Ferm Assurance

PHOTO: CHRIS RICHARDS

December 6, 2012

BY Susanne Retka Schill

An old-time plant manager once said he could tell there was trouble brewing by the smell when he arrived at the plant in the morning. A sudden contamination event causing that distinctly sour smell is often a relatively straightforward problem to solve. “In a transient contamination, you might see something suddenly happen from one fermentation to the next, something suddenly dropped or changed and it’s raising alarm bells in the process control system,” explains Graeme Walker, scientific director of the Ethanol Institute and professor of zymology at the University of Abertay in Scotland. “That might point to some contaminated material coming in, or something that an operator has done by mistake, perhaps leaving some cleaning solution in the fermentor.”

The bigger challenge to the quality control team at an ethanol plant is spotting a chronic contamination well before it becomes an issue. The root problem can be ingrained in the process, Walker suggests, most likely residual contaminants that have been there quite a while, resistant to normal cleaning routines. “That’s the chronic situation that can be more difficult to identify and do something about,” he explains. “A chronic contamination gradually builds, showing up in small incremental changes in the process. The chronic contaminations would be a buildup of biofilms of contaminant bacteria in pipework, for example. These are difficult to remove because they are in the nooks and crannies where automatic cleaning systems won’t remove them.”

Biofilms are ubiquitous in industrial plants, he adds. “Most living micro-organisms in nature exist in biofilms attached to surfaces. Certainly in the human body, bacteria stick to tissues in the body in the form of biofilms,” he says. “And, keeping the medical analogy going, bacterial biofilms are notoriously difficult to treat with antibiotics and anti-infective drugs in a hospital environment. It’s a similar scenario in an industrial environment. If you get a buildup of biofilms, you may occasionally kill just the upper surface of the biofilm cells but the ones that are deep-seated can be more resistant to antimicrobial agents.”

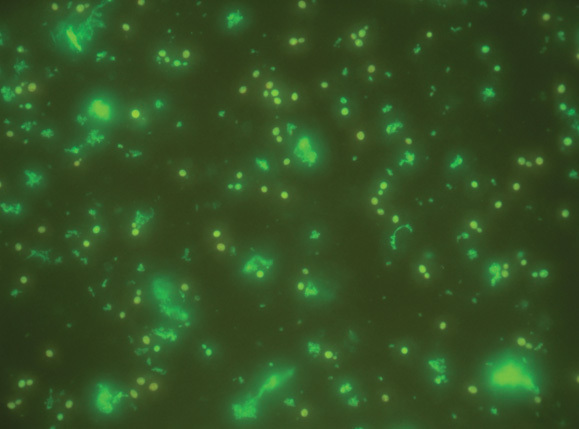

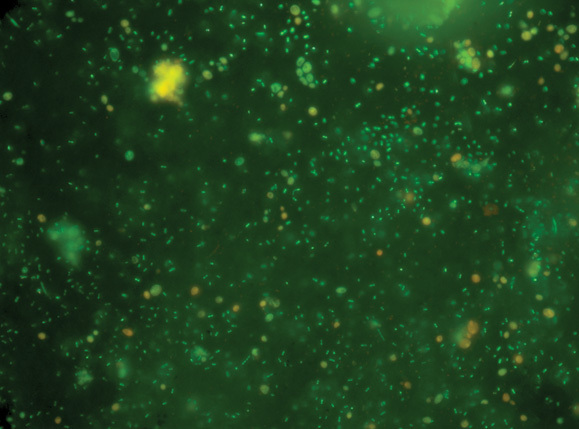

Bacteria are a problem for ethanol producers because every molecule of acetic or lactic acid produced by a bacterium means there’s one less molecule of ethanol produced by yeast. Bacteria grow very quickly in the right environment, doubling every 15 minutes to an hour, Walker says. Thus, theoretically, a single cell can multiply to more than a million (1 x 106) cells in five hours and to 2.8 x 1014 cells in 12 hours. The single most important tool in an ethanol plant’s arsenal to limit that exponential growth is a microscope. “Even fairly rudimentary microbiological monitoring is helpful,” Walker says. “By that I mean you don’t have to have a PhD in microbiology working in your plant, but with relatively simple training you could get people to provide useful information.” Gram stains, slide cultures and direct microscopy can be used to detect bacteria in samples and, by using certain dyes, can provide additional information on viability, morphology and identity of bacterial contaminants. There are also a number of rapid tests, such as bioluminescence methods where swabs can be used to take samples from tank walls and quickly show contamination using the accompanying luminometer.

Advertisement

Advertisement

Cleanliness is crucial to avoid contaminated fermentations, Walker stresses. “That means you’ve removed the vast majority of unwanted organisms.” But with ethanol plants providing the ideal environment for micro-organisms—ethanol-producing yeast being the good and bacteria the bad—monitoring the levels of residual bacteria becomes the goal. “Things to look out for include the consistency of alcohol production and yields from week-to-week and month-to-month,” he says. “If things are beginning to show a downward trend that might point the finger at the levels of hygienic cleanliness in the plant, and the fermentation vessel particularly.”

Spotting Incremental Change

In addition to watching for downward trends, ethanol producers need to know their baseline numbers, stresses Chris Richards, global sales manager for Lallemand Biofuels and Distilled Spirits. He’s part of the Lallemand team troubleshooting fermentation issues and doing hygiene audits at ethanol plants. “You have to know what your plant normally does when it is running well,” he says, “so you can tell the difference when it is not.” There can be quite a variation from plant to plant in those baseline numbers. A plant’s quality control team can monitor ethanol yield trends as one baseline indicator. If yields begin to drift lower, it’s time to look for issues in plant systems that can include issues with grind, with enzyme dosing or distillation inefficiencies. For fermentation quality assurance, increasing organic acid levels are a prime indicator of increasing bacterial contamination.

