Pathways Await Priority

PHOTO: JIM STEWART, ACE ETHANOL

May 20, 2019

BY Susanne Retka Schill

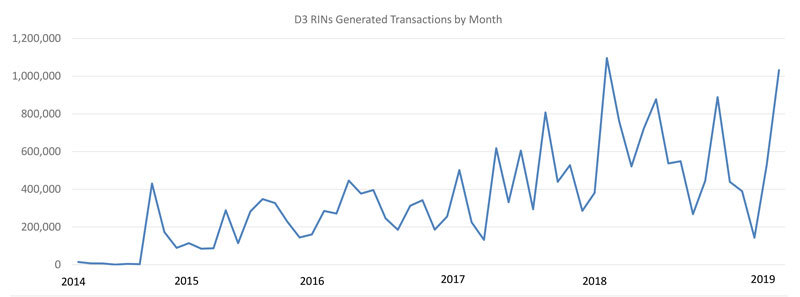

Pathway approvals by the U.S. EPA came to a screeching halt in 2018, putting the expansion of corn kernel fiber cellulosic ethanol in limbo. The EPA Part 80 Fuels Program List shows no new registrations for plants approved for D3 renewable identification number (RIN) generation in the past 18 months. And while cellulosic ethanol production is trending upward, tracking EPA’s monthly RIN generation data indicates wide swings in production.

“EPA approval of Part 80 applications for corn fiber-to-cellulosic ethanol processes have apparently come to a halt because the EPA has several higher-priority issues it is working on, like E15, the RFS reset and regulatory changes to modify the RIN compliance system,” says Mark Yancey, chief technology officer for D3Max, which is building its first commercial-scale plant to convert corn kernel fiber in wet cake to cellulosic ethanol.

On May 8, EPA issued a guidance document to articulate a proper basis for D3 pathway registration. The guidance specifies EPA has determined analytical methods designed for starch components to be ineffective in calculating accurate cellulosic ethanol yields. The intent of the guidance, EPA says, is to explain its interpretation of regulatory requirements and articulate clear criteria for the type of analysis appropriate for D3 pathway registration.

Brian Thome, CEO of Edeniq, says the paused pathway approvals have caused headaches. Before EPA delayed approvals, the company was poised to work with a number of ethanol plants wanting to add cellulase enzymes to starch fermentation to convert the corn kernel fiber into cellulosic ethanol. Edeniq licenses its Intellulose technology for an EPA-approved method of measuring the lift, plus helps plants make adjustments to optimize the process. The number of plants approved using the Intellulose pathway remains where it was more than 18 months ago, at six.

“There’s been a lot of discussion about test methods,” says Steve Hartig, ICM’s vice president of technology development. In ICM’s Gen 1.5 technology, corn kernel fiber is separated at the front end, pretreated and fermented for cellulosic ethanol production with a special yeast. The 1.5 broth is then introduced into starch fermentation at fill. With the necessary data to apply for a pathway unavailable until the first commercial plant under construction is running, ICM has been laying groundwork with several agencies to develop its testing protocol. The company has been working with EPA, the California Air Resources Board, the National Renewable Energy Laboratory and the National Institute of Standards and Technology. “We think test methods should be robust, reliable, public and peer reviewed, so that everyone has confidence in them,” Hartig says.

RIN Price Decline

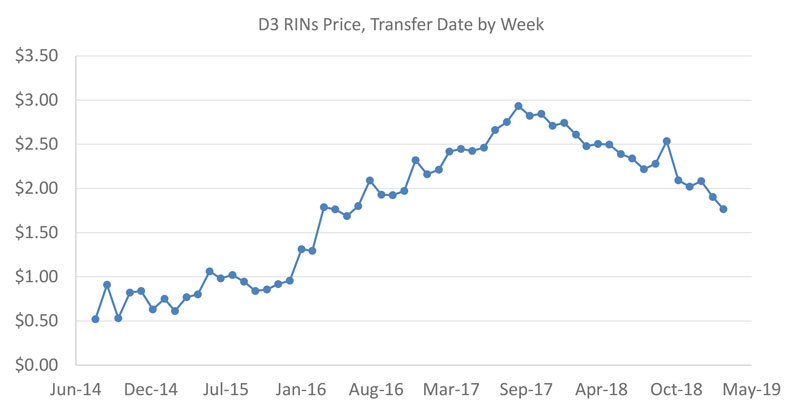

While new EPA registrations have been on hold, the value of D3 RINs has eroded, dropping more than a dollar from the $2.93 peak in September of 2017 to $1.84 in February. With cellulosic ethanol volumes still low, D3 RIN prices are primarily based on the value of the cellulosic waiver credit plus the D6 RIN for conventional biofuel—the D-code applied to corn starch ethanol—both of which are down.

In its document, “Cellulosic Waiver Credit Price Calculation for 2019,” EPA explains that using the criteria and formula specified in the Clean Air Act, the agency calculated the average wholesale gasoline price for the previous 12 months at $1.813 with an inflation adjustment of 1.193 to set the Cellulosic Waiver Credit at $1.77 for 2019.

