Neste reports strong Q1 for renewable products segment

May 2, 2022

BY Erin Krueger

Neste Corp. released first quarter 2022 financial results on April 29, reporting a strong perfomrance for its renewable products segment. Renewable diesel demand was robust during the three-month period, but feedstock markets remained tight, according to the company.

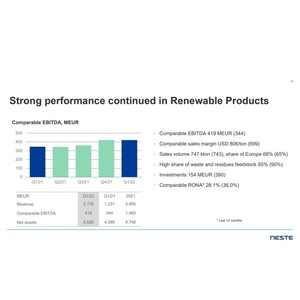

Neste’s renewable products segment posted a comparable EBITDA of EUR 419 million (440.28 million) in the first quarter, up from EUR 344 million reported during the same period of 2021.

Peter Vanacker, president and CEO of Neste, said that Russian’s invasion of Ukraine has strongly impacted the vegetable oil and the oil products markets. The impact on waste and residue markets is taking place with some time delay, he added.

Advertisement

Advertisement

“In this market situation we reached a record-high comparable sales margin of [$806 per ton],” Vanacker said, which up when compared to the $699 per ton reported for the same period of last year. “This outstanding achievement was supported by our strong sales performance, margin hedging and the flexibility provided by our global optimization model,” Vanacker continued. “Our sales volumes were 747,000 tons, slightly higher than in the corresponding period last year. During the first quarter our renewables production facilities operated at an average 104 percent utilization rate, and reached a new quarterly production record of 858,000 tons. This production record will help us to manage through the scheduled maintenance shut-down period later this year. Feedstock mix optimization continued, and the share of waste and residue inputs increased to 95 percent.”

Approximately 68 percent of the 747,000 tons of renewable fuel sold during the first quarter was sold into the European market, up from 65 percent during the same period of 2021, with 32 percent sold into the North American market, down from 35 percent. The share of 100 percent renewable diesel delivered to end users was at 27 percent, down from 31 percent.

Advertisement

Advertisement

Moving into the second quarter, Neste predicts that the utilization rates of its renewables production facilities will remain high. Second quarter sales volumes for the renewables segment are expected to be slightly higher than in the previous quarter. Neste also predicts waste and residue markets will remain tight. The company currently expects its second quarter sales margin for renewable products to be in the range of $675-$750 per ton.

Overall, Neste reported comparable EBITDA of EUR 578 million for the first quarter, up from EUR 429 million reported for the same period of 2021. EBITDA was EUR 916 million, up from EUR 585 million.

A full copy of Neste’s first quarter report is available on the company’s website.

Related Stories

The USDA’s National Agricultural Statistics Service on June 30 released its annual Acreage report, estimating that 83.4 million acres of soybeans have been planted in the U.S. this year, down 4% when compared to 2024.

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

Global digital shipbuilder Incat Crowther announced on June 11 the company has been commissioned by Los Angeles operator Catalina Express to design a new low-emission, renewable diesel-powered passenger ferry.

Scientists at ORNL have developed a first-ever method of detecting ribonucleic acid, or RNA, inside plant cells using a technique that results in a visible fluorescent signal. The technology could help develop hardier bioenergy and food crops.

Upcoming Events