While the contamination may first be spotted in the fermentor—where any bacteria in the mash have many hours to multiply—the source may be elusive. “You can have a contamination from a fill line or heat exchanger that only shows in the fermentor because the mash only remains in the heat exchanger for a few seconds or minutes,” Richards explains.

Multiple samples need to be gathered from as many places as possible and analyzed, using one of several methods, such as titrations, high-performance liquid chromatography (HPLC) or fluorescence microscopes. The samples need to be re-analyzed after several hours to determine if bacteria are growing. An increase in the organic acids, or other indicators being tested, indicates a possible source of contamination.

Advertisement

Advertisement

Sometimes the sources of chronic contaminations are structural. Many plants were engineered for mechanics and cost effectiveness and not necessarily optimized for hygiene, Richards points out. Furthermore, when changes to a plant are proposed, the economic and process impacts are well studied, while the hygienic implications can sometimes be overlooked. He recommends that a plant’s quality control team systematically select areas of the plant to review in detail, looking at each line connection and valve. “Look at the product running through the branch or line and assess the risk to the process by looking at the type of product, frequency of cleaning and normal temperatures,” he says. Look for and eliminate dead legs—lines that are no longer in use, or perhaps used only occasionally—and make sure that there is no potential for bacterial contamination to move into the process. An ongoing project for every plant should be to optimize the pipework, he adds. Key things to look for include verifying internal weld surfaces are polished, making sure valves aren’t positioned too far from the T and finding any pipe runs with low points that are not drained. Each tank and all heat exchangers need scrutiny as well, using the same sort of logic as applied to pipework, Richards advises.

While plants can’t change design easily, a good set of standard operating procedures can be designed to optimize hygiene. “Find key performance indicators that can be used to monitor effectiveness,” he says. Clean in place (CIP) procedures need to be reviewed to make sure the fluids are at the proper temperatures, the correct cleaners are used, the cleaning head is matched to the CIP cycle time and that the head is rotating properly. It can be easy to install a new cleaning head and not remember to make the appropriate adjustments, he adds. A rotating head with off timing can result in a significant portion of a tank not being properly cleaned.

Decisions to slow throughput could be problematic as well. A simplified example would be to slow the flow in the plant by 50 percent. “What are the implications of this from a hygienic point of view?” he asks. If the turbulence in the pipes and heat exchanges is reduced, particles are less likely to stay in suspension, he suggests, and deposits are more likely to form. Cleaning protocols may need to be adjusted to insure those deposits are flushed out.

What’s an Acceptable Loss?

So, if bacteria are ubiquitous and plant design sometimes works against thorough hygiene, how clean is clean enough? “We have to be realistic, alcohol plants are not pharmaceutical, they are not going to be sterile,” Walker says. “It’s a case of keeping an eye on the process and monitoring potential contaminating microorganisms. It’s going to be impossible to completely, 100 percent, remove them. As long as plant managers are able to live with what might be there, and it is not deleteriously affecting the yields and the process to a huge extent, that’s probably going to be okay.”

Mike Ingledew, professor emeritus at the University of Saskatchewan who preceded Walker as the scientific director of The Alcohol School, suggests that even low, 1 to 4 percent losses in well-operated plants adds up to serious money. Running his calculations a year ago, with 209 plants in the U.S. producing 14.76 billion gallons, Ingledew figured a 1 to 4 percent loss amounted to between 147 MMgy to 588 MMgy for the industry as a whole. With ethanol at $2.20 per gallon, that would add up to an average loss per plant ranging between $1.5 million to $6.2 million per year, all at low infection levels.

The move towards decreased antibiotic use has increased the chance for infections, Ingledew adds. “In my view, unless someone finds new antimicrobials that act at low concentrations to kill or prevent growth of contaminant microbes, the industry's only recourse might become cleaning and sanitation of all vessels and ancillary equipment prior to addition of almost sterile mash and the adding of culture yeasts with very few contaminating microbes,” Ingledew says. “This cleaning and sanitation technology is already used in the dairy and brewing industries, but is more expensive and would reduce profits significantly.” Dairies and breweries use things like caustic cleaning solutions, descalants, sodium hypochlorite, iodophors and hydrogen peroxide to sanitize. “It will take such measures to eliminate the use of antibiotics, yet remove inherent contamination at decent cost,” he adds. “Serious microbial audits in the plant will become commonplace.”

Author: Susanne Retka Schill

Contributions Editor, Ethanol Producer Magazine

701-738-4922

sretkaschill@bbiinternational.com

Related Stories

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

FutureFuel idles biodiesel production amidst regulatory uncertainty, shifts full focus to specialty chemicals growth

FutureFuel Corp. on June 17 announced it will temporarily idle its biodiesel facility upon completion of its remaining contractual obligations, anticipated to occur by the end of June. The company is shifting its focus to specialty chemicals.

The U.S. EPA on June 18 announced 1.75 billion RINs were generated under the RFS in May, down from 2.07 billion that were generated during the same period of last year. Total RIN generation for the first five months of 2025 reached 9.06 billion.

TotalEnergies has announced the company expects its facilities will be able to produce more than half a million tons of SAF a year by 2028 to cover the increase in the European SAF blending mandate, set at 6% for 2030.

Upcoming Events