Ethanol group leads The Andersons Q3 segment earnings

The Andersons Inc.

November 8, 2016

BY Susanne Retka Schill

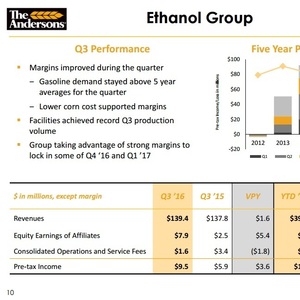

The Andersons Inc. reported third quarter net income of $1.7 million, or 6 cents per diluted share, on revenues of $860. Pre-tax earnings were led by the ethanol group at $9.5 million, with the grain group earning $1.9 million, off-set by challenges in the plant nutrient group.

"Conditions are improving for our grain group and margins are strong for the ethanol group, but challenges persist with our plant nutrient group facing weak margins and our rail group continuing to experience softening in utilization," said CEO Pat Bowe. "In this mixed environment, the team is making good progress on our $10 million cost reduction initiative and continuing to take action on the items within our control to combat uncertainty in some of our markets."

Advertisement

Advertisement

The ethanol group’s Q3 pre-tax income of $9.5 million compared to $5.9 million in the same quarter last year. The group saw a third-quarter best, producing 95.4 million gallons compared to 93.5 million the same quarter last year. The ethanol group’s year-to-date performance is still behind last years, but is closing gap.

In its Q3 earnings report, the company reported ethanol margins rose throughout the quarter as corn prices remained modest and gasoline prices began to return to prior year levels after holding at five year lows for most of the year. Renewable identification number (RIN) prices held at strong levels through the quarter, near the cent level, which supports demand for higher blends such as E85. A portion of the quarter’s margins were hedged early in the quarter to lock in at attractive levels, the company said. In the Nov. 8 investor call, Bowe added that the ethanol group has locked 70 percent of Q4 production at solid margins and 30 percent of the next quarter.

The expansion of the ethanol production facility in Albion, Michigan, continues to proceed safely, on budget and on schedule, expected to come online in the first half of 2017. The project will double the joint venture's annual capacity to about 130 million gallons

Advertisement

Advertisement

Industry dynamics in the quarter were supportive, with record production levels and historically high levels of gasoline demand driven by low fuel prices. The group continues to see softness in distiller's dried grain (DDG) prices. Chinese sanctions and higher vomitoxin levels near some facilities have had some negative impact on DDG.

In responding to a question in the investor call, Bowe said the company is not a major exporter, but the entire industry benefits from the growth in ethanol exports. “When you think about the U.S. industry with reasonable corn prices and plants running strong and efficiently, we’re in a good place,” he said. Brazil sugar producers are putting more production into sugar than ethanol, which is positive for U.S. exports. China is a wild card, he added, active in the export market for a while, but now quiet. The policy change to drop corn subsidies in China and draw down its corn inventory doesn’t have a direct impact on the Andersons in the short term, but it does suggest a more positive outlook for the grain industry in general and in the long term.

Related Stories

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

EcoCeres Inc. has signed a multi-year agreement to supply British Airways with sustainable aviation fuel (SAF). The fuel will be produced from 100% waste-based biomass feedstock, such as used cooking oil (UCO).

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

Upcoming Events