum. Because California, Oregon, and Washington are the only states with active clean fuel programs that incentivize the consumption of renewable diesel beyond the incentives provided by federal policies, renewable diesel is primarily consumed on the West Coast.

Advertisement

The United States imported 29% more renewable diesel during the first five months of 2024 than in the same period last year. The increase in imports was likely driven by increased:

- Production capacity at Neste’s Singapore plant following its expansion in mid-2023

- Renewable diesel storage capacity at Vopak’s terminal in Los Angeles, California

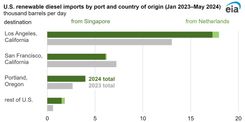

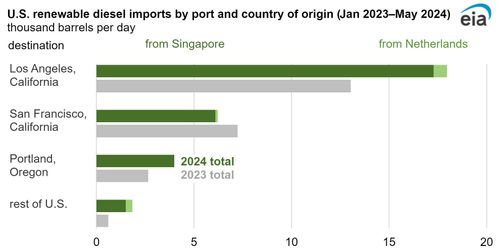

So far in 2024, 18,000 b/d of the 30,000 b/d of imported renewable diesel have gone to Los Angeles, an increase from 2023’s annual average of 13,000 b/d, according to our company-level import data. The increase in terminal capacity in Los Angeles has likely underpinned the growth in imports to that port in 2024.

Renewable diesel imports arriving in San Francisco, California, have decreased slightly, while imports increased slightly in 2024 to Portland, Oregon; Atlanta, Georgia; and Perth Amboy, New Jersey. Neste’s Singapore plant has supplied 96% of U.S. renewable diesel imports so far in 2024, and its Rotterdam plant has supplied the remaining 4%. The ratio was similar in 2023, but Neste’s Finland plant also supplied some renewable diesel last year.

Advertisement

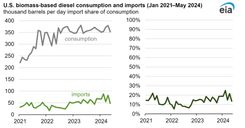

Imports of biomass-based diesel—a category that includes both renewable diesel and biodiesel—have made up a larger-than-normal portion of U.S. consumption. In the first five months of 2024, imported biomass-based diesel supplied about 20% of U.S. biomass-based diesel consumption, compared with about 15% in 2023 and 10% in 2022.

Although we forecast that more biodiesel and renewable diesel will be imported in 2024 than in previous years in our Short-Term Energy Outlook, we expect imports to decrease in the second half of the year in part because of scheduled maintenance at Neste’s Singapore and Rotterdam plants.

Related Stories

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

The government of Brazil on June 25 announced it will increase the mandatory blend of ethanol in gasoline from 27% to 30% and the mandatory blend of biodiesel in diesel from 14% to 15%, effective Aug. 1.

The U.S. EIA reduced its 2025 and 2026 production forecasts for a category of biofuels that includes SAF in its latest Short-Term Energy Outlook, released June 10. The forecast for 2025 renewable diesel production was also revised down.

Upcoming Events