IEA report outlines growth potential for liquid biofuels

November 1, 2022

BY Erin Krueger

The International Energy Agency on Oct. 27 released its World Energy Outlook 2022. The report, in part, predicts global biofuel consumption could more than double by 2030 and continue to increase through 2050.

According to the IEA, more than 80 countries currently have biofuel blending mandates in place. Impacts associated with the COVID-19 pandemic, however, caused many biofuel targets to be delayed or scaled back. The IEA also notes that Russia’s invasion of Ukraine has also impacted the global biofuel sector due to the resulting increased energy and feedstock costs.

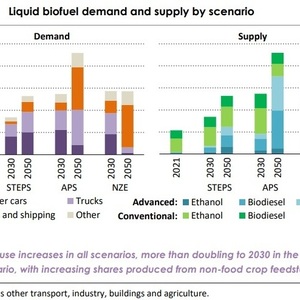

The IEA’s report considers the potential for future growth in biofuels production and use via three specific scenarios. The Stated Polices Scenario (STEPs) shows the trajectory implied by today’s policy settings, while the Announced Pledges Scenario (APS) assumes that all aspirational targets announced by governments are met on time and in full, including their long-term net zero and energy access goals. Finally, the Net Zero Emissions by 2050 (NZE) Scenario maps out a way to achieve a 1.5 degree Celsius stabilization in the rise in global average temperatures, alongside universal access to modern energy by 2030.

Advertisement

Advertisement

Under the STEPs scenario, the IEA predicts demand for liquid biofuels would grow from 2.2 million barrels of oil equivalent per day (mboe/d) in 2021 to 3.4 mboe/d in 2030 and 5.3 mboe/d in 2050. The agency primarily attributes the forecasted increase to blending mandates for passenger cars that lead to an increased use of ethanol produced from advanced feedstocks. Under the scenario, passenger cars consume 50 percent of total liquid biofuels in 2030 and almost 40 percent in 2050. Ethanol comprises 55 percent of total biofuels production in 2030, down from 60 percent today.

Under the APS scenario, demand for liquid biofuels would increase to 5.5 mboe/d in 2030 with much higher use of liquid biofuels in road transport in the U.S., China, India and Canada. After 2030, increasing sales of electric cars would cause liquid biofuels demand to plateau in road transport. A much higher share of biofuels, however, would be used in the aviation and shipping industries. By 2050, total liquid biofuels consumption would surpass 9 mboe/d, with 75 percent of that volume consisting of advanced biofuels. Approximately 40 percent of biofuels consumption in 2050 would be consumed in aviation and shipping, with liquid biofuels accounting for more than 25 percent of total fuel use in aviation.

Advertisement

Advertisement

Under the NZE scenario, demand for liquid biofuels would increase to 5.7 mboe/d in 2030 and be maintained near that level through 2050. High penetration of electric cars and trucks would lead to a significant reduction in biofuels consumption in road transport after 2030, with more of the limited supply of sustainable bioenergy used in the form of solid bioenergy in power generation and industrial applications. As a result, demand or liquid biofuels in 2050 would be 40 percent lower than under the APS scenario. The IEA also notes that under the NZE scenario, approximately 90 percent of liquid biofuels produced in 2050 would be advanced biofuels, with 75 percent of liquid biofuels consumed in aviation and shipping. The agency estimates that more than 40 percent of the fuel used in aviation in 2050 takes the form of liquid biofuels.

Currently, IEA estimates that more than 90 percent of liquid biofuels are conventional biofuels produced from food crop feedstock, such as sugarcane, starch and vegetable oils. The production of advanced, non-food based liquid biofuels increases under all three scenarios but is critically dependent upon developed sufficient quantities of advanced feedstocks; demonstrating and scaling up ways to derived sustainable feedstocks from non-food energy crop production on non-arable and degraded land; and regulatory stability, according to IEA.

A full copy of the report can be downloaded from the IEA website.

Related Stories

Bangkok Airways Public Company Limited has officially announced the adoption of sustainable aviation fuel (SAF) on its commercial flights, reinforcing Thailand’s green aviation industry. The initiative took effect starting July 1, 2025.

Avalon Energy Group LLC and Sulzer Chemtech have signed a strategic alliance and partnership agreement to scale up the production of SAF. Under the agreement, Avalon has selected BioFlux technology for its portfolio of SAF projects.

The USDA has announced it will delay opening the first quarterly grant application window for FY 2026 REAP funding. The agency cited both an application backlog and the need to disincentivize solar projects as reasons for the delay.

Neste and DHL Express have strengthened their collaboration with the supply of 7,400 tons (9.5 million liters) of neat, i.e. unblended, Neste MY Sustainable Aviation Fuel to DHL Express at Singapore Changi Airport starting July 2025.

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

Upcoming Events