Ethanol's Recovery Readout

October 1, 2020

BY Lisa Gibson

Since the COVID-19 pandemic slammed the ethanol industry in March of this year, almost 30% of producers recently surveyed by Ethanol Producer Magazine have drastically changed daily operations. Twenty-five percent said the economic downturn seriously affected operations and business. Still, almost 84% of respondents laid off only 1% to 5% of their staff.

EPM emailed a 23-question survey about the impacts of COVID-19 to CEOs and general managers of U.S. ethanol plants. Forty-four completed the survey, providing a snapshot of experiences across the industry.

Production

Production slowdowns started as early as February for some, and as late as May for others. One producer didn’t slow production, but increased it, while another also maintained but “emptied the tanks” during the downturn.

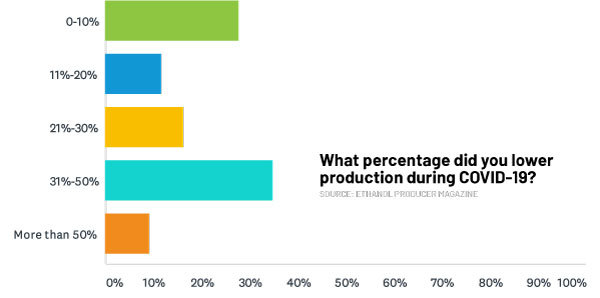

Less than 10% of respondents lowered production by more than half of their pre-pandemic production volume; the majority—more than a third—lowered by 31% to 50%. Interestingly, 0 to 10% was the next most common reduction, at 28%. Results showed 12% lowered production by 11% to 20%; 16% lowered production by 21% to 30%; and 9% reported reductions of more than 50%.

U.S. Energy Information Administration data reports a sharp decrease in production of more than 35% from March to April (1.04 million barrels per day to 672,000).

As of the end of August, almost 32% of survey respondents said production had increased more than 50% since the low point. Twenty percent said production had only increased 0 to 10%; 16% reported an 11% to 20% increase; about 14% reported an increase between 21% and 30%; and 18% said production had increased 31% to 50%.

Daily Operations

While one-fourth of respondents said their operations were seriously affected by the COVID-19 slowdown, just 7% said they were severely affected—the only worse category. The others reported less negative effects. About one in five respondents said operations were somewhat seriously affected; a third of them said operations were moderately affected; and 16% reported no effect at all.

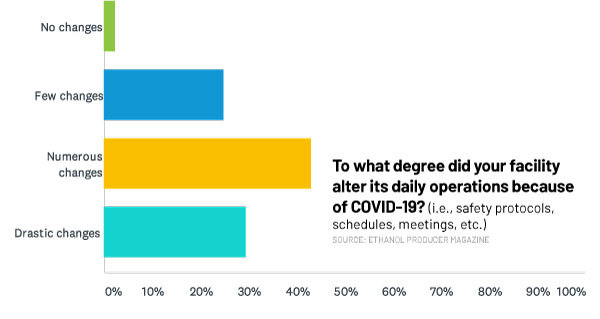

Thirty percent said drastic changes have been required in areas such as safety protocols, schedules and meetings. About 43% reported numerous changes were required; one-fourth reported few changes; and just 2% said the pandemic required no changes to operations.

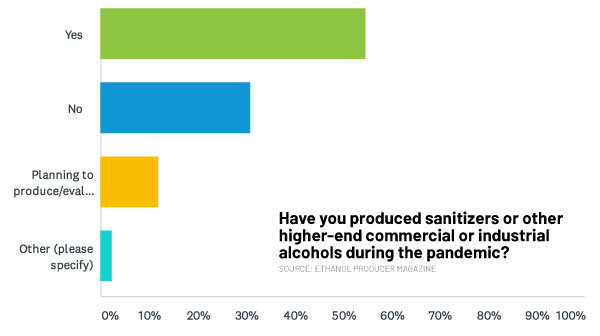

More than 54% of respondents said they have produced hand sanitizer or other high-end commercial alcohols during the pandemic. Thirty-two percent said they have not; and 12% said they are considering it. More than 57% of those producing sanitizer or high-end alcohol said they will continue to produce it after the FDA guidance for ethanol in hand sanitizer expires. The remainder said they will not.

Advertisement

Expenses are being reduced in a several ways beyond decreasing production, including reducing hours, paying more attention to feedstock prices, minimizing travel and other expenses, shortening planned shutdowns, overtime reduction, reducing maintenance, freezing capital projects, lowering chemical usage, and negotiating price breaks with vendors. Some respondents also said they are reducing staff.

