EU Commission begins antisubsidy process against Indonesia

December 11, 2018

BY UFOP

The Union zur Förderung von Öl- und Proteinpflanzen (UFOP) welcomes the EU Commission’s adoption of the proposal made by the European Biodiesel Board to now also begin an antisubsidy process against Indonesia. UFOP calls for urgent action in the form of the temporary appointment and application of customs duties on imports of palm oil biodiesel. In this context, UFOP refers to the cap on palm oil fuels for 2019 and the gradual subsequent phaseout per the revised version of the Renewable Energy Directive (REDII), which has recently been approved. The EBB warns that import duties to be applied in 2019 will be circumvented by the increased import of palm oil for the production of biodiesel in the European Union.

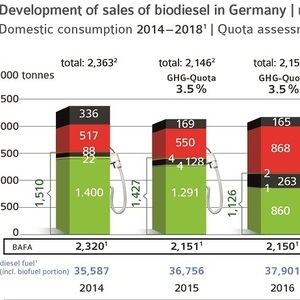

UFOP clarified their call for action by referring to the sales development of biodiesel in Germany, especially in reference to raw material composition. This meant that the proportion of palm oil-based biofuels, specifically biodiesel, increased in Germany in 2017 to more than 0.5 million metric tons, according to the Evaluation and Progress Report of the German Federal Office for Agriculture and Food (BLE). In 2015 and 2016, the figures were 0.3 and 0.43 million tons respectively. In the same time period, the proportion of rapeseed oil methyl ester (RME) decreased from 1.3 to 0.8 million tons. As a result, RME and rapeseed oil had to be exported at lower prices.

Advertisement

The cause of this price pressure is the global increase in the production of plant oil. In the economic year 2018-’19, more than 200 million tons of plant oil were produced worldwide for the first time, of which approximately 72.3 million tons were palm oil (up 4.3 percent). This surplus is the cause of the enduring price pressure. This caused wholesale prices to sink to 465 euros per ton for palm oil and around 765 euros per ton for rapeseed oil. UFOP questions how sustainable production of palm oil, with social criteria being taken into particular consideration, is possible at these prices. The example of palm oil shows that the sustainability certification requires more intense monitoring. The success and reputation of sustainability certification must be recognizable, completely irrespective of the end use, especially in terms of improving income in agriculture. UFOP notes that the food and chemical industries are freeloaders who are benefiting from the current market trends in palm oil, and who are not required to fulfill any statutory requirements in order to enter the market.

Advertisement

Related Stories

Louis Dreyfus and Global Clean Energy renew agreement to expand camelina cultivation in South America

Louis Dreyfus Company and Global Clean Energy Holdings Inc. announced on March 11 the renewal for an additional 10 years of their collaboration to promote the cultivation of Camelina sativa (camelina) in South America as an intermediate crop.

The U.S. EPA on March 12 announced it has kicked off a formal reconsideration of 2009 Endangerment Finding, which forms the legal basis for GHG regulations, and is considering the elimination of the agency’s Greenhouse Gas Reporting Program.

Fuel retailers, trucking fleets and home heating industry urge Congress to extend the biodiesel blenders tax credit

NATSO, representing America’s truck stops and travel centers, SIGMA: America’s Leading Fuel Marketers, and a variety of other groups are urging Congress to extend the “Section 40A" Biodiesel Blenders' Tax Credit.

The USDA reduced its forecast for 2024-’25 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released March 11. The outlook for soybean oil price was unchanged.

The U.S. EPA on March 7 announced it will extend the compliance year 2024 Renewable Fuel Standard reporting deadline and signaled its intent to revise the 2024 RFS renewable volume obligation (RVO) for cellulosic biofuel.

Upcoming Events