Industry Improves as Indicators Stabilize, Diversification Expands

PHOTO: BBI INTERNATIONAL, SUSANNE RETKA SCHILL

November 5, 2012

BY Paula Emberland

Despite challenges and tight margins, recent months demonstrate that ethanol plants have diversified and stabilized since the earlier days of the industry, according to the Biofuels Benchmarking Industry Report produced by Christianson & Associates PLLP. The Midwest accounting and consulting firm has been collecting data from its ethanol benchmarking program participants since 2003. The industry report profiled here focuses on the 18-month period from January 2011 to June 2012, and includes data from about a quarter of all ethanol plants in the U.S. and Canada.

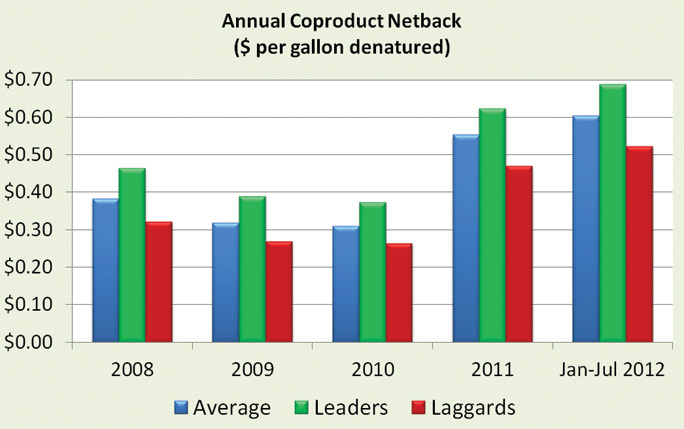

Looking at the numbers, three key factors at work in recent years provide indicators of a future of increased stability and higher levels of synergy with local economies. First, and perhaps most importantly, more plants are producing different types of coproducts, and they’re making more money from those coproducts, both in real numbers and as a percentage of total revenue. Over 25 percent of plants now recapture and sell CO2, for instance, and over half have begun extracting corn oil. Distillers grains prices have also risen in correlation with corn prices, which hasn’t always been the case with ethanol prices. The result of this diversification is that coproduct revenue accounted for 23 percent of average grind revenue in the first half of 2012, up from just 16 percent in 2008.

Multiple revenue streams mean less dependence on the price of ethanol to determine profitability, and coproduct prices overall have been less volatile. Although ethanol netbacks fluctuated from a high in the third quarter of 2011 of $2.66 per gallon, on average, to a low of $2.04 in Q2 of 2012, coproduct netbacks rose steadily. Measured in revenue-dollars-per-gallon-of-ethanol sold, coproducts brought in an average of 62 cents per gallon in Q2 of 2012, which is a steady increase of 59 percent since the last quarter of 2010, when coproduct revenue was just 39 cents per sales gallon of ethanol.

Not only does the increase in coproduct profitability indicate better ability to withstand low ethanol prices, it also reflects close integration with other local industries to get the best return on coproduct technology investments. This type of geographical targeting, to maximize profit and minimize transportation costs, is a key component of successful coproduct strategy. Obviously, plants have always used their regional market to make decisions about how much to dry their distillers grains, but plants now have increasingly diverse markets to consider for other types of coproducts.

Advertisement

Advertisement

For example, plants may find it profitable to sell CO2 when they’re near another business that makes use of it, such as a bottling plant. They may also determine that it’s more profitable for them to refine CO2 themselves, or to simply sell the raw product, illustrating an area where it’s important for plant leadership to carefully review markets and evaluate payback on technology investments. A look at netbacks from CO2 sales makes this clear when one compares the group of leaders, which is the average of the top 25 percent, and a laggard group, the average of the lowest 25 percent. Leaders in CO2 sales can expect netbacks about 10 times higher than laggards in this category, so clearly a careful evaluation of local markets is critical.

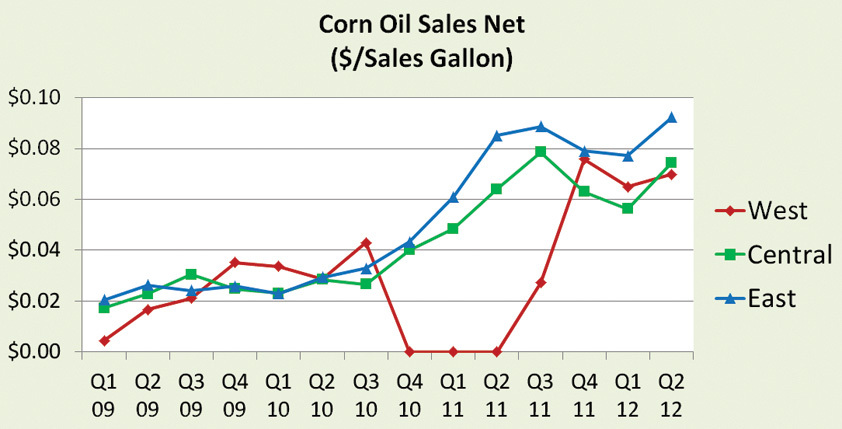

Similarly, plants may determine that corn oil is profitable for them if they’re near a big consumer of the oil such as a biodiesel refinery. Although the benchmarking program does not collect specific information about the industries to which corn oil is marketed, higher profits are earned by the plants in the eastern third of the country, as shown in a regional comparison of corn oil net sales. This is indicative of a correlation between higher corn oil profits and proximity to biodiesel producers, which are concentrated east of the Mississippi River.

