Ethanol performs well in disappointing year for The Andersons

The Andersons Inc.

February 11, 2016

BY Susanne Retka Schill

The Andersons reported a disappointing overall year for 2015. Positive results in its rail and ethanol segments were offset by losses in the grain, plant nutrient and retail segments. Although adjusted net income was $41.2 million, the resulting GAAP (following generally accepted accounting principles for financing accounting) was a net loss of $13.1 million, or a 46 cent loss per diluted share on revenues of $4.2 billion for 2015.

Performance in the fourth quarter was positive. Adjusted net income attributable to The Andersons for the fourth quarter was $5 million, or 18 cents per diluted share, on revenues of $1.2 billion compared to $25.9 million, or 89 cents per diluted share, on revenues of $1.3 billion in the same period of the prior year.

"We are understandably disappointed in 2015's overall results. Market conditions this year in the Eastern Corn Belt coupled with underperformance in our grain group significantly impacted the performance of our agriculture businesses," said CEO Pat Bowe. "We were pleased to see the record performance in our rail group and felt good that our ethanol group executed well in a very challenging energy environment. We remain confident in our ability to navigate tough market conditions and deliver shareholder value and growth."

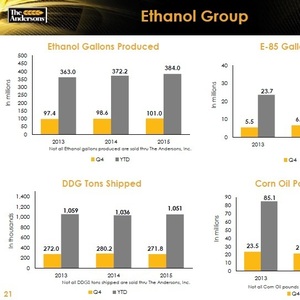

The ethanol group reported record production output in the fourth quarter and full year, producing 384 million gallons in 2015 compared to 372 million gallons in 2014, and a nameplate capacity of 330 million gallons. Construction is expected to be completed in the first half of 2017 that will double the capacity at the company’s joint venture in Albion, Michigan, which currently produces about 65 MMgy. Bowes commented during the call that the truck-in and truck-out environment, plus the ethanol deficient market in Michigan made the expansion attractive.

Advertisement

Advertisement

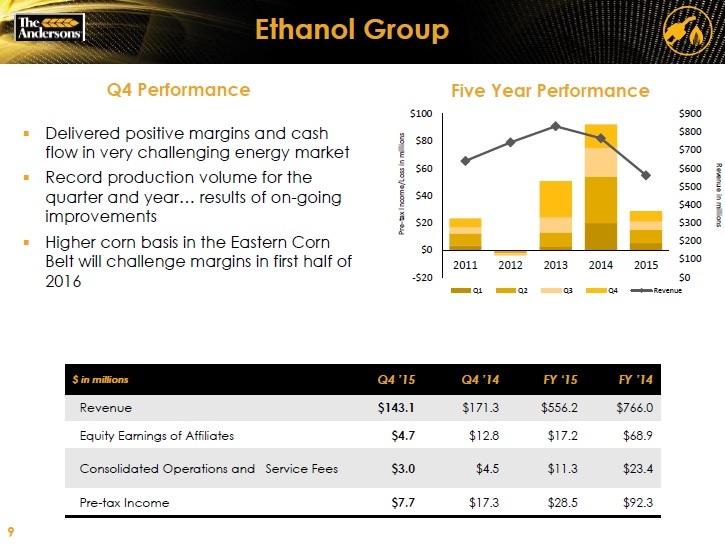

The Andersons’ ethanol group showed Q4 revenues of $143 million and a gross profit of $5.9 million. When affiliate earnings and other adjustments were made, the net income before taxes for the segment was $7.7 million. That compares with revenues of $171.3 million in the same period a year ago, and net income before taxes of $17.3 million. “The ethanol group executed very well in the face of low oil prices and high industry supply levels, delivering its third best profit year despite market conditions,” the company release said, adding that margins of coproducts were also under pressure in Q4 on low international demand, particularly in distillers grains bound for China.

For the year, the ethanol segment saw $556.2 million in revenues and a gross profit of $24.3 million. After adjustments for affiliates, the final income before taxes for the segment was $28.5 million. That compares with $765.9 million in revenues for 2014 and net income before taxes of $92.3 million. The ethanol segment came in second in 2015 for revenues behind the rail group with its net income before taxes of $50.7 million, compared to 2014 when ethanol brought in the highest earnings, trailed by the grain group’s performance at $58.1 million in income before taxes.

The plant nutrient group ended the year lower as volumes slowed on deteriorating prices following a difficult spring and fall seasons. The grain group also struggled due to lower crop production in the Eastern Corn Belt.

This was the first investor call chaired by the company’s new CEO Patrick Bowe who is stepped in for the retiring Mike Anderson at the end of the year. Coming to The Andersons with a 35-year career in the grain business and many years with Cargill Inc. in various executive positions, Bowe said he is impressed with the quality and commitment of the team at The Andersons.

Advertisement

Advertisement

A number of other top positions changed in past months. Chief operating officer Hall Reed and corporate vice president Tom Waggoner announced their retirements and both senior leadership roles were eliminated, the company said in its Jan. 8 news release.

Neill C. McKinstray, who has served as the president of both the grain and ethanol groups, will retire in July. He will continue as president of the ethanol group until then and offer guidance to the new president of the grain group, Corbett J. Jorgenson. Jorgenson has nearly 20 years of experience in general management, agricultural trading and risk management with Cargill, most recently serving as the vice president and regional lead for the Americas with Cargill Transportation and Logistics.

Senior vice president of human resources Arthur DePompei will retire April 30, providing assistance to his replacement, Valerie Blanchett who became vice president of human resources Feb. 1. She also comes to The Andersons from Cargill, most recently serving as the vice president for the Food Ingredients & Systems Platform, leading the North American human resources teams.

Related Stories

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

Global digital shipbuilder Incat Crowther announced on June 11 the company has been commissioned by Los Angeles operator Catalina Express to design a new low-emission, renewable diesel-powered passenger ferry.

International Air Transport Association has announced the release of the Sustainable Aviation Fuel (SAF) Matchmaker platform, to facilitate SAF procurement between airlines and SAF producers by matching requests for SAF supply with offers.

Upcoming Events