Gen 1+1.5+2 Equals Process Progress

PHOTO: ICM

May 15, 2013

BY Susanne Retka Schill

The Beast is parked along a wall near the door. Auntie Em and Dorothy are rolled off to the side, out of the way, as the number and size of reactors have grown to demonstration scale at ICM Inc.’s research facility in St. Joseph, Mo. The laboratories packed with analytical machines hum at a fast pace.

Even on a quiet day between big integrated runs, more than a dozen people were running system trials, pulling samples to test and evaluate the data. On that March day, pilot plant supervisor Jon Licklider and scientists Chris Gerken and Laers Malburg gave Ethanol Producer Magazine a behind-the-scenes look at the research facility.

ICM’s work on cellulosic conversion technology began in earnest in 2009, with a $25 million grant awarded by U.S. DOE. The Kansas technology provider and engineering company that teamed up with Fagen Inc. to build nearly two-thirds of the capacity in the U.S. ethanol industry was shifting gears to join the ranks of companies designing the next generation of cellulosic ethanol processes.

The initial work was done with the refrigerator-size, flask-scale reactor called the Beast. That soon scaled up to two reactors capable of handling 50-gallon batches, dubbed Auntie Em and Dorothy. The Wizard of Oz theme is most appropriate, as many in the ICM research and development team pulled up stakes from the heart of Kansas, where ICM is headquartered at Colwich, to move across the Missouri River to St. Joseph, Mo.

As work progressed, the tanks grew bigger and more numerous and personalized naming got dropped in favor of numbered tanks. In all, there are five 15,000-gallon pilot fermenters and four 35,000-gallon hydrolysis/fermentation reactors housed in the pilot facility on the LifeLine Foods LLC campus.

Once owned by a large oats processor, the warehouse and processing plant were turned into a food-grade corn products facility by the farmer cooperative AgraMarke Quality Grains. ICM installed a 50 MMgy ethanol plant to add value to excess starch supplies, acquiring a 49 percent share in LifeLine in the deal. With much of the old warehouse standing empty, ICM utilized unused space for both its starch-based and cellulosic research and development.

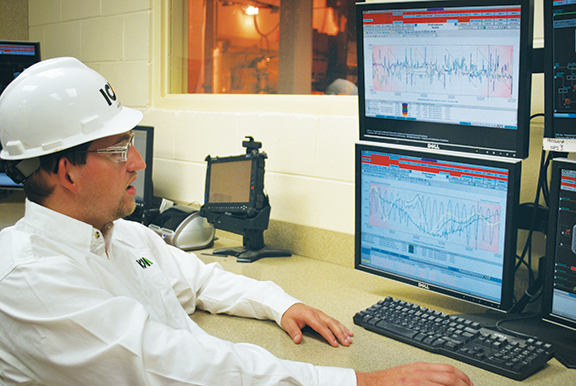

In late November, the R&D team completed a six-week, continuous, integrated run of the Generation 1.5 process. Doing a 1,000-hour run is a whirlwind experience. “The laboratory is filled with people running tests, all day and all night,” says Malburg. More than 2,000 samples were pulled during the continuous run, with about 10 tests run on each sample. Some tests needed to be done as the run progressed, while other fractions could be labeled and set aside for later analysis. Data was collected at every pump and every valve as well via the distributed control system. In all, the data report was more than 900 pages long in March, and growing.

The patent-pending Gen 1.5 cellulosic technology is built on two trademarked and proprietary technologies that can be implemented in stages: Select Milling Technology and Fiber Separation Technology. Select milling has been installed at about a dozen ethanol plants, demonstrating enhancements of 2 to 3 percent more ethanol and 10 to 20 percent greater oil recovery. Similar enhancements may be gained in ethanol and oil yields from removing the fiber with the newest technology, even without taking the fiber to the cellulosic conversion step. (See sidebar.) Going the final step of converting the fiber to cellulosic ethanol brings the total gain from Select Milling Technology, Fiber Separation Technology and Gen 1.5 to 14 percent in ethanol production and about a 70 percent increase in oil recovery. Or, as the ICM team likes to put it, allowing the same ethanol production from 14 percent less corn.