Financial Progress

The second factor pointing to increased stability is a financial one and can be observed by looking at historical earnings and working capital numbers over the past five years.

Consistently favorable revenue and profitability throughout 2010 and most of 2011 allowed plants to position themselves more securely than ever before, by reducing debt and increasing working capital (the difference between current assets and current liabilities). Working capital has decreased slightly over the most recent two quarters, and currently averages about 17 cents per production gallon. Overall liquidity remains well above the low levels seen during the industry recovery period of 2009 to early 2010. Average working capital bottomed out at an average of just 5 cents per production gallon in Q2 of 2009. This improvement should, in turn, help maintain some degree of overall industry stability during the remainder of 2012 and into 2013, as plants cope with continued tight grind margins and the effects of this year’s Midwest drought season.

Optimizing Success

Ethanol production spurs better science, encouraging creation of the engineering and technology jobs that accompany applying theoretical science into production. Indicators of ongoing efforts to optimize production technology are the third contributing factor in the industry data that point to ethanol’s lasting significance in the domestic economy as we head into 2013.

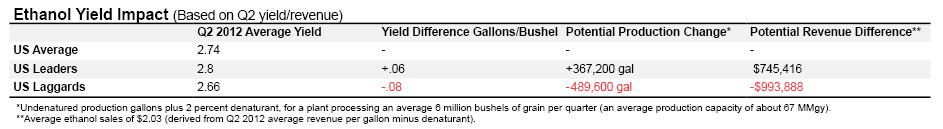

One such indicator of technological advancement is, of course, improved yield. Although overall average ethanol yields have remained fairly constant, leaders have shown average yields of about 2.80 gallons per bushel, while the overall industry average hovers at around 2.73 gallons per bushel. The laggards group isn’t far behind, averaging about 2.65 gallons per bushel. However, extracting just a bit more ethanol per bushel, as leader plants do, can make a difference of millions of dollars to a plant’s bottom line.

Advertisement

Advertisement

Moving from the laggard average ethanol yield of 2.66 gallons per bushel to the yields achieved by the average leader yield of 2.8 gallons may not seem like a big difference. But multiply those numbers by the average plant feedstock use of 6 million bushels per quarter, and that change can mean an increase in revenue per quarter of over $1.7 million, the difference between a profitable year and an unprofitable one, particularly in today’s tight-margin environment.

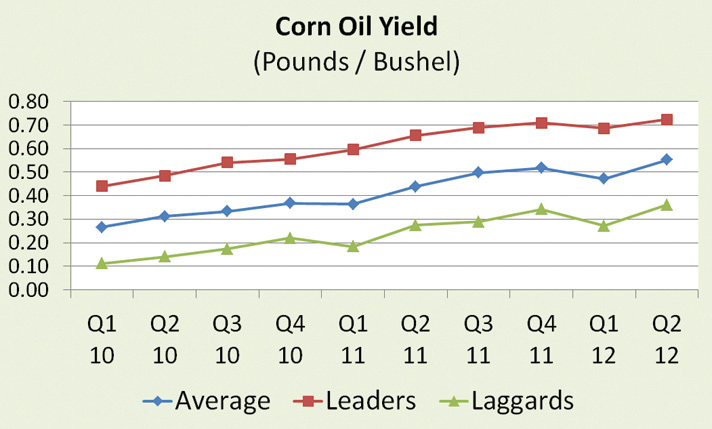

Corn oil yields have jumped even more due to better extraction technologies—they’re up an average of 40 percent since the first quarter of 2011. Leader plants in this category can expect even higher yields, averaging 0.72 pounds per bushel in the most recent quarter.

Based on the trends emerging from the data in the report, the outlook is good that plants will continue to find ways to become increasingly stable and self-sustaining, largely by making savvy technology investments that help them diversify into new coproduct markets, which in turn result in ever-better integration with the surrounding agricultural and economic environments.

Author: Paula Emberland

Benchmarking Business Analyst

Christianson & Associates PLLP

pemberland@christiansoncpa.com

320-441-5544

The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Ethanol Producer Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

Related Stories

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

EcoCeres Inc. has signed a multi-year agreement to supply British Airways with sustainable aviation fuel (SAF). The fuel will be produced from 100% waste-based biomass feedstock, such as used cooking oil (UCO).

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

Global digital shipbuilder Incat Crowther announced on June 11 the company has been commissioned by Los Angeles operator Catalina Express to design a new low-emission, renewable diesel-powered passenger ferry.

Upcoming Events