Pacific Ethanol predicts 2015 will be a transformational year

Pacific Ethanol Inc.

May 12, 2015

BY Erin Krueger

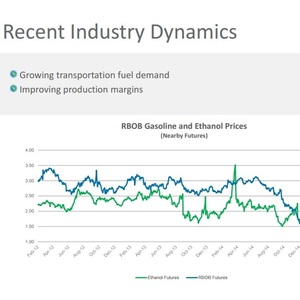

Pacific Ethanol Inc. has released first quarter financial results, reporting a net loss of $4.7 million. According to Neil Koehler, president and CEO of the company, margins have improved so far in the second quarter.

"During the first quarter of 2015, the ethanol industry was negatively impacted by lower production margins resulting from high ethanol inventory levels and volatile energy markets,” Koehler said. “As a result, we reported a first quarter 2015 net loss of $4.7 million. We have seen a solid improvement in margins so far in the second quarter, as U.S. ethanol production has moderated while the demand for transportation fuels is strengthening. Looking forward in 2015, we are optimistic about the financial performance of the company and the industry. We began producing corn oil at our Madera facility and are close to initiating corn oil production at our Columbia plant, which will further diversify our revenues and contribute to overall margins.”

"2015 is expected to be a transformational year for Pacific Ethanol as we extend our market reach through our planned merger with Aventine Renewable Energy and amplify our destination market strategy with key facilities in origin markets,” Koehler added. “In addition, as the fifth largest producer and marketer of ethanol in the United States post-merger, I am confident we will have the resources and strategy in place to drive profitable growth for years to come.”

During an investor call, Koehler indicated that efforts over the past few years to diversify the company’s revenue streams have led to improved plant efficiencies and strengthened its balance sheet, helping to mitigate the negative impacts of seasonal downturns.

Advertisement

Advertisement

“In 2014, we began producing corn oil in Magic Valley and Stockton, which contributed operating income of over 5 cents per gallon,” Koehler said. “We are now producing corn oil at our Madera facility and are close to initiating production at our Columbia plant, which will further diversify revenues and contribute to overall margins.” He also indicated the company has been improving yield over time by investing in mechanical technology and optimizing enzyme and chemical treatments. According to Koehler, Pacific Ethanol has many additional projects in various phases of development. He said the company believes there is significant potential to further reduce production costs, lower the carbon intensity of the ethanol it produces, and generate additional revenue opportunities at each Pacific Ethanol plant, positioning the facilities to be even more competitive.

Regarding the merger with Aventine, Koehler said the transaction is on track to close late in the second quarter. “This transaction will support and extend Pacific Ethanol’s production and marketing position in the ethanol industry,” he added, noting the merger also broadens the company’s scale, allowing it to realize efficiencies by combining shared functions and resources and benefit from expected returns by making investments in plant and logistical assets.

Pacific Ethanol reported net sales of $206.2 million for the first quarter, down 19 percent from $254.5 million during the same quarter of the prior year. The decline in net sales is attributed to a decrease in the average price per gallon of ethanol, partially offset by an increase in production gallons sold, reflecting the restart of production at the company’s Madera facility in the second quarter of last year.

Gross loss was $1 million, compared to a gross profit of $38.5 million during the first quarter of 2014. The decline is attributed to significantly reduced production margins resulting from lower ethanol prices.

Advertisement

Advertisement

Operating loss was $5.9 million, compared to an operating income of $34.9 million during the first three months of the previous year. Net loss available to common stockholders was $4.7 million, compared to $11.1 million during the same quarter of 2014. Adjusted EBITDA was a loss of $2.7 million, compared to an adjusted EBITDA of $35.4 million during the first quarter last year.

Related Stories

Neste Corp. on July 24 released second quarter results, reporting record quarterly renewable product sales volumes despite weaker margins. SAF sales were up nearly 80% when compared to the first quarter of 2025.

Valero Energy Corp. on July 24 released second quarter results, reporting a profitable three-month period for its ethanol segment. The renewable diesel segment posted a loss, but the company’s new sustainable aviation fuel (SAF) unit operated well.

The IRS on July 21 published a notice announcing the 2025 calendar-year inflation adjustment factor for the Section 45Z clen fuel production credit. The resulting adjustment boosts maximum the value of the credit by approximately 6%.

U.S. Secretary of Agriculture Brooke L. Rollins today announced the reorganization of the USDA, refocusing its core operations to better align with its founding mission of supporting American farming, ranching, and forestry.

The U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy is soliciting public comments on a preliminary plan for determining provisional emissions rates (PER) for the purposes of the 45Z clean fuel production credit.

Upcoming Events