More rapeseed meal in compound feeds despite declining production

March 20, 2020

BY UFOP

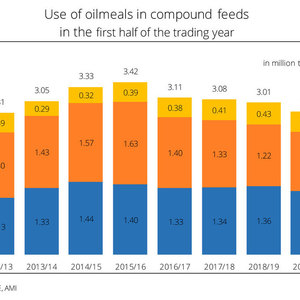

The use of oilseed meals in Germany’s compound feeds has declined continuously over the past four years. In the first half of the 2015-’16 marketing year, it amounted to 3.4 million metric tons, whereas in 2019-’20 the figure was down around 17 percent to 2.84 million tons. The share of soybean meal fell particularly sharply, not least as a consequence of the declining pig population. Soy meal use plummeted almost 30 percent to 1.2 million tons. In contrast, the use of rapeseed meal declined 10 percent to 1.3 million tons.

At the same time, the meal percentages in total processing shifted. Whereas the share of soybean meal sagged from 48 to 41 percent in the past four years, that of rapeseed meal rose from 41 to 44 percent.

According to information published by Agrarmarkt-Informationsgesellschaft (mbH), most soybean meal used in feed production is genetically modified (GM) soybean meal imported from non-EU countries, especially Argentina, the U.S. or Brazil. It is mainly used in fowl and pig feeds. The reasons for the rising demand for GM-free rapeseed meal are the fact that dairy products are increasingly labelled “without GM” and the feed value of rapeseed meal. Feeding projects undertaken by the Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) have repeatedly confirmed the high suitability of rapeseed meal as sole protein component in dairy feeding.

Advertisement

UFOP has underlined the enormous importance of highlighting the unique selling point of “without GM” for safeguarding domestic rapeseed production. As much as approximately 60 percent of the rapeseed is processed into rapeseed meal. UFOP has pointed out that rapeseed is by far the most important GM-free source of protein in Germany and the EU, with an area of more than 6 million hectares. This aspect is playing an increasing role also in France, which is reflected in the fact that dairy products are increasingly declared “GM-free,” as they are in Germany.

Against this background, UFOP is watching the lack of strategy for rapeseed oil-based biodiesel with concern, the biodiesel market being the key outlet for rapeseed oil. The association has argued that the perspective of regional protein supply through rapeseed, the most important flowering crop, can only succeed if rapeseed oil can achieve an adequate level of appreciation. German producers of biodiesel are by far the most important purchasers of rapeseed oil. UFOP has emphasized that politicians must at last recognize the economic interrelations in the existing bioeconomy and take into account the full ecosystem service of rapeseed cultivation in crop rotation in lifecycle assessments. The association expects those responsible to bear this approach towards improving the competitive situation in mind when developing the agricultural strategy.

Advertisement

Related Stories

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

The USDA’s National Agricultural Statistics Service on June 30 released its annual Acreage report, estimating that 83.4 million acres of soybeans have been planted in the U.S. this year, down 4% when compared to 2024.

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Scientists at ORNL have developed a first-ever method of detecting ribonucleic acid, or RNA, inside plant cells using a technique that results in a visible fluorescent signal. The technology could help develop hardier bioenergy and food crops.

Upcoming Events