Green Plains reports progress with transformation plan

May 3, 2021

BY Erin Krueger

Todd Becker, president and CEO of Green Plains Inc., discussed the company’s efforts to transform into a global ag tech company and provided an update of plant improvement projects during a first quarter earnings call held May 3.

“Our first quarter was transformative to both our balance sheet and our technology platform. Additionally, our 1.0 platform performed well, as our risk management and hedging programs were beneficial to the quarter,” Becker said. “Fully funding our Total Transformation Plan to deploy Fluid Quip’s protein technology was a critical step in building the biorefinery platform of the future. The milestones achieved during the quarter have moved us along the path to achieving our 2024 financial goals, including partnering with BlackRock and Ospraie Management in the acquisition of Fluid Quip Technologies to transform Green Plains into a global leading ag tech company focused on value added, low carbon novel agricultural ingredients.”

“We achieved a number of impressive milestones in the first quarter across every phase of our transformation, including protein, sugar, corn oil, and carbon, culminating with successful capital raises to provide the liquidity necessary to achieve our vision for Green Plains 2.0,” added Becker. “Moving forward, we are focused on announcing the construction sequence of MSC Ultra-High Protein deployment, finalizing our selection of a general contractor to build our Ultra-High Protein technology across our biorefinery platform, finalizing Project 24, beginning production of Ultra-High Protein at our Wood River, Nebraska biorefinery and startup of clean sugar production at our York Innovation Center. Even more exciting are the advancements we are seeing in Ultra-High Protein purities, renewable corn oil yields and innovations in yeasts, oils and sugars. Across our platform we believe we are on track to achieve our 2024 financial goals.”

Advertisement

Becker said the company’s ultra high-protein business has continued to exceed expectations at the company’s ethanol plant in Shenandoah, Iowa. During the quarter, the plant produced 58 percent protein product in full-scale production and delivered that product to pet food partners. “Early indications are very positive on how this product can be used,” he added. In recent weeks, Becker said Green Plains has seen protein yields of 4 pounds per bushel and has seen corn oil yields consistently above 1.1 pounds per bushel, approaching the 1.2 pounds that the company expects to achieve with the Fluid Quip MSC system. Even more exciting, Becker said the company’s post-MSC distillers product is in great demand and pricing at a slight premium to traditional distillers grains. Construction of the Fluid Quip MSC System at the Wood River, Nebraska, plant is progressing nicely, Becker said, with startup currently expected in the third quarter. Projects to add the Fluid Quip MSC technology to the Mount Vernon, Indiana, and Obion, Tennessee, plants are scheduled to break ground soon, he added.

Becker also noted that Green Plains’ Project 24 initiative is nearing the finish line, as the Mount Vernon, Indiana, facility recently startup and construction at the Madison, Illinois, facility is on track to be complete during the third quarter. The Project 24 initiative aims to reduce the company’s per-gallon operating expense to 24 cents.

In addition, Becker said Green Plains continues to evaluate plans to add technology to produce grain neutral spirits (GNS), a high-value alcohol product, at the company’s plant in York, Nebraska. No final decision on that upgrade has been made, he added.

The clean sugar technology (CST) installation at Green Plains’ York Innovation Center is nearly complete, Becker said, with the company preparing for its first commercial shipments of the product. “Our goal is to work with these end customers and to select one of our existing facilities for a full-scale deployment of this innovative technology in the near future,” he added.

Advertisement

Becker also addressed Green Plains’ growing focus on carbon capture and storage (CCS). “In February, we announced our initial three locations to be included on a proposed carbon pipeline to sequester pure [carbon dioxide] into geologic formations,” Becker said. “As a founding partner of the development company, we believe will be able to benefit from the pipeline on top of the LCFS income generated at each of the connected biorefineries.” That project, under development by Summit Carbon Solutions, is now being expanded into Southwest Iowa and Nebraska, which Becker said will allow Green Plains to add five more of its biorefineries to the project. The company’s remaining three plants are each potential candidates for direct injection carbon sequestration due to their proximity to suitable geologic formations, Becker added.

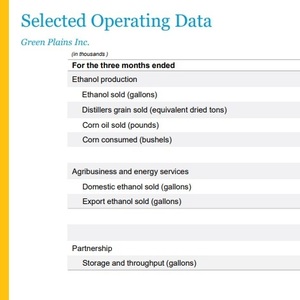

Patrich Simpkins, chief financial officer at Green Plains, said that Green Plains’ plants ran at 71.1 percent capacity during the first quarter, down from an 85.9 percent run-rate reported for the same period of 2020. Green Plains sold 178 million gallons of ethanol during the first quarter, down from 240.5 million gallons sold during the same period of last year. The consolidated crush margin was $18.9 million, or 11 cents per gallon.

Net loss attributable to the company was $6.5 million, or a loss of 17 cents per diluted share, compared to a net loss of $16.4 million, or a loss of 47 cents per share, reported for the first quarter of 2020. Revenues were $553.6 million, down from $632.9 million.

Related Stories

CountryMark on July 22 celebrated the completion of more than $100 million in upgrades at its refinery in Indiana, including those related to soybean oil storage. The facility produces renewable diesel via coprocessing technology.

ATOBA Energy and Air Moana are partnering to implement scalable solutions for the supply of SAF. The collaboration aims to ensure long-term SAF availability while supporting local initiatives to develop sustainable fuel production in Tahiti.

Neste Corp. on July 24 released second quarter results, reporting record quarterly renewable product sales volumes despite weaker margins. SAF sales were up nearly 80% when compared to the first quarter of 2025.

Valero Energy Corp. on July 24 released second quarter results, reporting a profitable three-month period for its ethanol segment. The renewable diesel segment posted a loss, but the company’s new sustainable aviation fuel (SAF) unit operated well.

The IRS on July 21 published a notice announcing the 2025 calendar-year inflation adjustment factor for the Section 45Z clen fuel production credit. The resulting adjustment boosts maximum the value of the credit by approximately 6%.

Upcoming Events