Options Expand for Effective Bacterial Control in Ethanol Production

November 10, 2016

BY Scott Lewis

Maximizing ethanol production is the top priority for fuel ethanol producers. It is, however, a process that requires tremendous effort by well-trained, experienced operators who understand both the many variables that affect production and the many new production-enhancing technologies on the market.

Given the importance of maintaining high production levels, the last thing ethanol plant managers want is bacterial infections compromising their production process and decreasing yields. In a typical corn-to-ethanol, dry-grind process, corn is converted to sugar, which is consumed by the yeast to produce ethanol.

Unfortunately, yeast are not the only hungry organisms looking for a sugar fix. Any bacteria present will also consume the sugars. Because they typically grow at rates much faster than yeast, a small number of bacteria will quickly multiply and outcompete the yeast for vital nutrients. As a result, there is less sugar to produce alcohol. Additionally, the byproducts secreted by the bacteria, lactic and acetic acids, act as stressors that are harmful to the yeast.

Bacterial problems can have expensive consequences. For example, in a 100 MMgy fuel ethanol plant, a moderate level of bacterial contamination can lead to an annual revenue loss of $4.5 million at current ethanol prices. Excessive bacteria can cost as much as $190,000 if a single fermentor is entirely lost.

Unfortunately, fuel ethanol plants were not designed to be sterile environments, thus eliminating bacterial infections is cost prohibitive, if not impossible. Not only are bacteria introduced with the incoming corn, but they also find their way into the fermentors from other sources, such as cooling tower water, which may be added to the cook water. While the raw water might be fine, any time a tank or yeast propagator is filled with water and additives, there is the potential to introduce bacteria.

First Line of Defense

Good plant hygiene is the first line of defense against bacteria. Plant managers who keep their plants as clean as possible will reduce places for bacteria to hide, thrive, and then be transferred to the production process via surface contacts or simply in airborne dust.

A robust clean-in-place (CIP) program to remove deposits, such as beer stone, or organic fouling, such as scum, which form at the liquid-air interface in tanks, is critical. Cleaning piping, heat exchangers and tank surfaces to bare metal eliminates places where bacteria persist before rapidly infecting the production process when the next tank is filled. This is very important because the fewer bacteria in the propagator at the start of propagation, the greater the head start for the yeast.

The quality of the water used in the ethanol production process is also very important in controlling bacteria. Reuse of wastewater streams, such as cooling tower blowdown or scrubber water, benefits the environment, including the water table on which the local community depends. However, while reuse of wastewater is the right thing to do from an environmental perspective, it may not be right from a production perspective, because wastewater streams can be a significant source of bacteria. Making the right choice regarding where and how best to reuse water can be difficult given the numerous variables. Technology providers, like Solenis, are an excellent source of information that can help facilitate this decision-making process.

These plant hygiene practices play a critical role in maximizing ethanol yields, but may still not be sufficient to control a bacterial infection. As a result, a traditional course of action for ethanol plants looking to maximize yields is a bacterial control strategy based on antibiotics.

Antibiotic-Based Treatments

Many plant managers opt for treatment programs using antibiotics that have a solid track record in reducing both the number of bacteria present in the fermentation process and the bacteria’s ability to grow. Among the benefits of these programs are that they are easily incorporated into the production process and they effectively arrest bacterial growth, reducing the risk of a costly problem. While there are many positives associated with antibiotic programs, they are not without their drawbacks. Some of these issues have received attention from the media, consumers and corporate America.

The highest-profile concern is over the presence of antibiotics in meats and poultry from animals fed with distillers grains sourced from fuel ethanol plants where antibiotics are used to control bacteria in fermentation. Whether these antibiotics find their way into the human food chain or can potentially confer antibiotic resistance to strains of bacteria in livestock and poultry is widely debated in scientific circles. Nonetheless, these matters are understandably concerning to consumers, consumer advocates and companies like Subway, McDonald’s and Walmart.

Lastly, managers of some fuel ethanol plants have expressed concerns about potential time-consuming documentation of antibiotics use that will likely be required under increasingly stringent government regulations, such as the Food Safety Modernization Act.

Antibiotic-Free Alternatives

In an effort to address these drawbacks, there are a growing number of antibiotic-free additives for controlling bacterial infections available in the marketplace. One choice for plant managers is a novel technology from Solenis that uses a patented, synergistic combination of iso-alpha acids derived from hops and organic acids to control bacterial infections. These products, which are marketed as Solenis fermentation aids, have proven to be an economical way to eliminate antibiotics from the ethanol production process and ease the concerns of consumers and other important influencers in the marketplace about antibiotics in the food chain.

Another advantage of this technology over other antibiotic alternatives is that, like antibiotics, it exhibits differential toxicity. This means that it will negatively impact unwanted organisms, such as Lactobacilli, but will not harm yeast. The fermentation aids are also cost-effective, safe to handle, sustainable, biodegradable, designated as generally regarded as safe (GRAS) and Kosher certified.

