Pacific Ethanol reports Q2 margins up slightly

SOURCE: Pacific Ethanol Inc.

August 2, 2019

BY Matt Thompson

During Pacific Ethanol Inc.’s 2019 second quarter earnings call, president and CEO Neil Koehler said the company’s crush margin, while still low, had improved slightly over the first quarter. “Crush margins were slightly better than in the first quarter but continue to be near historic lows,” he said. “Our team did an admirable job in controlling costs and running efficiently under the adverse market conditions.”

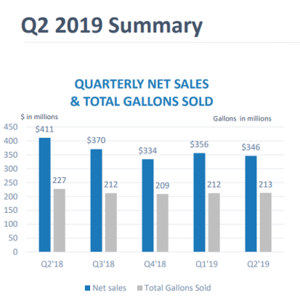

Koehler said an $8 million loss was available to Pacific Ethanol shareholders in the second quarter of 2019. The first quarter loss was $13.2 million.

Koehler said the company experienced a decline of nearly $10 million in net sales from the first quarter, due the flooding in the Midwest. The floods hampered shipments from the company’s Pekin, Illinois facilities, Koehler said. “The plants have now returned to full production with high river levels subsiding in mid-July,” he said. “Even with lower sales, we saw a significant improvement in adjusted EBITDA, which was a positive $7.2 million compared to a positive $1.6 million in the first quarter,” he added.

The ethanol industry, continues to experience overproduction, which Koehler said is due to small refinery exemptions (SREs) granted by the U.S. EPA, as well as the ongoing trade dispute with China. The SREs have reduced demand by 2.6 billion gallons over the last two years. Pacific Ethanol, Koehler said, has responded to the over supply by reducing it’s capacity. “As a company, our production capacity was 80 percent in the second quarter, as we have idled production of 45 million gallons at our Aurora East plant, as previously announced, and reduced rates at other facilities,” he said.

Advertisement

Advertisement

Despite continued difficult margins, Koehler said the rule allowing year-round E15 sales is a potential bright spot for the industry. “We are already begging to see additional E15 gallons being sold at gas stations,” Koehler said, but added that additional demand for E15 may be slow, as stations work to add the blend to their operations.

Koehler also said the company continues working towards its strategic initiatives, and is “actively engaged in discussions, which could lead to the sale of production assets, new financing arrangements, the formation of new strategic partnerships, or some combination of these alternatives, and when concluded, we expect them to meet our stated objectives.”

Advertisement

Advertisement

Related Stories

The U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy is soliciting public comments on a preliminary plan for determining provisional emissions rates (PER) for the purposes of the 45Z clean fuel production credit.

On July 17, Iowa’s cost-share Renewable Fuels Infrastructure Program awarded $1.12 million in grants for 20 applicants to add B11 and 4 applicants to add E15 to retail sites. This was the first meeting following the start of RFIP’s fiscal year.

Par Pacific Holdings Inc., Mitsubishi Corp. and ENEOS Corp. on July 21 announced the signing of definitive agreements to establish Hawaii Renewables LLC, a joint venture to produce renewable fuels at Par Pacific’s refinery in Kapolei Hawaii.

A new study published by the ABFA finds that the U.S. EPA’s proposal to cut the RIN by 50% for fuels made from foreign feedstocks, as part of its 2026 and 2027 RVOs, could stall the growth of the biomass-based diesel (BBD) industry.

The European Commission on July 18 announced its investigation into biodiesel imports from China is now complete and did not confirm the existence of fraud. The commission will take action, however, to address some systemic weaknesses it identified.

Upcoming Events