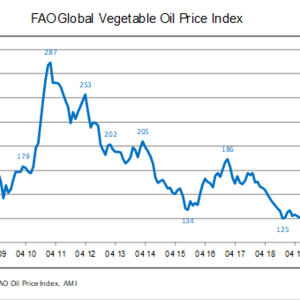

FAO vegetable oil price index falls to 8-month low

May 20, 2020

BY UFOP

Decreases in prices of palm, soybean and rapeseed oils show through more strongly in the Food and Agriculture Organization of the United Nations’ price index than do increases in asking prices for sunflower oil. Consequently, the index declined for the third month running.

The April FAO price index for vegetable oils slipped 7.2 points, or 5.2 percent, compared to the previous month, to 131.8 points. This was the lowest level since August 2019 and also the third decline in three months running. The reason was falling prices for palm, soybean and rapeseed oils. In contrast, sunflower oil became more expensive. Palm oil dropped especially sharply compared to the previous month.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has stated that the slump was mainly due to the corona-related economic downturn and the associated sharp decline in diesel and biodiesel consumption to meet blending quota requirements. The pressure on prices was also exacerbated by the ruinous competition in crude oil production. Crude oil prices recently hit historic lows. UFOP has pointed out that, at the same time, larger than expected palm oil production and increased supplies in Malaysia put pressure on vegetable oil prices.

Advertisement

Advertisement

Prices for soybean oil and rapeseed oil were also pulled down. Soybean oil was under additional downward pressure from swelling supply based on a temporary significant increase in U.S. processing volumes. In contrast, international sunflower oil prices rebounded slightly in April on support from brisk import demand and concerns about shortages in exportable supply.

Advertisement

Advertisement

Related Stories

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

The USDA’s National Agricultural Statistics Service on June 30 released its annual Acreage report, estimating that 83.4 million acres of soybeans have been planted in the U.S. this year, down 4% when compared to 2024.

Upcoming Events