EU tariffs on Indonesian biodiesel welcomed with caution

July 31, 2019

BY Ron Kotrba

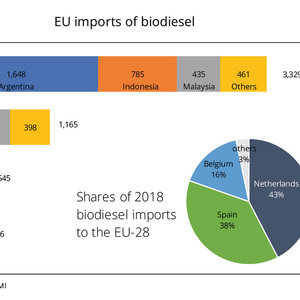

The EU Commission recently decided to introduce temporary countervailing duties on biodiesel imports from Indonesia, which will be determined on a company-specific basis varying between 8 and 18 percent. Germany’s Union for the Promotion of Oil and Protein Plants (UFOP) welcomed the decision but warns that a suspension or slowdown of biodiesel imports from Indonesia must not lead to European biodiesel producers using palm oil as a raw material instead.

“The introduction of customs duties on biodiesel from Indonesia leads to a market vacuum that is filled by imports of palm oil by European biodiesel producers,” Dieter Bockey with UFOP told Biodiesel Magazine. “This does not benefit European rapeseed cultivation—the introduction of customs duties serves exclusively to secure the market share of European biodiesel producers. We therefore appeal to the responsibility of these companies to use rapeseed oil instead of palm oil so that this vacuum is closed by a ‘European’ raw material.”

Advertisement

Although UFOP naturally desires European biodiesel producers to rely on domestically produced rapeseed oil, Bockey said in Germany and elsewhere drought is causing problems. “In Germany we will probably only harvest 3 million [metric] tons of rapeseed,” he said.

According to Bockey, the critical discussion about palm oil has led to considerable damage. “But if the biodiesel industry nevertheless increasingly switches to palm oil, the environmental associations will publicly denounce this,” he said. “I fear that, regardless of the raw material, biodiesel will then be dead.”

This fear, Bockey said, can be seen from the fact that the EU Commission expressly excludes renewable raw materials from cultivated biomass from all funding options, especially for energy use. “This is now so widespread that even within the framework of the [German] national strategy for the decarbonization of transport, the committees to be set up by the federal government are only in favor of biofuels from residual materials,” he said. “Biofuels from cultivated biomass are practically ignored.”

Advertisement

UFOP also highlighted that import pressure resulting from the effects of the antisubsidy measures against Argentina should be considered.

“The EU Commission has set company-specific penalty tariffs, yet 1.2 million [metric] tons of tariff-free soya methyl ester imports were allowed at the same time,” UFOP stated. “The UFOP fears that this compromise could possibly form the blueprint for the final arrangement with Indonesia.”

Related Stories

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

Upcoming Events