Fueling Canadian Decarbonization

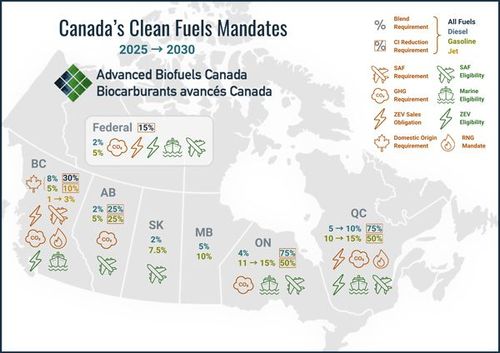

Advanced Biofuels Canada's map illustrates its clean fuel mandates, contrasting 2025 and 2030 requirements across the country at both the federal and provincial level. CREDIT: ADVANCED BIOFUELS CANADA

May 28, 2025

BY Katie Schroeder

Trade turbulence supplies both new challenges and opportunities as tensions with the United States, Canada’s closest trading partner, remain high. Meanwhile, provincial governments are increasingly recognizing their local renewable fuel producers and looking for ways to encourage local use of Canadian-made fuels. According to Canadian industry experts, however, the expiration of the U.S. Biodiesel Blenders’ Tax Credit and the implementation of its subsequent replacement, the 45Z Clean Fuel Production Credit, will harm the Canadian industry. Unlike the BTC, 45Z is paid to the domestic (U.S.) producer, and the fuel is exportable to Canada. Before the BTC expired, Canadian fuel was able to be sent to the U.S. where it was blended to receive the BTC.

The federal and provincial support structures built to promote renewable fuels production and usage in Canada are part of the country’s strategy to decarbonize. Each year, Advanced Biofuels Canada commissions a study to track the state of the country’s biofuels industry. Titled the “Biofuels in Canada Report,” prepared by Naivus Research, it assesses the impact of low-carbon fuel policies across the country. Fred Ghatala, president of Advanced Biofuels Canada, explains that his organization has commissioned this report series to track the state of the biofuels industry in Canada since 2010. The study’s longitudinal tracking provides helpful context to newly collected biofuel use information. The 2024 report reflects on data from 2023 and provides a helpful jumping-off point for deeper dialogue with government entities looking for data about renewable fuels.

One of the study’s key data points is the change in clean fuel consumption each year. The report shows that ethanol consumption increased by 13% from 2022 to 2023, and biomass-based diesel consumption grew by 68% with much of that increase due to a “surge” in renewable diesel usage.

Production Volumes

Canada possesses over 2 billion liters (approximately 530 million gallons) of installed ethanol capacity and 1.9 billion liters of biomass-based diesel capacity, which includes both renewable diesel and biodiesel. The biodiesel sector produces 550 million liters per year, and the two renewable diesel facilities have the collective capacity to produce roughly 1.2 billion liters yearly, according to Dany Laferriere, vice president of communications and outreach with the Canadian Biofuels Association. The country’s biomass-based diesel production volume will likely expand in 2025 when the new Imperial Oil RD facility, located near Edmonton in Strathcona, Alberta, comes online with a production capacity of 1.16 billion liters.

A total of 16 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production facilities are either under construction or producing fuel in Canada, according to research from Biodiesel Magazine’s data specialist, Chloe Piekkola. The country’s production portfolio includes five operational biodiesel facilities and 11 RD or SAF facilities, six of which are under development, two under construction and three operational facilities.

The report reflects the impact that Canada’s Clean Fuel Regulations have had on the fuel supply since they came into effect in June 2022, explains Ghatala. The CFR received support from a broader base of constituents because the regulations contain compliance pathways “that are an opportunity for the refining sector,” Ghatala says. Refineries are able to generate Category 1 compliance credits by implementing refinery improvements. “There are lots of ways that you can nip and tuck emissions around a refinery and that can generate compliance credits,” Ghatala adds.

