Novozymes: Bioenergy drives 2014 growth

Novozymes

January 20, 2015

BY Erin Krueger

Novozymes has released 2014 financial results, reporting that sales growth was in line with expectations. During an investor call, Peder Holk Nielsen, president and CEO of Novozymes, said bioenergy was the strongest growth driver last year.

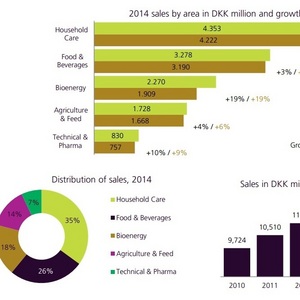

Organically, sales grew by 7 percent last year, when compared to 2013. In the fourth quarter alone, sales grew by 4 percent organically when compared to the same period of the prior year. EBIT grew by 17 percent last year and the EBIT margin was 27.2 percent, a 2.5 percent increase when compared to 213.

According to Novozymes, total sales reached DKK 12.46 billion ($1.94 billion) in 2014, up 6 percent compared to the prior year. The company indicated exchange rates had a negative impact on sales.

In its financial report, Novozymes estimated the global industrial enzyme market grew by 5 percent in DKK last year, reaching DKK 23 billion. Novozymes said its global market share is approximately 48 percent.

Advertisement

While overall sales grew by 7 percent organically, bioenergy sales grew by 19 percent last year, reaching DKK 2.27 billion, up from DKK $1.91 billion in 2013. The bioenergy sector accounted for approximately 18 percent of Novozymes’ sales last year. According to Novozymes, U.S. ethanol production grew approximately 8 percent last year when compared to 2013. Bioenergy sales grew by an estimated 10 percent organically in the fourth quarter when compared the same period of the previous year. U.S. ethanol production increased by about 3 percent during the same period.

According to Novozymes, the strong growth in bioenergy sales was mainly driven by the company’s yield-discovery solutions Avantec, Spirizyme, Achieve and Olexa. Novozymes estimates more than one-third of U.S. fuel ethanol is produced using one or more of these solutions. Per Falholt, executive vice president of research and development, said the company plans launch new technology for its corn ethanol customers during the first half of this year. While he didn’t provide specifics on the product, he did say it is expected to increase yields.

Andrew Fordyce, executive vice president of business operations at Novozymes, said 2015 U.S. fuel ethanol production is expected to be on par with 2014 production. While the year is expected to start out slightly slower due to fluctuation in ethanol production following a record fourth quarter and lower oil prices, demand remains solid, supporting a stable outlook.

Advertisement

Thomas Videbaek, executive vice president of business development, said 2014 was a breakthrough year for many of the companies that are starting to produce cellulosic ethanol. There are six commercial-scale facilities ramping up worldwide, he said, and the pipeline of new projects looks good.

According to Videbaek, Novozymes is still seeing strong interest from around the world from a range of different companies that are looking to unlock value from biomass. He also said the company has recognized that the ramp-up of the industry has been slower than initially expected. While 15 cellulosic plants may be operational by 2017, he said Novozymes no longer bases its sales target on that figure. However, he also noted the company expects to supply technology to approximately 15 plants operating at full capacity by the end of 2020.

Within its financial report, Novozymes said the outlook for 2015 is positive. The company expects organic sales growth of 7-9 percent this year. Bioenergy and agriculture and feed are expected to be the most significant growth contributors. Through 2020, Novozymes is targeting annual organic sales growth of 8-10 percent on average.

Related Stories

Neste Corp. on July 24 released second quarter results, reporting record quarterly renewable product sales volumes despite weaker margins. SAF sales were up nearly 80% when compared to the first quarter of 2025.

Valero Energy Corp. on July 24 released second quarter results, reporting a profitable three-month period for its ethanol segment. The renewable diesel segment posted a loss, but the company’s new sustainable aviation fuel (SAF) unit operated well.

The IRS on July 21 published a notice announcing the 2025 calendar-year inflation adjustment factor for the Section 45Z clen fuel production credit. The resulting adjustment boosts maximum the value of the credit by approximately 6%.

U.S. Secretary of Agriculture Brooke L. Rollins today announced the reorganization of the USDA, refocusing its core operations to better align with its founding mission of supporting American farming, ranching, and forestry.

The U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy is soliciting public comments on a preliminary plan for determining provisional emissions rates (PER) for the purposes of the 45Z clean fuel production credit.

Upcoming Events