Green Plains: Q4 operations impacted by weather, rail delays

February 8, 2023

BY Erin Krueger

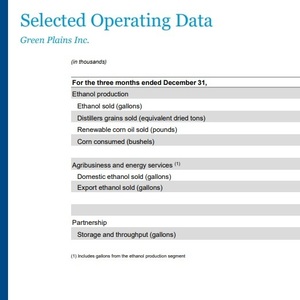

Green Plains Inc. released fourth quarter financial results on Feb. 8, reporting that the company’s operations were impacted by high corn prices, rail embargoes, and cold weather during the three-month period. Todd Becker, CEO of Green Plains, said the company made an economic decision to temporarily idle 10 percent of its production based on current market conditions and continues to evaluate the right time to bring that capacity back online.

Becker said fourth quarter margins were improved when compared to the lows experienced in the third quarter, but noted margins continued to be weak. He said corn basis remains stubbornly high for this time of year in the Western Corn Belt at approximately 45 cents per bushel higher than the five-year average and 30 cents per bushel higher than the previous year.

Advertisement

Advertisement

A severe cold snap in December caused outages across the Green Plains platform, according to Becker. Rail embargoes also hit the company unusually hard. As a result, Green Plains experienced inventory backup at some of its locations, causing plant slowdowns and some plants going offline for a period of time. Despite these challenges, however, Green Plains’ facilities ran at a 93 percent utilization rate during the quarter, up from 83 percent during the fourth quarter of 2021. The consolidated gross margin for the quarter was approximately 3 cents per gallon, Becker continued.

Becker also discussed ongoing improvement and product diversification projects at Green Plains’ facilities. The company completed construction of three additional MSC protein technology projects last year, bringing the total to five. All five MSC facilities are now operational and producing ultra high protein, Becker said. Green Plains also plans to add MSC technology to its facilities in Madison, Illinois, and Fairmont, Minnesota, locations.

Advertisement

Advertisement

Green Plains also broke ground on its first clean sugar facility last year. That project, located in Shenandoah, Iowa, is expected to have the capacity to produce 200 million pounds of dextrose annually. The facility could later expand capacity to 500 million pounds per year.

Green Plains reported a net loss attributable to the company of $38.6 million for the four quarter, or a 66 cent loss per basic and diluted share. For the same period of 2021, Green Plains reported a net loss attributable to the company of $9.6 million, or 18 cents, per basic and diluted share. Revenues for the fourth quarter reached $914 million, compared to $802.3 million reported for the same quarter of 2021.EBITDA was $5.7 million, compared to $30.3 million.

Related Stories

The U.S EPA on July 17 released data showing more than 1.9 billion RINs were generated under the RFS during June, down 11% when compared to the same month of last year. Total RIN generation for the first half of 2025 reached 11.17 billion.

The U.S. EPA on July 17 published updated small refinery exemption (SRE) data, reporting that six new SRE petitions have been filed under the RFS during the past month. A total of 195 SRE petitions are now pending.

European biodiesel producer Greenergy on July 10 confirmed plans to shut down its biodiesel plant in Immingham, Lincolnshire, U.K. The company temporarily suspended operations at the facility earlier this year.

Aemetis Inc., a renewable natural gas and biofuels company, announced on July 17 that its India subsidiary, Universal Biofuels, appointed Anjaneyulu Ganji as chief financial officer, effective July 17.

Avia Solutions Group, the world's largest ACMI (aircraft, crew, maintenance, and insurance) provider, has partnered with DHL Express to reduce greenhouse gas emissions from its international shipments using SAF.

Upcoming Events