To date, most of the volume obligations under the CFR have been met through imports, explains Laferriere. He describes the Canadian low-carbon fuels industry as “small but growing.” Renewable diesel projects make up much of the industry’s development focus at the moment. Canadian biorefineries have room to grow in order to meet the projected demand of 4 billion liters by 2030. ABFC’s report shows that the nationwide blending for biomass-based diesel reached 6.5% in 2023, projected to increase up to 7% when 2024 numbers are released.

In 2030, the volume demand for renewable fuels in the national gasoline pool is expected to reach 7 billion liters. The Canadian ethanol industry likely will not be able to supply this volume on its own. “We could be just about self-sufficient on the diesel side, but we are forecast to continue being importers on the gasoline side, which generally reflects Canada’s agricultural landscape,” Ghatala says. “Because of our canola sector, we are larger lipid producers than we are sugar producers—we simply don’t grow as much corn as the U.S. does[.]”

Advertisement

Provincial Standards

Canada’s plethora of provincial clean fuel standards stand alongside the country’s CFR. In recent months, however, economic pressures led Prime Minister Mark Carney to remove the consumer carbon tax, which was an achievement of former Prime Minister Justin Trudeau’s environmental agenda.

Provinces across the country have enacted renewable fuel and clean fuel regulations with different structures. Because 95% of fuels supplied in Canada are covered under a provincial regulation, producers are able to stack compliance credit values in some provinces, explains Ghatala. Renewable fuel programs exist in “every province [from] Quebec and west [of it],” he says.

In 2023, renewable diesel blend rates hit above 20% in British Columbia—far exceeding the province’s 4% minimum volumetric blending requirement—in order to meet carbon intensity reduction requirements. When 2024 numbers come out, Ghatala anticipates that B.C.’s numbers will stand at around 30%. After the trade turbulence began, B.C. increased the minimum volume obligation to 8%, along with a requirement that the obligated volumetric portion must be met with domestically produced renewable fuels. The requirement came into effect on April 1.

“We see the renewable and lower-carbon fuels being pulled to markets that have this visible credit price,” Ghatala says. “Of all the provinces, British Columbia’s policy has the most transparent compliance credit market.”

Most other provincial programs, such as those in Manitoba and Saskatchewan, have volumetric requirements without any compliance credit trading. Manitoba’s clean fuel mandates for 2025 are set at 5% for diesel and 10% for gasoline. Saskatchewan’s blending mandate stands at 2% for diesel and 7.5% for gasoline.

Quebec holds the highest minimum volume requirements of any province, with the 2025 minimum set at 12% renewable content in gasoline and 5% renewable content in diesel; the requirements are set to increase to 15% and 10%, respectively, by 2030.

Ontario’s 2025 volume requirements are set at 11% for gasoline and 4% for diesel. Alberta’s requirements are lower on the gasoline front this year, standing at 5%, with diesel at 2%.

ABFC’s report found that the renewable fuels industry saves Canadians half a cent per liter of fuel. Ghatala explains that this calculation originates from the price for renewable diesel and biodiesel being more expensive than conventional fuels by five cents, and ethanol being cheaper by six cents. “We’re seeing the average cost of carbon abatement through renewable fuels to be about $123,” he says.

Advertisement

Coprocessing Production

Coprocessing constitutes a small portion of Canada’s renewable fuels volume, but it provides a cost-effective option to increase renewable fuel production, according to Laferriere. This process uses renewable content such as vegetable oil or animal fats and requires mixing with a crude oil input at a petroleum refinery. Depending on where the renewable material is inserted into the refinery’s hydrotreater or fluid catalytic cracker unit, the renewable material ends up in one of the refinery’s products.

Provincial regulations across the country include methodologies for calculating credit generation, such as carbon-14 dating and a monitoring, measurement and verification program, he explains. According to ABFC’s report, 100 million liters per year of coprocessing capacity are available.

Refineries across the country are limited in the amount of organic content they can add, Ghatala explains. For example, jet fuel can only have 5% organic feedstock added. “Policymakers, I think, view the opportunity that coprocessing provides as an additional means through which to pursue reducing emissions of liquid transportation fuels. The fact that we have coprocessing diesel, renewable diesel, biodiesel, sustainable aviation fuel and related products like biodiesel distillation bottoms [and] arctic-grade renewable diesel, and that those fuels can be used in different transportation modes means that we have the tools at hand to address transportation emissions growth.”