“The biggest reason the cellulosic waiver credit is down to $1.77 versus $1.96 from last year is that the gasoline price average was down about 30 cents,” explains Jordan Godwin, senior journalist with the Oil Price Information Service. Those cellulosic RINs were assessed by OPIS on April 2 at $1.70 for the 2019 compliance year and $1.85 for 2018 compliance. That’s compared with $2.50 for 2018 compliance and $2.58 for 2017 compliance on April 2, 2018. “So the RINs are down even sharper than the CWCs are,” Godwin says. “I’ve been told that the decline in D6 ethanol RINs has played a factor in that. D6 RINs were assessed by OPIS on April 2 at 14.5 cents for 2019 and 12 cents for 2018, compared with 39.5 cents for 2018 and 37.25 cents for 2017 a year ago.”

What impact that erosion in D3 RIN value has had on cellulosic ethanol production is difficult to determine. EPA’s reported cellulosic RIN generation each month has been bouncing around, dropping as low as 140,000 gallons in December 2018. January’s RIN data indicates 539,000 gallons generated D3 RINs, which nearly doubled in February’s data to 1.03 million gallons. The swings to higher production levels are attributable to the large, pure-play cellulosic producers—Poet DSM in the U.S. and two Brazilian producers—who are producing inconsistently as they work through first-of-their-kind start-up challenges. The lowest monthly RIN generation totals recorded in the past year, however, suggest the corn kernel fiber folks have also dropped out at times. An estimate based on a 1.5 percent cellulosic lift for those plants using in-situ cellulases, plus Quad County Corn Processors, puts the potential monthly RIN generation for corn kernel fiber ethanol over 800,000, which was only topped twice in 2018.

Thome reports that even with EPA’s hiatus from registering new D3 producers, plants interested in taking advantage of California’s Low Carbon Fuel Standard continue to evaluate Edeniq’s Intellulose technology. “Eastward facing plants would have difficulty in having any reason to measure their corn kernel fiber conversion today because the EPA is not moving, and they don’t ship to California, nor do they have an easy route to California,” he says. “But there are a number of other plants in the Midwest and westward facing where it certainly makes sense to be looking for that extra bump. Some of our customers are getting as much as 75 cents per gallon premium for cellulosic ethanol, and for some customers it correlates to a penny a gallon increase in margin for their entire plant, when you take the numbers and spread that out across all of their gallons.” The California Air Resources Board, he adds, is aligning with EPA in its rules regarding ongoing testing to verify yields, either annually or every 500,000 gallons.

Construction Updates

Just how many plants will move toward adding cellulases once EPA resumes evaluating new registrations remains to be seen. The real boost in cellulosic volumes from corn kernel fiber will come when the two plants under construction come online later this year.

Yancey reports D3Max construction at Ace Ethanol in Stanley, Wisconsin, is largely on schedule, although the winter weather in Wisconsin was a challenge. “I estimate construction will be about 75 percent complete by the end of June and commissioning should start in October.” In the D3Max technology, the corn kernel fiber in wet cake is diverted to a separate reactor for pretreatment and fermentation and, in the Stanley installment, will go through a dedicated beer column and then membrane distillation. Therefore, the D3Max process is still in line with the May 8 EPA test method guidance document. Yancey is anticipating EPA approval will come quickly. Based on pilot tests, a 7 percent or better yield increase is expected from the corn kernel fiber conversion at a corn ethanol plant.

Gen 1.5 is part of a suite of ICM technologies being deployed at Element LLC, the 70 MMgy ethanol plant under construction in Colwich, Kansas, next to the ICM headquarters. Element is a joint venture between ICM and The Andersons Inc. An Element spokesman says the project is on track, with initial production expected to start this summer and full-scale operation of all systems expected by the end of the year. The company is not disclosing the projected cellulosic ethanol gallons, but does say it expects to achieve a total ethanol yield of 3.1 gallons per bushel of corn.

Whether generating D6 or D3 RINs, a yield increase through coprocessing is still valuable. So expansion into corn kernel fiber cellulosic ethanol is poised to continue, despite EPA’s new pathway guidance and tight margins.

Author: Susanne Retka Schill

Freelance journalist

retkaschill@yahoo.com

Advertisement

Advertisement

Advertisement

Advertisement

Related Stories

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

Global digital shipbuilder Incat Crowther announced on June 11 the company has been commissioned by Los Angeles operator Catalina Express to design a new low-emission, renewable diesel-powered passenger ferry.

International Air Transport Association has announced the release of the Sustainable Aviation Fuel (SAF) Matchmaker platform, to facilitate SAF procurement between airlines and SAF producers by matching requests for SAF supply with offers.

Alfanar on June 20 officially opened its new office in London, further reaffirming its continued investment in the U.K. The company is developing Lighthouse Green Fuels, a U.K.-based SAF project that is expected to be complete in 2029.

ATR and French SAF aggregator ATOBA Energy on June 19 signed a memorandum of understanding (MOU) to explore ways to facilitate and accelerate sustainable aviation fuel (SAF) adoption for ATR operators.

Upcoming Events