Phillips 66 reports difficult Q1 for renewables segment

SOURCE: Phillips 66

April 28, 2025

BY Erin Voegele

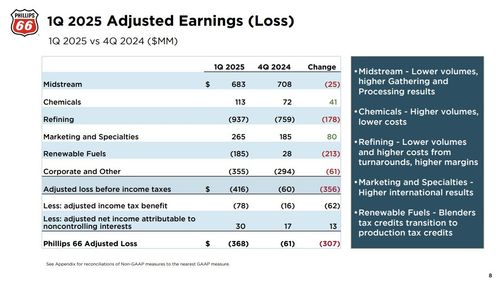

Phillips 66 released first quarter financial results on April 25, reporting reduced pre-tax earnings for its renewable fuels segment despite increased production volumes. The decrease is primarily attributed to the changing tax credit structure and other market factors.

The company currently produces renewable fuels at its Rodeo Renewable Energy Complex, a biorefinery project that commenced development in mid-2022 and reached full processing rates during the second quarter of 2024. The facility began producing sustainable aviation fuel (SAF) in September 2024.

Advertisement

Advertisement

According to Phillips 66, its renewable fuels segment produced 44,000 barrels per day of renewable fuels during the first quarter, up slightly from 42,000 barrels per day produced during fourth quarter of last year, and up significantly when compared to the 9,000 barrels per day produced during the first quarter of 2024.

Total renewable fuel sales for the first quarter reached 63,000 barrels per day up from 34,000 barrels per day during the same period of last year.

The segment reported a $185 million loss for the first quarter, compared to $28 million in earnings reported for the proceeding quarter. Adjusted EBITDA loss was $162 million, a $212 million decline when compared to the $50 million in adjusted EBITDA reported for the fourth quarter of 2024

Advertisement

Advertisement

The company said the pre-tax results for renewable fuels decreased primarily due to the transition from the blenders tax credits to production tax credits, inventory impacts and lower international results.

During a first quarter earnings call, Brian Mandell, executive vice president of marketing and commercial at Phillips 66, explained that outstanding policy issues make it difficult to be able to provide second quarter guidance on the renewable fuels segment. Those issues include tariffs, the upcoming Renewable Fuel Standard renewable volume obligations (RVOs) and implementation of the 45Z clean fuels production credit. The proposed RFS RVOs for 2026 are currently expected to be released in May, he said, noting Phillips 66 also expects additional guidance on the 45Z credit to be available this summer.

Related Stories

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

Global digital shipbuilder Incat Crowther announced on June 11 the company has been commissioned by Los Angeles operator Catalina Express to design a new low-emission, renewable diesel-powered passenger ferry.

International Air Transport Association has announced the release of the Sustainable Aviation Fuel (SAF) Matchmaker platform, to facilitate SAF procurement between airlines and SAF producers by matching requests for SAF supply with offers.

Alfanar on June 20 officially opened its new office in London, further reaffirming its continued investment in the U.K. The company is developing Lighthouse Green Fuels, a U.K.-based SAF project that is expected to be complete in 2029.

ATR and French SAF aggregator ATOBA Energy on June 19 signed a memorandum of understanding (MOU) to explore ways to facilitate and accelerate sustainable aviation fuel (SAF) adoption for ATR operators.

Upcoming Events