Advertisement

Advertisement

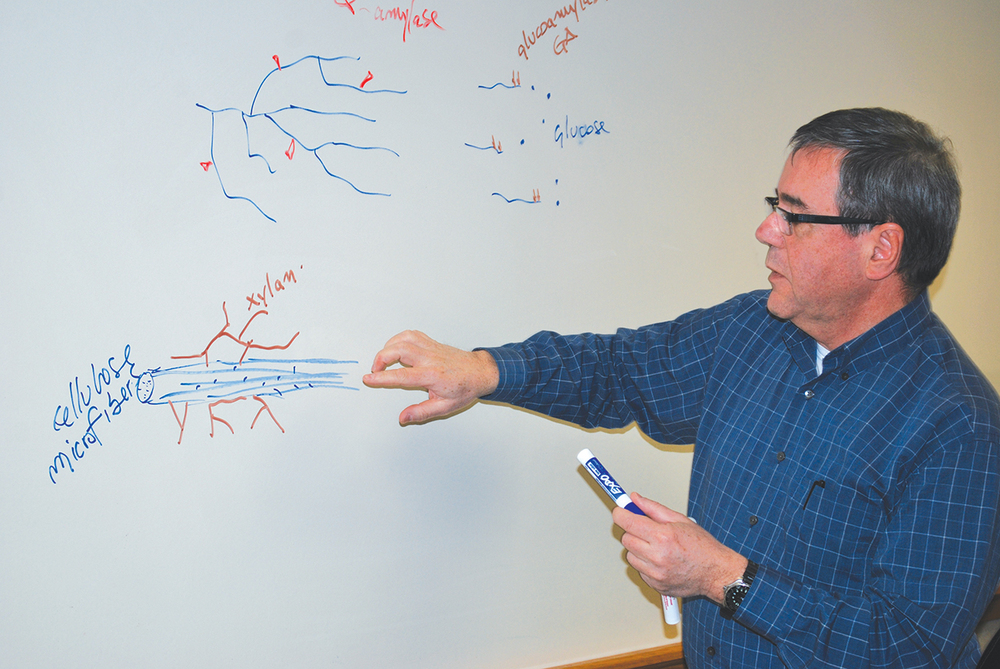

Ethanol producers going the cellulosic route will have a few more tasks on the front end, says Gerken, whose scientific focus on the team is pretreatment and enzymatic hydrolysis. A dilute acid pretreatment step hydrolyzes hemicellulose to xylose while also fluffing the cellulosic structure for the enzymatic action that breaks down the cellulose to glucose. From there, the pretreated fiber can take one of two paths. In the hybrid hydrolysis and fermentation, the pretreated and hydrolyzed fibers are first fermented in separate tanks using genetically modified (GM) yeasts for C5 conversion before being introduced into the plant’s main fermenters. “Some ask why we do that,” says Gerken about the two-stage fermentation, “but you get some added efficiencies, and you don't get to 14 percent unless you do that.” If the producer doesn’t want to go the GM route and is willing to give up the C5 conversion, the pretreated, hydrolyzed fiber fraction can be sent directly to the corn starch-based mash being fermented by conventional yeast. From there on, the two processes are comingled through the back end of the plant.

Malburg, a yeast specialist on the team, explains that ICM has worked with several companies that are developing GM yeasts for C5 conversion. The GM yeasts, however, will require federal approval before they can be used commercially because they end up in the distillers grains feed coproduct. “Those [yeast] suppliers are in different stages in the regulatory path,” Malburg says. “But, we think within a year there will be more than one GM yeast approved.”

Designing a successful cellulosic process goes far beyond pretreatment, enzymes and yeasts. One of the first challenges in the Gen 1.5 development was figuring out how to handle the highly viscous material on the front end. Licklider says they quickly began using flexible hoses, rather than piping, and installed motors, valves and pumps on skids that could be moved aside with forklifts. “We can make changes on the fly,” he explains. “We have fabricators, electricians, and computer programmers on staff.” They also make a point to use the same suppliers of the various components as the starch-based designs.

Systems were developed individually until the big test of the integrated run last winter. “When running continuously you get buildups you don’t see in batches,” Malburg says. “We knew it was there and would be coming, but we didn’t have a good idea of the scale of the scale.” For a time, the ICM team thought they might be looking at a new polymer coproduct, he adds wryly, but as the process was refined, the team altered the pretreatment to avoid the issue.

With the 1,000-hour run on the integrated corn fiber process under their belts, the team is preparing for a similar run on the Gen 2 cellulosic ethanol process in late summer, initially using energy sorghum as feedstock. Once hydrolyzed, the sorghum behaves much like the corn fiber, Malburg adds, but the two cellulosic feedstocks handle quite differently when mixed with water and pumped through the front end. “Corn fiber is more like a flake, like wheat bran,” Malburg says. “Sorghum is more stick-like. What we’re learning now is what it will take to get our front end humming along with energy sorghum.”

