Model ethanol plant profit peaks at $4.50 per bushel of corn

FarmDocDaily

May 7, 2014

BY Susanne Retka Schill

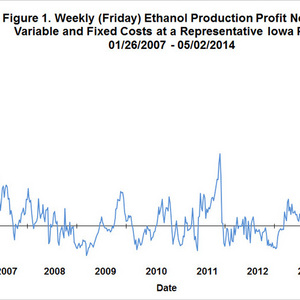

Ethanol profits have been off-the-chart, peaking in late March and just recently dropping back, University of Illinois economist Scott Irwin wrote in his latest analysis of the industry in FarmDocDaily.

“The new peak profits were almost $2 per bushel higher than the previous record,” Irwin said. “The historic spike in profits began during the first week in February 2014, peaked at the previously unheard level of $4.50 per bushel in the last week of March, and then dropped back to ‘only’ $1.45 per bushel in the first week of May (note: just divide the bushel profits by 2.8 to convert to gallons).” Irwin’s figures are based on the economic modeling of a hypothetical Iowa ethanol producer using spot prices.

Advertisement

Advertisement

Irwin cites a combination of factors as supporting the 63 percent increase in ethanol prices between January and March at a time when corn prices increased just 8 percent. While profitability has retreated to a still-high $1.45 a bushel, the situation is not likely sustainable. Between 2007 and 2013, ethanol production profits averaged 20 cents per bushel. If this is the normal level, then either ethanol prices will adjust down from the current level of $2.23 per gallon to $1.78, or corn will go up from the current $4.95 to $6.20. “If corn prices now tend to drive ethanol prices due to the E10 blend wall, then one would expect ethanol prices to do the bulk of the adjusting,” Irwin concluded.

Irwin added there caveats in applying the model to the industry as a whole. The spot prices used in the model don’t reflect the impact of forward marketing and hedging strategies, he explained. Other caveats include the substantial variation in production efficiency as compared to the model and the fact that a number of ethanol plants may not have been in the position to take advantage of the high ethanol prices due to rail car shortages.

Advertisement

Advertisement

Related Stories

The European Commission on July 18 announced its investigation into biodiesel imports from China is now complete and did not confirm the existence of fraud. The commission will take action, however, to address some systemic weaknesses it identified.

Kintetsu World Express Inc. has signed an additional agreement with Hong Kong, China-based Cathay Pacific Airways for the use of sustainable aviation fuel (SAF). The agreement expands a three-year partnership between the two companies.

Broco Energy on July 17 announced a new partnership with the Massachusetts Port Authority (Massport) to deliver and transition Massport's fuel tanks to renewable diesel across its various facilities.

Shell Aviation, Accenture, and Amex GBT on July 10 announced Avelia is in the process of evolving to an industry solution with independent data hosting and a multi-supplier model helping users access the GHG benefits of SAF.

The U.S EPA on July 17 released data showing more than 1.9 billion RINs were generated under the RFS during June, down 11% when compared to the same month of last year. Total RIN generation for the first half of 2025 reached 11.17 billion.

Upcoming Events