Real cost of producing corn lower today than the late '70s

FarmDoc Daily

November 19, 2015

BY Susanne Retka Schill

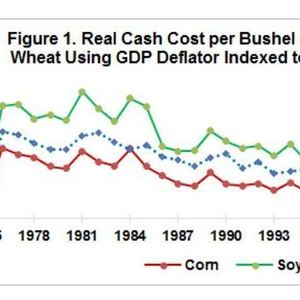

The real cash cost of producing a bushel of corn and other crops is lower now than during the late 1970s, according to analysis by Ohio State University economist Carl Zulauf in a FarmDocDaily post, “Declining Real Cash Cost of Producing Corn, Soybean, and Wheat: Historical Perspective and Potential Implications for the Future.” Furthermore, history suggests “real per bushel U.S. cash cost of producing corn, soybeans, and wheat is likely to trend lower in the future,” he writes.

Over the past 40 years, corn has had the lowest real cash cost per bushel, Zulauf finds in his analysis of USDA cost of production and yield data from 1975-2014. The real cash cost per acre decreased during the first years, 1977-2003, and increased from 2003-’12, with the percent increase greatest for corn, followed by soybeans. “Examination of real cash cost during the period of prosperity lifts up the role of a factor not often discussed about this period,” he points out, “the relatively slow growth in U.S. corn and soybean yields. The slow growth put upward pressure on crop prices and returns, then on input prices and cash cost of production.”

Advertisement

Advertisement

Changes in input prices lag changes in crop input costs, he adds “thus, the sizable decline in crop prices since 2012 is likely to lead to lower input prices and thus cash costs.” Zulaug suggests farmers should aim to reduce their cost of production faster than the price decline. “The historical evidence in this study suggests a managerial goal of reducing real cash cost per bushel by 2 percent per year on average, or approximately the decline observed between 1977 and 2003.”

While short term weather impacts can override the long term trends, Zulauf cautions, his analysis shows that lowering the cash cost of production dampens the response to lower prices. “If cash costs per bushel decline faster than crop price, supply will expand, further reducing prices, everything else constant,” he writes.

Advertisement

Advertisement

Related Stories

Neste Corp. on July 24 released second quarter results, reporting record quarterly renewable product sales volumes despite weaker margins. SAF sales were up nearly 80% when compared to the first quarter of 2025.

Valero Energy Corp. on July 24 released second quarter results, reporting a profitable three-month period for its ethanol segment. The renewable diesel segment posted a loss, but the company’s new sustainable aviation fuel (SAF) unit operated well.

The IRS on July 21 published a notice announcing the 2025 calendar-year inflation adjustment factor for the Section 45Z clen fuel production credit. The resulting adjustment boosts maximum the value of the credit by approximately 6%.

U.S. Secretary of Agriculture Brooke L. Rollins today announced the reorganization of the USDA, refocusing its core operations to better align with its founding mission of supporting American farming, ranching, and forestry.

The U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy is soliciting public comments on a preliminary plan for determining provisional emissions rates (PER) for the purposes of the 45Z clean fuel production credit.

Upcoming Events