For Gen 2, ICM is targeting a scale that would co-locate 25 MMgy of cellulosic ethanol production with a 100 MMgy first- generation plant. Gen 2 will include new levels of energy integration, Gerken says. “There will be a lot more unit operations that take energy loads. With the co-located approach—cellulosic and starch plants—we’re looking at the energy needs of the entire process and how to make the best use of the lignin.”

While Gen 1.5 is going to add some complexities to the front end of a first generation plant primarily in the pretreatment step, Gerken cautions that Gen 2 is going to be a 20-fold increase in complexity. “As a result, we’re trying to automate as much as possible,” Malburg adds, explaining the team is testing several kinds of probes in multiple locations.

Advertisement

Advertisement

As the R&D work continues on Gen 2, Licklider says his team of plant operators are preparing standard operating procedures for Gen 1.5 and getting ready to go out in the field as the first Fiber Separation Technologies and Gen 1.5 systems are installed. Indeed, the first ethanol producer in ICM’s early adopter group was running water through the system to check for leaks in mid-April before starting up its Fiber Separation Technology. A full announcement and more details on the process will be released at the International Fuel Ethanol Workshop & Expo set for June 10-13 in St. Louis.

Author: Susanne Retka Schill

Senior Editor, BBI International publications

701-738-4922

sretkaschill@bbiinternational.com

-------------------------------------------------------------------------------------------------------------

Stepping Up Technologies

Gen 1.5 is built on ICM’s trademarked and proprietary Selective Milling Technology, a process enhancement designed for first-generation corn-ethanol plants that offers a 2 to 3 percent ethanol yield boost and a 10 to 20 percent oil increase in the dozen or so plants that have added the system so far. Going the next step with the new wet fractionation technology, trademarked Fiber Separation Technology, will add another 2 to 3 percent increase in ethanol yield and 15 to 20 percent on oil, says Kurt Dieker, ICM director of product development. Each of those steps have been designed for a targeted payback of around a year.

Rather than going to a finer grind, the ICM process backs off to a coarser grind from the hammermills to keep fiber sizes larger, followed by a secondary grind once the grain is slurried and before liquefaction. “The goal is liquefy everything but the insoluble fiber,” he explains. “There’s a reason we went with wet fractionation. When you grind corn dry, the fiber grinds just as well as everything else. When you grind corn wet, the fiber doesn’t tear as easily. We also want to macerate the germ because germ has 85 percent of the oil.” By freeing the oil and keeping the fiber molecules larger, he adds, “that allows us to separate it more easily and get the same or larger yield with less horsepower.”

Efficiencies are gained in targeting solids, he says. A 56-pound bushel of corn amounts to 47 pounds of solids when moisture is subtracted. That is reduced in a prescreening step to 9 to 10 pounds going through selective milling. By concentrating the stream, horsepower requirements and operational costs are reduced, he points out. The next step takes the 10 pounds down to 4 or 5 pounds of actual fiber content.

In shifting commodity markets and an uncertain political environment, giving the customer options is important, says Dieker. The fiber can simply be separated and added back to the distillers grains, creating more fermentation space by removing the unfermentable fiber solids. The separated fibers can also become a new feed coproduct. “For some markets that will be preferred, in that it is a high-fiber, lower-protein supplement and they can add specific components back in. Dairies, for instance, add specific fats for the positive impact on milk.”

The third choice is to send the fiber into Gen 1.5 for conversion to cellulosic ethanol, starting with a dilute acid pretreatment before going through enzymatic hydrolysis. Once again, there are options. More than 80 percent of C5 sugars can be converted by first fermenting the fiber mash with GM yeast, before sending it to the corn starch fermenter to complete the C6 fermentation. If the producer wants to avoid the use of GM yeasts for C6 conversion, forfeiting that ethanol yield boost, another option is to send the hydrolyzed fiber to the corn mash for fermentation with conventional yeasts. The fiber conversion achieves a rate of greater than 100 gallons per ton, while the overall gain is about 10 percent more ethanol per bushel of corn on top of the gains from selective milling and fiber separation.

ICM estimates the Gen 1.5 payback will be a little under two years, if the value of the cellulosic renewable identification number (RIN) stays high. If it doesn’t, it would be closer to three years, Dieker says. “It also depends on what market you’re in—what you’re getting for your coproducts and what you value your fiber as,” he says, adding that he suspects regional patterns will develop based on feed market preferences.

Related Stories

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

EcoCeres Inc. has signed a multi-year agreement to supply British Airways with sustainable aviation fuel (SAF). The fuel will be produced from 100% waste-based biomass feedstock, such as used cooking oil (UCO).

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Upcoming Events