Export Exchange addresses drought, RFS waiver

SOURCE: USDA

October 24, 2012

BY Holly Jessen

The 2012 Export Exchange drew more than 200 international attendees from more than 30 countries. The event, put on by the Renewable Fuels Association and U.S. Grains Council, ran Oct. 22 to Oct. 24 in Minneapolis.

Carl Casale, president and CEO of CHS Inc., gave a keynote address Oct. 23 on the outlook for global grain supplies and renewable energy. The company doesn’t own any ethanol plants, but Casale called it a leading exporter of distillers grains and a leading marketer of ethanol in the U.S.

The uncertainties facing the industry today are fourfold, he said. Drought, the 2012 election, the European debt crisis and unrest in the Middle East. The odds that all or none will persist in 2013 are smaller than the odds that some of those uncertainties will persist in the next year. “We could be in for some pretty interesting times in 2013,” Casale said.

Advertisement

If the drought continues into next season, it will result in food security concerns. However, thanks to federal crop insurance, U.S. farmers will be able to survive. If the RFS is waived or altered, Casale believes blenders will continue to utilize it as an oxygenate. There will still be demand for at least half of the ethanol produced today, plus demand for distillers grains and corn oil, ethanol’s coproducts. “We may see an industry that is smaller than today but I don’t believe the industry is going to go away—at least that’s how we are basing our business model,” he says.

Joe Glauber, chief economist for the USDA, gave attendees a recap of drought conditions, which he referred to as a “band of dryness” that moved south to north through the summer. While some compared the drought of 2012 to droughts that happened in the 1930s or 1950s, he felt it had the most similarities to the drought of 1988, a year which also started with early signs of crop progress but progressed into a “serious drought indeed.”

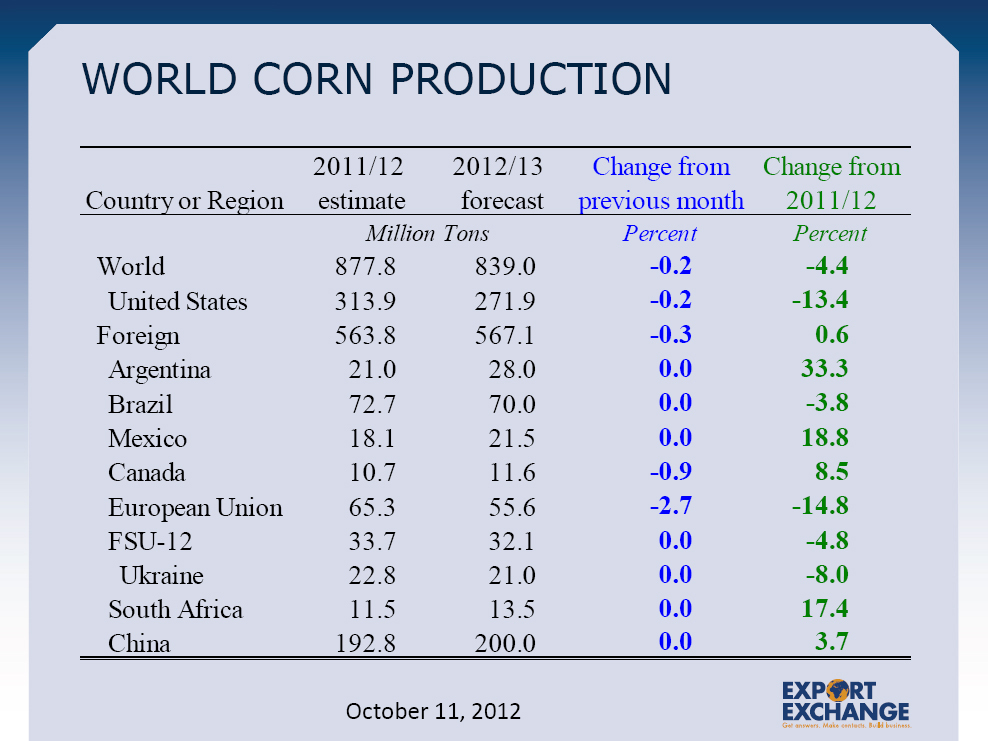

Although crop conditions were difficult in the U.S., other areas of the world actually produced more corn. Argentina, for example, is forecast to produce 33.3 percent more corn in 2011-’12 than it did the same time period last year. Overall, global corn production is forecast to be down 4.4 percent from the past year. On the other hand, global corn ending stocks are at the lowest since 1973-’74, at 50 days of use, compared to last year’s stocks of 55 days of use. (See the charts for more details.) “I don’t think this is a situation that can turn around very rapidly,” he said.

Due to tight supplies of corn, all end users have cut back. Compared to the USDA’s June forecasts, feed use is reduced 30 percent, ethanol production 10 percent and exports 40 percent. Glauber also talked about the incentive to blend ethanol due to its oxygenate properties. A waiver of the RFS would have little effect on corn prices or supply, he said, adding that would be a different story in the long term.

Advertisement

Two farmers also spoke about their personal experiences with the summer’s drought. Ron Gray, secretary/treasurer of the U.S. Grains Council, experienced greatly reduced yields due to drought while John Mages, chairman of the Minnesota Corn Research & Promotion Council, had the best crop year since he started farming in 1981. To see and hear about the effects of the U.S. drought was the reason some international attendees came to the event, the moderator pointed out.

Gray farms in southern Illinois and expects to see yields at 90 percent of the national average. After very little rain, crops in southern Illinois were devastated, with about one-third destroyed and not harvested. Federal crop insurance will have a significant impact on getting farmers through such a tough year, he said, adding that he’s optimistic for a good corn crop next year. The crop did have some aflatoxin contamination but not nearly as bad as was first thought and it was easily diverted to separate bins and sold to a swine producer that was able to accept the contaminated corn.

Mages, whose farm is located 100 miles northwest of Minneapolis, produced more than 200 bushels of corn per acre, 30 percent better than yields the previous year. He pointed out that advances in corn hybrids helped boost corn yields despite the drought. “We never would have had these kinds of yields 20 years ago,” he said. Minnesota has virtually no problems with aflatoxin, he added.

Related Stories

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

International Sustainability & Carbon Certification has announced that Environment and Climate Change Canada has approved ISCC as a certification scheme in line with its sustainability criteria under its Clean Fuel Regulations.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

The government of Brazil on June 25 announced it will increase the mandatory blend of ethanol in gasoline from 27% to 30% and the mandatory blend of biodiesel in diesel from 14% to 15%, effective Aug. 1.

The U.S. Court of Appeals for the D.C. Circuit on June 20 rejected several claims challenging the U.S. EPA’s RFS Set rule but will require the agency to provide additional information on certain environmental findings.

Upcoming Events