IEA Task40: Biomass provides 10 percent of global energy use

September 19, 2013

BY Susanne Retka Schill

A new report from the International Energy Agency takes a global overview of biomass use in the industrial and transport sectors, identifying leading countries and the top 15 production companies in each sector. The IEA’s Bioenergy Task40 report, “Large Industrial Users of Energy Biomass,” was released in early September.

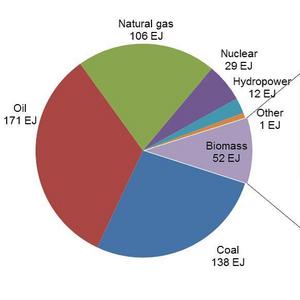

Currently biomass covers approximately 10 percent of the global energy supply, of which two-thirds is used in developing countries for cooking and heating. In 2009, about 13 percent of biomass use was consumed for heat and power generation, while the industrial sector consumed 15 percent and transportation 4 percent. The global consumption of biofuels in transportation equaled 2 percent of the transport sector total.

Excluding residential use, the top countries utilizing all sources of biomass for energy were Brazil, the U.S. and India. Brazil leads the list at 18 percent of the total industrial use globally in 2009. The U.S. and India each had a 16 percent share of global industrial biomass use for energy, with Nigeria, Canada, Thailand and Indonesia trailing far behind in the next group, each having about a 4 percent global share.

In Brazil, 21 percent of the energy used in industry came from sugarcane bagasse in 2010, with the food and beverage sector getting 75 percent of its energy from bagasse. The industrial sector in Brazil gets a significant amount of energy from wood as well. In the U.S., most of the biomass used in the industrial sector is derived from the forest, and more than half is black liquor.

Advertisement

Advertisement

In the transportation sector, the U.S. has far the largest share of the global consumption of biofuels at 43 percent in 2011, of which ethanol is 94 percent of the U.S. total. Brazil biofuel usage is also dominated by ethanol, at 94 percent of its total, with the country accounting for about 25 percent of global usage. The EU27 comes in at 23 percent of total global use, with biodiesel dominating EU biofuels with a 76 percent share. Canada and China trail far behind, each having a 2 percent share of global use. Thailand and Belarus each have a 1 percent share and all other counties combined total 3 percent.

In reviewing the top plants utilizing biomass resources, the pulp and paper industry accounts for nearly a quarter of global industrial use of biomass for energy. Globally, there are about 630 recovery boilers in use in chemical wood pulp mills.

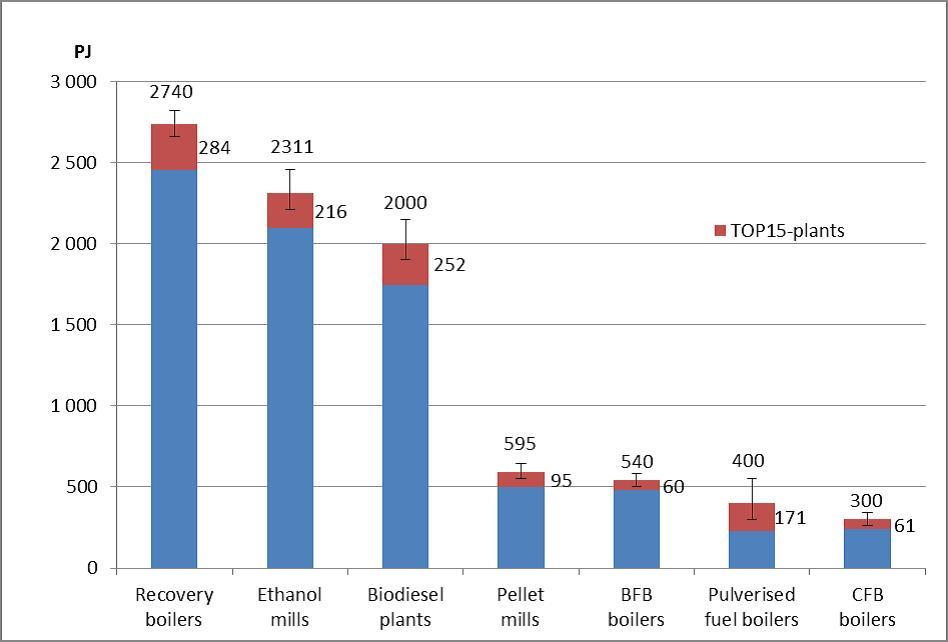

Next in line for global biomass utilization capacity is ethanol, with the U.S. having the largest capacity by far, followed by Brazil. Global biodiesel production capacity is slightly smaller than ethanol capacity, but the utilization rate is low at about 35 percent. Biodiesel is third in capacity, although its current rate of utilization compared to capacity is much lower. Among the plant types using solid biomass for energy, pellet mill capacity is nearly one-third of its liquid biofuel totals, followed by plants using three different boilers types for industrial plants and power generation. Torrefaction, pyrolysis and gasification applications were discussed, but not charted, as the total global plant capacity is comparatively small.

The report also examined the top 15 plants in different sectors, in part to determine the influence of the largest producers. The 15 largest pulverized firing boilers co-firing biomass cover up to 43 percent of the biomass co-firing capacity. For other boilers as well as wood pellet, biodiesel, and ethanol production, the share of the 15 largest plants is around 10 to 20 percent of the sector’s capacity. Actual use of biomass in the 15 largest plants exceeds 20 percent of the sector’s use for biodiesel plants, pulverized fuel boilers and circulating fluidized bed boilers, while for other categories, it is close to 10 percent.

The report also notes whether the biomass used in the largest plants was sourced locally or imported, finding that most were local biomass feeds. Imported biomass is used primarily in biodiesel plants and pulverized firing boilers, and most imported biomass is used in Europe. While the use of raw biomass will likely remain local, the trade of refined biofuels such as bioethanol, biodiesel and wood pellets will likely continue to increase in the near future.

Advertisement

Advertisement

The three authors, Esa Vakkilainen, Katja Kuparinen, Jussi Heinimö, are from the Lappeenranta University of Technology in Finland. The entire 75-page report, “Large Industrial Users of Energy Biomass,” is available here.

Related Stories

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Upcoming Events