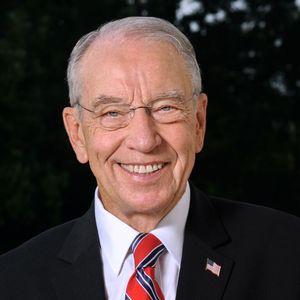

Grassley: RFS has minimal impact on success of refineries

February 6, 2018

BY Erin Krueger

Sen. Chuck Grassley, R-Iowa, has released a memo produced by his energy policy staff that finds that Renewable Fuel Standard blending requirements and the cost of renewable identification numbers (RINs) have little to do with the success of refineries and were not factors in the Philadelphia Energy Solutions bankruptcy. Grassley’s analysis reached similar conclusions as those of multiple recent studies, including several by the University of Pennsylvania’s Kleinman Center for Energy Policy.

“I’m concerned any time an American’s job could be lost,” Grassley said. “After I heard that the Renewable Fuel Standard was being blamed for the financial troubles of some refineries, I wanted to know more. So I asked my staff to get to the bottom of the situation. After reviewing the facts, I’m confident that the Renewable Fuel Standard isn’t harming refineries, that other factors are at work, and that the RFS law is working as Congress intended. Once these facts are known, there ought to be an end to the misleading rhetoric blaming the RFS. I’ve always said that I’m for an all-of-the-above national energy strategy. Biofuels are responsible for thousands of jobs across the country. There’s no reason biofuels and other renewables can’t exist alongside conventional fuels. I’m thankful President Trump continues to support biofuels and rural America. The President should be applauded for his ongoing commitment to the RFS, which makes our air cleaner, energy cheaper and country stronger with more domestic energy production.”

Advertisement

Advertisement

According to the analysis produced by Grassley’s staff, PES is in financial difficulty primarily due to changes in its available feedstock and other management decisions. “It does face a problem of having to acquire RINs to meet the looming RFS compliance deadline, but that is due in large measure to its reported decision last fall to sell off the RINs it had acquired, presumably in hopes of being able to buy them back at lower cost before the compliance deadline,” said Grassley’s staff in the memo. “Moreover, if PES had taken the sensible approach of other merchant refiners and invested in ethanol blending infrastructure or partnered with a blender, it appears it would have no need to purchase RINs at all.”

The American Coalition for Ethanol has spoken out to commend Grassley for the analysis. “As more light is shone on the decisions PES management made between 2012 and today, it has become clear that they sacrificed RFS compliance for other investments which went bad,” said Brian Jennings, CEO of ACE. “RIN prices might be a politically convenient excuse for PES but the inconvenient truth is that other merchant refiners who adapted their business model to blend ethanol aren’t running to bankruptcy court for protection. It would be outrageous for Congress or EPA to reform the RFS based on the mismanagement of one east coast refiner.”

Growth Energy is also speaking out in support of Grassley and the memo. “Analysts agree that equity managers at PES were gambling on oil trends, when they should have been investing in long-term financial security,” said Emily Skor, CEO of Growth Energy. “Fortunately, President Trump and rural champions on Capitol Hill aren’t falling for false arguments against America’s most successful energy policy—especially while other refineries are posting surging profits under the same law. When it comes to jobs, the RFS is a clear winner for hundreds of thousands of U.S. workers, and we are grateful for the President’s steadfast support.”

Advertisement

Advertisement

Grassley has said that it’s worth exploring ways to lower RIN prices without undermining the integrity of the RFS, has suggested making E15 available year-round, and noted that the EPA could do more to provide transparency in the RIN market.

A copy of the Grassley staff analysis can be found here, while copies of the Kleinman studies can be accessed at the following links: (1, 2, 3, 4).

Related Stories

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

EcoCeres Inc. has signed a multi-year agreement to supply British Airways with sustainable aviation fuel (SAF). The fuel will be produced from 100% waste-based biomass feedstock, such as used cooking oil (UCO).

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Upcoming Events