Neste reports solid Q3 performance for renewable diesel

October 23, 2020

BY Erin Krueger

Neste released third quarter financial results on Oct. 22, reporting solid performance despite the COVID-19 pandemic. Demand for the company’s renewable diesel remained good and sales volumes were relatively stable.

“Neste's overall performance was solid during the third quarter despite the COVID-19 pandemic. Renewable Products business was very resilient and improved its sales margin and sales volume compared to the corresponding period last year,” said Peter Vanacker, president CEO of Neste. “Oil Products continued to suffer from a very weak refining market caused by the global COVID-19 related demand destruction and over-supply, and the segment delivered a slightly negative comparable operating profit. Marketing & Services performed very well during the summer period also considering the earlier divestment of our Russian business.”

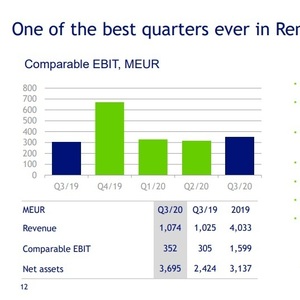

Neste reported a comparable operating profit of EUR 352 million for its renewable products segment, up from EUR 305 million during the third quarter of last year. Sales volumes for renewable diesel were relatively stable at 730,000 metric tons, up from 716,000 metric tons during the same period of 2019.

Advertisement

During the third quarter, 72 percent of Neste’s renewable diesel sales went to Europe, up from 70 percent during the third quarter of 2019, with 28 percent of sales going to the North American market, down from 30 percent. The comparable sales margin, including the biodiesel tax credit (BTC) averaged $744 per ton.

Neste’s renewable diesel plants operated at 95 percent of capacity during the three-month period, down from 101 percent during the same period of last year. Scheduled maintenance was performed at the Singapore refinery and on one unit at the Porvoo facility.

Feedstock markets for renewable diesel remained tight during the quarter, according to Neste. Animal fat prices continued to rise in the third quarter, supported by stronger vegetable oils. After trending up, the European used cooling oil (UCO) price development stabilized during the quarter, reflecting improved availability of imports and demand trends in the biodiesel and oleochemical markets. Vegetable oil prices also surged, the company reported.

Advertisement

Moving into the fourth quarter, Neste predicts sales volumes for renewable diesel to be down slightly. Waste and residue markets are expected to remain tight, the company said. Utilization rates at Neste’s renewable diesel facilities is expected to remain high, except for a scheduled catalyst change at the Rotterdam refinery during the quarter.

Overall, Neste reported comparable operating profit of EUR 373 million for the third quarter, down from EUR 435 million during the same period of last year. Operating profit was EUR 425 million, down from EUR 442 million.

Related Stories

CountryMark on July 22 celebrated the completion of more than $100 million in upgrades at its refinery in Indiana, including those related to soybean oil storage. The facility produces renewable diesel via coprocessing technology.

ATOBA Energy and Air Moana are partnering to implement scalable solutions for the supply of SAF. The collaboration aims to ensure long-term SAF availability while supporting local initiatives to develop sustainable fuel production in Tahiti.

Neste Corp. on July 24 released second quarter results, reporting record quarterly renewable product sales volumes despite weaker margins. SAF sales were up nearly 80% when compared to the first quarter of 2025.

Valero Energy Corp. on July 24 released second quarter results, reporting a profitable three-month period for its ethanol segment. The renewable diesel segment posted a loss, but the company’s new sustainable aviation fuel (SAF) unit operated well.

The IRS on July 21 published a notice announcing the 2025 calendar-year inflation adjustment factor for the Section 45Z clen fuel production credit. The resulting adjustment boosts maximum the value of the credit by approximately 6%.

Upcoming Events