Opportunities and Obstacles

Policy structures for increasing biofuel usage across Canada are present at both the provincial and federal level. However, implementation of the U.S. 45Z tax credit constitutes a significant challenge to the Canadian biofuels industry. “Our domestic sector has been negatively impacted by the 45Z tax incentive and its exportability to the Canadian market, along with other factors,” Ghatala says. Concerns abound as to whether Canadian producers can compete with U.S. imports and Canadian policies are durable enough to handle the influx of foreign fuel.

The shift away from the Biodiesel Blenders’ Tax Credit to 45Z’s Clean Fuel Production Tax Credit has triggered a “rationalization” in the North American biomass-based diesel market, Ghatala explains. In the past, U.S. renewable fuel producers would import Canadian feedstock to make biodiesel or renewable diesel, then sell the fuel into Canada. In light of 2025’s trade turbulence, Canadian federal and provincial governments started looking for strategies to encourage energy security and domestic resilience. Rather than crossing the border, Canadian feedstocks are used to produce biofuels at home, and those fuels are sold into local markets. “We are seeing renewable fuels be a big part of that conversation because they link so many things in our economy together,” Ghatala says. “They link agriculture with industry, they link agriculture with oil and gas refining, with greenhouse gas targets and energy security, and all of those things tied together is a very formidable consortium to encourage action.”

Even before trade turbulence, renewable fuels grew in popularity as the conversation around decarbonization has shifted in recent years, and policymakers have realized how long the road to full electrification is, Ghatala explains. A growing understanding that other options are needed to attain the net-zero target—especially for Class 7 and 8 vehicles—has brought renewable fuels back into the spotlight. “Renewable fuels do provide the ready-made, available now, commercially distributed technology that can reduce emissions immediately and pairs very well with electrification,” he says. Hybrid vehicles’ decarbonization potential when combined with renewable fuels offers drivers a cheaper option to pursue a lower carbon footprint.

Mandated volumes of SAF provide a firm basis for the growth of the country’s domestic SAF industry, another positive for the biofuels space. B.C. has implemented the first SAF mandate in North America, starting in 2026. The province’s revised LCFS regulations, which came into effect January 2024, mandate a 2% carbon intensity reduction for aviation fuel in 2026, increasing to 10% in 2030. A volumetric mandate begins in 2028, set at 1%, and increases to 3% in 2030.

The potential for a robust Canadian renewable fuels industry is there, but experts agree that the government needs to take action, ensuring that Canadian fuels get a fair shot. “Canada is well-positioned to lead globally in low-carbon fuel production, thanks to its abundant natural resources, existing infrastructure and technical expertise,” Laferriere says. “To realize this potential, CFA supports clear, stable and technology-neutral policies based on carbon intensity. These principles are critical to attracting long-term investment and building a resilient clean fuel sector.”

Author: Katie Schroeder

Associate Editor, Biodiesel Magazine

Related Stories

The European Commission on July 28 approved a €36 million ($41.07 million) Danish state aid scheme designed to encourage airlines operating in Denmark to use sustainable aviation fuel (SAF) on domestic routes.

The abrupt closure announcement by Biox Corp. is the latest example of a failure to secure Canada's domestic energy supply, says Unifor. The Canadian energy union is advocating for simply regulatory changes that could help restart the facility.

The U.S. EPA on July 29 released a proposed rule to repeal the agency’s 2009 Endangerment Finding, which forms the legal basis for the agency’s GHG regulations. The proposal also aims to repeal all GHG regulations for motor vehicles and engines.

While final IRS guidance is still pending, the foundation of the 45Z program is well defined. Clean fuel producers should no longer be waiting; they can now move forward with critical planning and preparation, according to EcoEngineers.

The IRS on July 21 published a notice announcing the 2025 calendar-year inflation adjustment factor for the Section 45Z clen fuel production credit. The resulting adjustment boosts maximum the value of the credit by approximately 6%.

Upcoming Events