Ethanol blending provides another proxy for gasoline demand

U.S. Energy Information Administration

October 7, 2013

BY U.S. Energy Information Administration

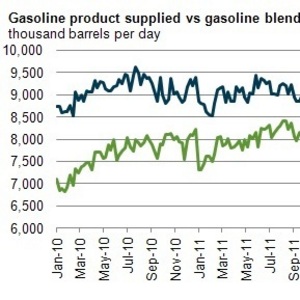

Measuring current U.S. gasoline demand can be difficult, as there are 160,000 retail gasoline stations and more than 250 million vehicles in the country. The U.S. Energy Information Administration traditionally used average daily product supplied (the dark blue line in the graph), calculated from weekly and monthly data on refinery operations and changes in product inventories at refineries and terminals, as one estimate of daily gasoline consumption over a given week. However, issues surrounding the timing and availability of some data, notably the lack of weekly product export data, can sometimes skew the product supplied calculation. Another proxy for gasoline consumption is the amount of gasoline blended with ethanol each week. This measure (the green line in the graph above) is based on only one factor and represents nearly all gasoline consumed in a given time frame.

In 2010, about 85 percent of gasoline consumed in the United States contained ethanol, almost all in a 10-percent blend often referred to as E10. The share of the gasoline pool that contains ethanol has continued to rise, and most of this fuel is E10.

Advertisement

The rising share of ethanol-blended fuels reflects, in part, retailers' desire to sell gasoline to consumers at the lowest possible volumetric price, since consumers do not typically take account of the lower energy content of E10 compared to petroleum-only gasoline. Rising mandates under the renewable fuel sstandard (RFS) program have also supported increased use of ethanol and other renewable fuels. Higher prices for the renewable identification numbers (RINs) that are used by the U.S. EPA to track compliance with the RFS program since early 2013 have increased the incentive to blend ethanol into gasoline.

Under present market conditions, where nearly all gasoline sold is E10, the volume of ethanol blended into gasoline has become a stronger indicator of overall U.S. gasoline demand, as shown by the recent convergence of the blue and green lines in the figure.

Advertisement

Ethanol blending typically takes place at a truck rack as a final step in the gasoline production process and is then taken directly to market for consumption within days. Since nearly all gasoline consumed today is E10, it is reasonable to assume that the amount of ethanol blending reported to EIA each week is representative of nearly the full amount of gasoline consumed that week. This calculation is not affected by issues affecting the quality and timing of import, export, refinery operation, and inventory data that enter into the traditional gasoline product supplied calculation. However, it is important to recognize that both the share of the overall gasoline pool sold as ethanol blends and the proportion of ethanol used in such blends have both changed over time. Future changes in the share of gasoline blended with ethanol or increasing variation in the proportion of ethanol used in blends, as would occur if higher ethanol blends, such as E15 and E85, were widely sold, would reduce the value of using total ethanol blending as a proxy for gasoline use.

Related Stories

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

EcoCeres Inc. has signed a multi-year agreement to supply British Airways with sustainable aviation fuel (SAF). The fuel will be produced from 100% waste-based biomass feedstock, such as used cooking oil (UCO).

Upcoming Events