Those reported reductions have amounted to considerable savings, sometimes up to or more than $100,000 per month, as reported by three respondents. One producer said they’re saving about $34,000 per month, another $10,000 per month, and one facility reported that 90% of its expenses had been eliminated, presumably due to being idle. Many declined to give a dollar amount or percentage.

Staff and Pay

About 84% of CEOs and general managers who took the survey said they only had to layoff or furlough 1% to 5% of employees. Approximately 10% of respondents said they laid off or furloughed more than 25% of their staff. About 3% reported 6% to 10%, mirroring the 11% to 15% range. No respondents said they laid off or furloughed 16% to 25% of their staff.

Morale has been affected, too. More than one-fifth of respondents said employee morale has been affected somewhat seriously; 47% reported moderate effects; 30% said morale has not been affected at all. Thankfully, no respondents reported severe blows to morale during the pandemic.

About 88% of respondents said no employees have voluntarily resigned over dissatisfaction during the pandemic, while about 12% said they have had voluntary resignations as a result of dissatisfaction.

The resignations included operators, supervisors, receptionists and accountants. All respondents reporting voluntary resignations said they will replace those employees, though some must wait until the plants resume production. About 76% of respondents said they have not frozen hiring, while 24% said they have.

Similarly, about 62% said they have not suspended pay raises or bonuses. Nineteen percent said they have not decided whether to suspend raises and bonuses; less than 10% said raises and bonuses have been suspended; 2% said bonuses have been suspended; and 7% said raises have been suspended.

Recovery and the Future

The majority of survey respondents 76% reported that fuel market stability and recovery are their main concerns in terms of maintaining normal operations during the pandemic. None said their main concern is coproduct market stability; and 19% said their main concern is personnel health. It is reasonable to assume all respondents have similar concerns about employee health during the pandemic, but simply do not view it as a primary operational threat. Write-in responses included staffing concerns, the political climate, the upcoming election, and U.S. EPA’s lack of cooperation.

Advertisement

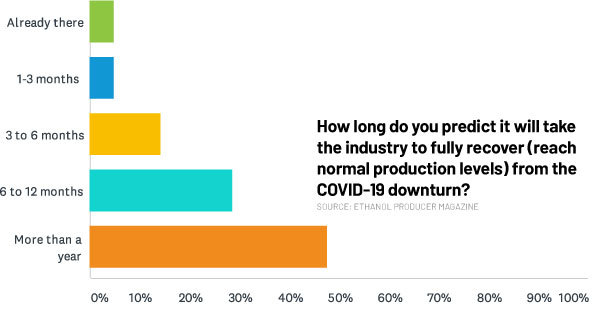

Recovery seems to be a ways out, according to most respondents. Nearly half of the producers that responded expect it will take more than a year for the ethanol industry to recover. Twenty-nine percent expect full recovery in six to 12 months; 14% in three to six months; about 5% said one to three months; and another 5% said the industry is already recovered, which doesn’t square with the industry’s collective production rate—still 10% below last year—and is presumably a reflection of their own experience.

An astonishing 93% said they are evaluating or investing in new product technologies to enhance operational efficiency. They include high-end alcohol, cogeneration, high-protein coproducts, wind and solar technologies, additives, energy efficiency gains, fiber separation, distillation, centrifuges and carbon reduction.

Respondents are largely dissatisfied with the current administration, saying President Donald Trump has been too pro-oil, has not matched actions with promises, and has given far too many breaks to big oil. One respondent said, “Current administration rhetoric, does not match their actions. No reason to think that will improve if they have another four years and no reelection pressure.” Another wrote, “We need an administration that is going to follow the law and not cave to the oil industry.”

One respondent did say Trump’s support is critical to the ethanol industry. A few others said neither party is friendly to corn or ethanol, and one said politics drive too much.

As for trade, respondents expressed severe concern about China, citing the vitality of exports for U.S. ethanol. “If we don't get international markets opened up it will severely impact American agriculture,” one said. Another responded, “I do not think China was ever realistically going to be a viable source for ethanol exports. There will always be some global market for DDGS.”

Other countries raising trade concerns include Brazil, Canada and Mexico. A few said they have concerns with EU markets, as well.

Moving forward, small refinery exemptions (SREs) prompt intense concern, reported many respondents. Of 29 responses to the question of other policy concerns, 12 centered on SREs. Other responses included trade policy, additional demand loss, E15 or E30 growth, guidelines for USP-grade ethanol, and oil prices.

One respondent likely summed up the mentality of many producers, when they said, “I am concerned about all things these days. Seems like head wind on everything we do.”

Author: Lisa Gibson

Editor, Ethanol Producer Magazine

701.738.4920

lgibson@bbiinternational.com

Related Stories

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events