Green Plains achieves progress with Project 24, high-protein feed

May 4, 2020

BY Erin Krueger

Green Plains Inc. released first quarter financial results on May 4. The company announced progress with its Project 24 and high-protein animal feed initiatives and discussed actions it taking as a result of the COVID-19 pandemic.

During an earnings call, Todd Becker, president and CEO of Green Plains, said the company is proactively managing its current plant utilization rates, but declined to reveal its run rates for the first quarter. Becker explained that other ethanol producers have in the past used run rate data released by the company to determine their own run rates, which proved to be a disadvantage to Green Plains.

“We will exercise our operational discretion at each of our plants in order to maximize our variable contribution margin, and we will make decisions at each facility that best maintains our cash liquidity going forward,” Becker said. “Since we have done this many times before, our ability to be agile and maintain strong liquidity is our advantage in times like this.”

Becker said consolidated crush margin for the first quarter was negative 1 cent per gallon, with the spot crush declining sharply late in the quarter as the crude oil war ensued and COVID-19 began to impact fuel demand. “While certainly not a number we strive for, it was certainly better than the daily average market,” he said.

Advertisement

Advertisement

Becker also discussed the startup of Green Plains’ first high-protein facility. That project, located at the company’s Shenandoah, Iowa, plant started up during the first quarter. “We have been scaling up to full production rates within the past week or two,” Becker said. The high-protein product produced at the facility can be used to produce feed for companion animals and aquaculture.

The high protein feed ingredient is produced using Fluid Quip Technologies’ patented Maximized Stillage Co-products system. Green Plains reviously said the technology is expected to provide an initial uplift of approximately 15 to 20 cents per gallon to the overall margin structure.

According to Becker, Green Plains is continuing to work on engineering for the second and third high-protein locations. He said full construction of those projects is somewhat dependent on arranging additional financing, but noted the company should have another one constructed within nine to 12 months of when the financing is lined up.

Advertisement

Advertisement

Becker also provided an update of Green Plains’ Project 24 initiative, which aims to reduce the company’s per gallon operating expense to 24 cents per gallon. Project 24 modification at the Fergus Falls, Minnesota, and Superior, Iowa, locations are now complete he said, noting results mirror the success the company had at its Wood River, Nebraska, facility. “We continue to be excited about this project and are anxious to roll it out across our remaining non-ICM plants,” Becker said. “The operating expense reduction puts these two plants squarely in the top quartile of the industry and leaves us confident in our ability to reach our goals for the platform to be at or below 24 cents per gallon once all are completed.”

Regarding the COVID-19 pandemic, Becker said Green Plains is working to keep its employees safe through various work-from-home measures. The company is also supporting its local communities by providing FCC-grade alcohol produced at its York, Nebraska, facility for the production of hand sanitizers and cleaning agents. Green Plains has also donated ground beef to local food banks and charities, and gave each Green Plains employee 40 pounds of ground beef.

“When the pandemic comes to an end and people begin to drive again, biofuels will continue to be an important and strategic part of the fuel supply due to the octane value,” Becker said. “So the top quartile plants and those plants that have diversified margin streams will most likely continue to operate during these challenging times. This is why we continue to focus on these areas.”

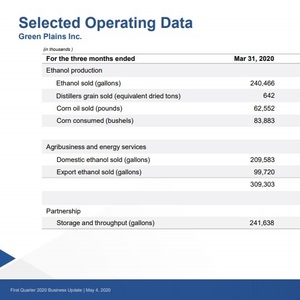

Green Plains reported net loss attributable to the company of $16.4 million, or 47 cents per diluted share, compared to a net loss of $42.8 million, or $1.06 per diluted share, reported for the same period of 2019. Revenues were $632.9 million, up from $438.6 million during the first quarter of last year.

Related Stories

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

FutureFuel idles biodiesel production amidst regulatory uncertainty, shifts full focus to specialty chemicals growth

FutureFuel Corp. on June 17 announced it will temporarily idle its biodiesel facility upon completion of its remaining contractual obligations, anticipated to occur by the end of June. The company is shifting its focus to specialty chemicals.

The U.S. EPA on June 18 announced 1.75 billion RINs were generated under the RFS in May, down from 2.07 billion that were generated during the same period of last year. Total RIN generation for the first five months of 2025 reached 9.06 billion.

TotalEnergies has announced the company expects its facilities will be able to produce more than half a million tons of SAF a year by 2028 to cover the increase in the European SAF blending mandate, set at 6% for 2030.

Upcoming Events