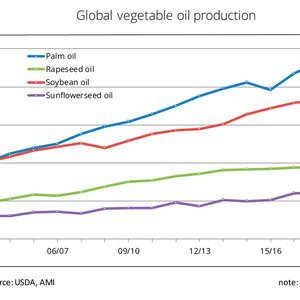

Global vegetable oil production set to reach new peak

October 9, 2018

BY UFOP

According to the USDA forecast, 2018-’19 world vegetable oil production will probably rise more than 3 percent from the previous year to a record level of just less than 204 million metric tons. Palm, soybean, rapeseed and sunflower oil account for around 87 percent of that figure.

Soybean oil is expected to see the biggest growth at 5 percent. The development benefits from ample availability of feedstock from the 2018 bumper harvests of soybeans in Brazil and the U.S. and continued buoyant international demand for processed soybean products.

Advertisement

Advertisement

Favorable growing conditions in Southeast Asia and surprisingly high yields on palm oil plantations are seen to lead to a 4.5 percent rise from 2017-’18 to 72.8 million tons.

Production of sunflower oil is expected to rise 4 percent, because Ukrainian sunflower production is up around 6 percent from a year earlier.

Advertisement

Advertisement

By contrast, 2018-’19 output of rapeseed oil of 28.1 million tons is projected 1 percent lower than in the 2017-’18 marketing year. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), the reason is drought-induced disappointing rapeseed harvests in the EU-28 and Australia in 2018.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has forecast that in the wake of this trend in supply, pressure on prices will persist in the international vegetable oil markets. Prices of vegetable oils have long since decoupled from crude oil prices, forcing vegetable oil-producing countries to adopt more active biofuel policies. Countries like Indonesia, Brazil and Argentina have tried to handle the price pressure by raising biofuel mandates, arguing that as palm oil prices are on a declining trend while crude oil prices are rising at the same time, biofuel mandates are becoming economically more attractive.

Related Stories

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

The USDA’s National Agricultural Statistics Service on June 30 released its annual Acreage report, estimating that 83.4 million acres of soybeans have been planted in the U.S. this year, down 4% when compared to 2024.

Upcoming Events