PMSS: Classification, organization and documentation

December 16, 2020

BY Lisa Gibson

It’s important to be aware of different safety and inspection requirements for different piping classifications, according to Jay Beckel, of PROtect. And don’t rely on your nondestructive testing (NDT) provider to keep track of it, he added.

Beckel was a speaker on an afternoon panel for the virtual Plant Maintenance and Safety Summit, Dec. 16 and 17. In Beckel’s presentation during the panel, “Miles of Pipe: Assuring the Mechanical Integrity of Your Plant’s Piping Matrix,” he talked about classification, organization, documentation and more. “Process safety information can be very, very vast,” he said. “Today, we’ll focus only on [piping and instrumentation diagrams] P&IDs.”

First, Beckel walked his audience through the four pipe classifications, including:

•Class 1 – Piping with the highest potential for emergency issues.

•Class 2 – Piping that is not otherwise classified.

•Class 3 – Piping containing flammable materials but not likely to vaporize, or located in remote areas where no significant consequences are likely.

•Class 4 – Piping containing nonflammable and nontoxic materials.

“Much of your piping probably is class 4,” Beckel said.

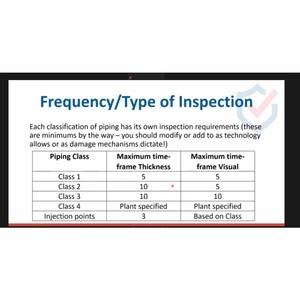

Each classification has its own inspection requirements, timeframe thickness and timeframe visual. But there’s more to consider. “Did any of you know that there could be minimum thickness?

Advertisement

Advertisement

Of utmost importance in a P&ID is an accurate legend, preferably just one, Beckel says. “With too many, it makes it hard to follow along.”

The legend should include at minimum: materials of construction; line size; pressure rating; whether the pipe is insulated or not; whether it’s heat traced or not; coating type; other piping details including classification, which should be on each line of the P&ID; and line numbers for all lines that follow the legend.

“It’s pretty straightforward, but you’d be amazed at the plants that don’t have something on each line for their P&IDs,” Beckel said.

“And you need a documented approach to tie all these things together,” Beckel said, listing pressure vessels, piping and tanks, transmitters and pumps. “All the pieces of the puzzle you have in your plant, you should have in your written approach to pipeline integrity.”

It should be plant specific, not a prepared program, he added. “Hold your contractors and staff accountable.”

Traditional Vs. Advanced

NDT can be traditional or advanced, Beckel said. Traditional is a visual approach with thickness. Advanced can include magnetic flux leakage, automated ultrasound thickness mapping, guided wave technology and pulsed eddy current.

Of magnetic flux leakage, Beckel said, “The technology is super. It really helps to ID pitting and gradual wall loss.” But it only works on carbon steel, he added.

Advertisement

Advertisement

Automated ultrasound thickness mapping needs to be on and insulated surface, he said, and can be used manually or in an automated fashion. “Automated UT mapping is pretty advanced. It’s a good system to have in place. It can really identify a lot of things you could miss.” The pipes must be clean for this method, he said.

Guided wave can inspect up to 1,150 feet of pipe from one location. “It’s a great technology for underground piping or other inaccessible piping,” he said, adding it has 100 percent coverage even with clamps or sleeves in place.

Pulsed eddy current is good for corrosion detection, as it can scan through thick insulation and even fireproofing, Beckel said. It can map and accurately identify remaining wall thickness without removing insulation.

Organization

The P&ID might have 150 to 300 different line numbers in a given section of the plant, Beckel told his audience. So, when spread out to the entire plant—the slurry tank all the way to loadout—the number grows exponentially. “It’ll take some organization, and spreadsheets might not be the best way,” he said.

Beckel strongly recommended an asset Integrity management platform that organizes by area or line number, has the capacity to compare with other facilities in the industry or corporation, easily identifies corrosion and erosion, and ties in with incident management system.

Armed with all this information, Beckel cautioned his audience on one last item:

“Don’t fall into the trap of only regulatory requirements. This needs to be a risk-focused approach, not solely about regulations.

“Your work is never done,” he added. “You’ll always want to improve.”

Related Stories

TotalEnergies on April 22 announced plans to reconfigure the petrochemical operations at its refinery in Antwerp, Belgium. One planned change will add sustainable aviation fuel (SAF) production capacity via coprocessing.

CARB on April 4 released a third set of proposed changes to the state’s LCFS. More than 80 public comments were filed ahead of an April 21 deadline, including those filed by representatives of the ethanol, biobased diesel and biogas industries.

The Oregon Department of Environmental Quality on April 18 proposed to delay the 2024 annual report deadline for the state’s Clean Fuels Program due to a cyberattack and extended outage of the Oregon Fuels Reporting System.

Aemetis India plant receives $31 million of biodiesel orders from OMCs for delivery in next 3 months

Aemetis Inc. on April 21announced the company’s subsidiary in India, Universal Biofuels, received multiple orders for an aggregate of $31 million for the delivery during May, June and July of more than 33,000 kiloliters of biodiesel.

Desmet has been awarded a new contract by LG-ENI Biorefining, a joint venture between LG Chem and ENI Italy, to will deliver a HVO pretreatment plant in Daesan, South Korea. The biorefinery will produce SAF, renewable diesel and naphtha.

Upcoming Events