Green Plains reports increased ethanol production, net income

Green Plains Inc.

November 3, 2017

BY Erin Krueger

Green Plains Inc. has released third quarter financial results, reporting net income of $34.4 million, or 74 cents per diluted share, up from $7.9 million, or 20 cents per diluted share, for the same period of last year.

"We will continue to flex our production based on market conditions at each individual plant and closely monitor for needed adjustments during the remainder of the fourth quarter and into 2018," said Todd Becker, president and CEO of Green Plains. "Our food and ingredients, and partnership segments had another strong quarter, led by continued growth in both segments. Our plan remains the same—we will focus on diversification of the platform, while determining optimal ethanol plant operating levels based on market dynamics."

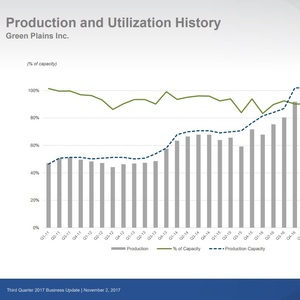

Green Plains produced 313.6 million gallons of ethanol during the third quarter, up from 292.2 million gallons produced during the same three-month period of 2016. The consolidated ethanol crush margin was $47.3 million, or 15 cents per gallon, compared with $51.6 million, or 17 cents per gallon, during the third quarter of last year.

Advertisement

Advertisement

The company produced 817,000 tons of distillers grains, up from 790,000 tons produced during the same quarter of last year. Corn oil production was also up, reaching 75.44 million pounds, up from 72.18 million pounds during the third quarter of last year. Green Plains consumed an estimated 109.54 million bushels of corn during the third quarter, up from 201.11 million bushels consumed during the same quarter of last year.

During an investor call, John Neppl, chief financial officer of Green Plains, said that consolidated volumes of ethanol sold during the quarter were up 13 percent, reaching 380 million gallons. The average realized price per gallon was also up slightly when compared to the third quarter of 2016, he noted. During the third quarter, the utilization rate for Green Plains ethanol production assets was approximately 84 percent. Becker indicated that Green Plains exported 11 percent of the ethanol it produced during the quarter.

Advertisement

Advertisement

Moving into the fourth quarter, Becker noted that margins have continued to drift downward. He also noted that industry-wide inventories are 1.7 million barrels higher than they were last year. Overall, he said the industry is in a slight oversupply situation for current ethanol demand, but said it is not enough to justify a broad industry slowdown as most of the plants are still running with positive contribution margins. Becker said even if the company sees some additional exports, the oversupply situation will remain, but will be a positive emphasis for 2018.

Becker said ethanol is at its widest discount to gasoline in many years, and is expected to remain so though 2018. “It is not only the cheapest octane, but approaching the cheapest Btu again,” he added, which could help grow exports. However, he also stressed that in order for exports to increase the industry needs to fight Brazilian tariffs, look for ways to engage China and reopen its markets, and work to get an open program in Mexico. He also mentioned the importance of trade initiatives with Canada, India, the Philippines and other countries.

Becker said Green Plains will continue to flex its production based on market conditions more than it has in the past. We will act much faster when we feel it is in the best interest of our shareholders, he added, noting the company will focus on its commitment to and growth prospects of the partnership.

Related Stories

Neste Corp. on July 24 released second quarter results, reporting record quarterly renewable product sales volumes despite weaker margins. SAF sales were up nearly 80% when compared to the first quarter of 2025.

Valero Energy Corp. on July 24 released second quarter results, reporting a profitable three-month period for its ethanol segment. The renewable diesel segment posted a loss, but the company’s new sustainable aviation fuel (SAF) unit operated well.

The IRS on July 21 published a notice announcing the 2025 calendar-year inflation adjustment factor for the Section 45Z clen fuel production credit. The resulting adjustment boosts maximum the value of the credit by approximately 6%.

U.S. Secretary of Agriculture Brooke L. Rollins today announced the reorganization of the USDA, refocusing its core operations to better align with its founding mission of supporting American farming, ranching, and forestry.

The U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy is soliciting public comments on a preliminary plan for determining provisional emissions rates (PER) for the purposes of the 45Z clean fuel production credit.

Upcoming Events