An important differentiator for the fermentation aids is that each product is a liquid and can easily be dosed automatically. As part of its offering, Solenis provides its customers with an automatic feed system to eliminate manual product dosing and operator error, enable plant operators to achieve more precise control of the chemical feed, help them optimize the results of the program over time, and reduce health and safety risks in the facility.

In-Plant Test Results

The efficacy of Solenis’ fermentation aids has been demonstrated recently in trials conducted at a new customer’s 55 MMgy corn ethanol plant in the U.S. Corn Belt. The goal of the trials was to confirm for the customer that the antibiotic-free fermentation aid would control bacterial infections and deliver equal or better plant performance at no additional cost.

The first step in the process was a detailed audit of the plant’s ethanol manufacturing process and an evaluation of its historical performance data. Among the things reviewed were details of the plant’s fermentation process, the additives being used, yeast counts and viabilities and concentration profiles of ethanol, sugars, lactic and acetic acid and glycerol. The results of these assessments indicated that the fermentation aid program would be a good fit for this customer.

The second step was for Solenis field and technical staff to work with the plant personnel to carefully develop a trial plan that would not negatively impact the plant’s production. Elements of the plan included a process for gradually converting from antibiotics to the fermentation aid program and contingency plans if production performance began to slip.

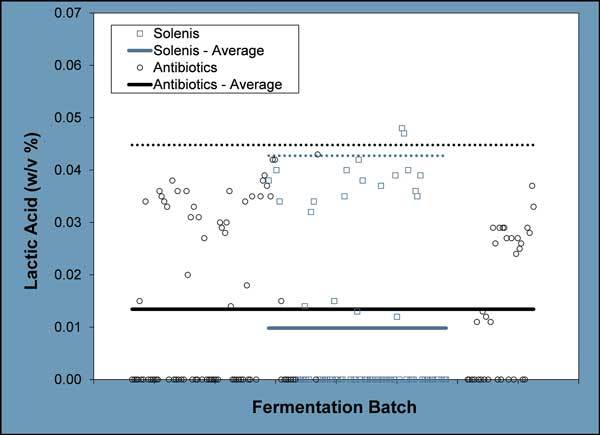

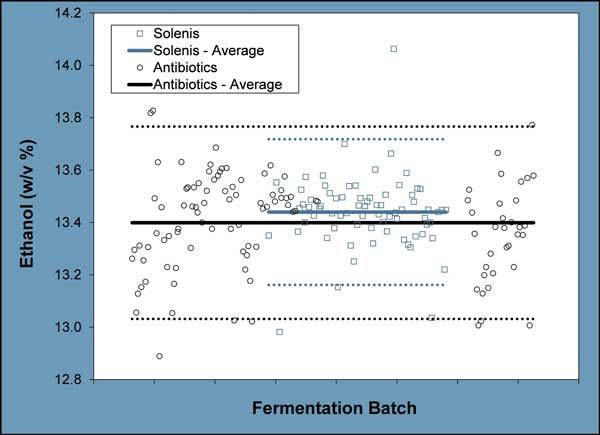

The final step was for the Solenis technical team to be on-site in order to work closely with the plant personnel during the trial to monitor and evaluate the program’s performance. Over the course of the trial, ethanol production was maintained (see graph on page 45) and DP3 and sugar profiles were not negatively impacted. The concentrations of bacterial byproducts, lactic and acetic acids, which are common indicators of bacterial infection, did not increase (see graph on page 46). Glycerol concentration, an indicator of yeast stress, did not increase either. Collectively, these data confirmed production levels using the fermentation aids were equal to or slightly better than the plant’s previous performance.

The test protocol called for a six- to eight-week trial but, based on the very positive initial results, the customer chose to fully convert to the Solenis fermentation aid program in just two weeks. It was clear that the program was a viable way to cost-effectively eliminate the use of antibiotics in the ethanol production process without impacting productivity, easing marketplace concerns regarding antibiotics in the distillers grains generated at the plant.

Author: Scott Lewis

Biorefining R&D Scientist, Solenis

866-337-1533

srlewis@solenis.com

Contributing authors: Andrew Ledlie

Biorefining Marketing Manager, Solenis;

Paul Shepperd, Biorefining Applications Project Manager, Solenis;

Advertisement

Advertisement

Related Stories

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

FutureFuel idles biodiesel production amidst regulatory uncertainty, shifts full focus to specialty chemicals growth

FutureFuel Corp. on June 17 announced it will temporarily idle its biodiesel facility upon completion of its remaining contractual obligations, anticipated to occur by the end of June. The company is shifting its focus to specialty chemicals.

The U.S. EPA on June 18 announced 1.75 billion RINs were generated under the RFS in May, down from 2.07 billion that were generated during the same period of last year. Total RIN generation for the first five months of 2025 reached 9.06 billion.

TotalEnergies has announced the company expects its facilities will be able to produce more than half a million tons of SAF a year by 2028 to cover the increase in the European SAF blending mandate, set at 6% for 2030.

Upcoming Events