Most areas of Corn Belt expected to perform well

PHOTO: FCSTONE

October 29, 2015

BY Jason Sagebiel, FCStone

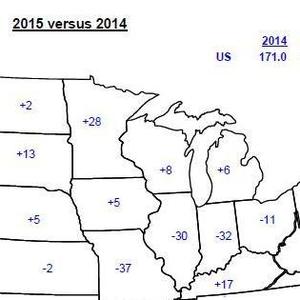

Harvest has wrapped up and yield reports have been better than expected. In the USDA’s October supply and demand report, the government increased yields to 168 bushels per acre, up from the first new crop yield report in May, which estimated 166.8 bushels per acre. Excessive rains in areas of the Corn Belt during May and June had analysts projecting yield cuts. As shown in the map, aside from the Eastern Corn Belt, most areas are projected to outperform last year’s yield numbers. Although yields are projected to drop substantially in Illinois, Indiana and Missouri year on year, recent estimates have shown slight rebounds and the departure from normal is not as extensive.

The October report placed corn production at 13.555 billion bushels, down from the previous report despite a yield increase. Demand for corn was unchanged with corn used for feed was pegged at 5.275 billion bushels; ethanol 5.350 billion bushels and exports 1.850 billion bushels. Last year, the above sectors consumed 5.317 billion bushels, 5.207 billion bushels and 1.864 billion bushels respectively.

Advertisement

Prices are finding support this fall, due to lack of movement by the producer. The crop will still be short in areas of the Eastern Corn Belt due to effects of the excess moisture and the shortfall will make the cash market a bit more volatile in the east when compared to the west. The Eastern Corn Belt will be short again this year, as state stocks in these areas are tight again. This will keep the cash market exuberant.

| Dec corn futures | |||

| Dec futures | Close in bu | Close in tons | |

| 10/28/2015 | $3.7600 | $134.29 | |

| 9/28/2015 | $3.8675 | $138.13 | |

| 10/28/2014 | $3.6450 | $130.18 | |

Advertisement

* Comments in this column are market commentary and are not to be construed as market advice.

Related Stories

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events