Low river levels in Germany continue to push biodiesel prices up

December 11, 2018

BY UFOP

It is often argued that the EU biofuels policy drives prices for agricultural feedstock, yet there is nothing to prove this.

When prices for agricultural commodities and staple foods exploded globally in 2007 and 2008 and prices became volatile as a result, the focus was on issues surrounding global nutrition. Continued famine and poverty since then have primarily been associated with changes in international prices for agricultural feedstock and the promotion of biofuels. Environmental associations in particular have frequently, and very effectively, made the case that the main cause is in the EU’s biofuels policy.

However, they fail to take into account that according to the United Nations’ Food and Agriculture Organization, suppliers respond by intensifying production and increasing yields. For several years now, bumper crops have led to global oversupply and, as a consequence, a build-up of stocks at high levels.

At the same time, the shares of biofuels in the top agricultural commodity exporting countries in Asia and North and South America reached new record highs. Governments have responded to the surpluses by raising the national biofuels mandates to stabilize producer prices.

Advertisement

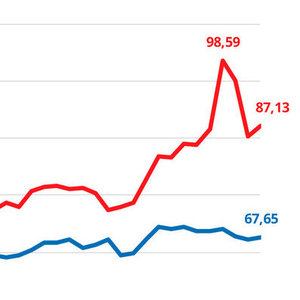

The current biodiesel hype, which has little impact on selling prices of raw rapeseed oil, shows that fuel prices have little influence on agricultural commodity prices. Demand for rapeseed methyl ester over the past few weeks caused a decline in supply, but feedstock remained abundant at all times. Consequently, rapeseed oil prices only rose slightly. At the same time, the price gap between rapeseed oil and palm oil widened to approximately 300 euros per metric ton, according to information published by Agrarmarkt Informations-Gesellschaft mbH (AMI).

The key issue affecting the product chain of rapeseed processing and biodiesel production in Germany is the uncertain transport situation due to low water levels in Germany's rivers that have curtailed the flow of goods and led to rising prices.

Advertisement

Related Stories

CountryMark on July 22 celebrated the completion of more than $100 million in upgrades at its refinery in Indiana, including those related to soybean oil storage. The facility produces renewable diesel via coprocessing technology.

ATOBA Energy and Air Moana are partnering to implement scalable solutions for the supply of SAF. The collaboration aims to ensure long-term SAF availability while supporting local initiatives to develop sustainable fuel production in Tahiti.

Neste Corp. on July 24 released second quarter results, reporting record quarterly renewable product sales volumes despite weaker margins. SAF sales were up nearly 80% when compared to the first quarter of 2025.

Valero Energy Corp. on July 24 released second quarter results, reporting a profitable three-month period for its ethanol segment. The renewable diesel segment posted a loss, but the company’s new sustainable aviation fuel (SAF) unit operated well.

The IRS on July 21 published a notice announcing the 2025 calendar-year inflation adjustment factor for the Section 45Z clen fuel production credit. The resulting adjustment boosts maximum the value of the credit by approximately 6%.

Upcoming Events